-

Median home prices are higher than the historical average in 61% of U.S. counties, Attom Data Solutions said, and it's unclear if the situation gets better or worse.

June 24 -

While purchasing power rose due to low rates and increasing income, “homebodies” suppressed inventory, according to First American.

June 22 -

Contract closings decreased 0.9% from the prior month to an annualized 5.8 million, according to data out Tuesday from the National Association of Realtors.

June 22 -

As home prices set new records, a shift in consumer attitude led to fewer bidding wars and a growing number of listings, according to Zillow and Redfin.

June 16 -

Residential starts rose 3.6% last month to a 1.57 million annualized rate, according to government data released Wednesday

June 16 -

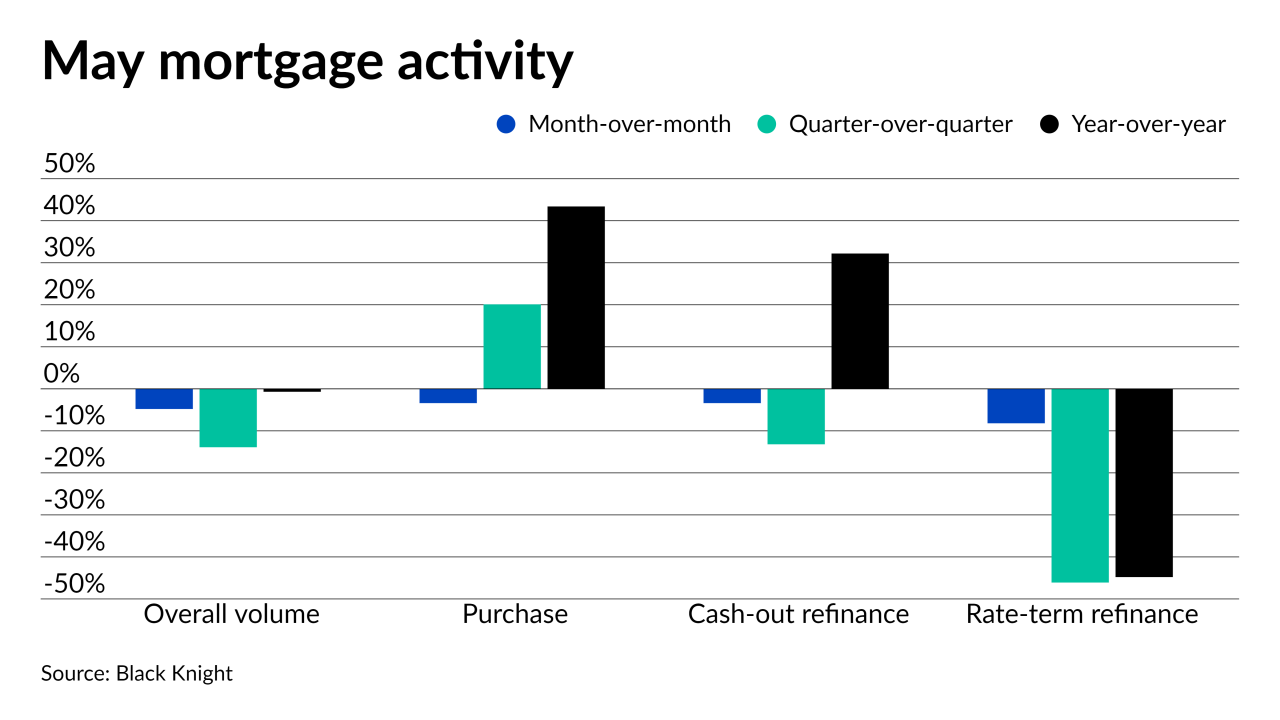

Changed borrower psychology and the severe housing inventory shortage dropped lending activity across the board, according to Black Knight.

June 14 -

There’s now a unique, additional source of demand that’s opening up in an already fiercely-competitive housing market that VA lenders have to solve for.

June 14 -

While a growing share of consumers feel optimistic about the economic recovery underway, the extreme seller’s market made the majority of prospective borrowers pessimistic for only the second time in 10 years, according to Fannie Mae.

June 7 -

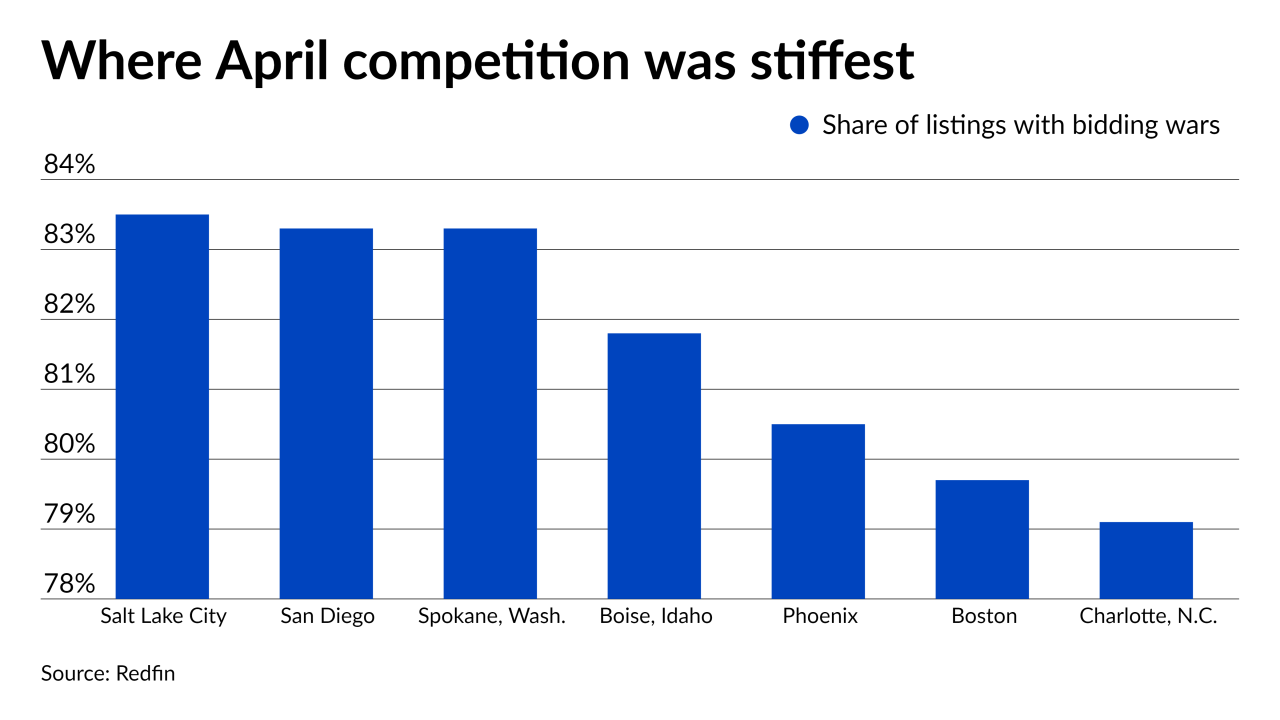

Home prices grew at a record annual pace in April but indicators of a possible slowdown popped up in May, Redfin noted.

June 7 -

Storm-related reconstruction costs — a large share of which may be concentrated in the New York City area — are estimated to total $1.9 trillion for water damage and $8.5 trillion for wind damage.

June 1 -

Housing value growth in April hit a 15-year high as the inventory squeeze created gridlock between baby boomer sellers and millennial buyers, according to CoreLogic.

June 1 -

Purchase contracts for the three months through April surged 85% from a year earlier to 3,487, the builder said in a statement after the close of trading Tuesday.

May 26 -

While elevated prices are acting as brake on demand, mortgage rates near historic lows and elevated backlogs suggest steady residential construction gains in coming months that will help contribute to economic growth.

May 26 -

Unlike fix-and-flip investors, who take title to homes, renovate them and put them back on the market, wholesalers typically negotiate with homeowners just to put homes under contract and sell those contracts to flippers.

May 25 -

Companies are facing delays for everything from sheet rock to cabinets and kitchen appliances and as a result, homes are taking about a month longer to build.

May 20 -

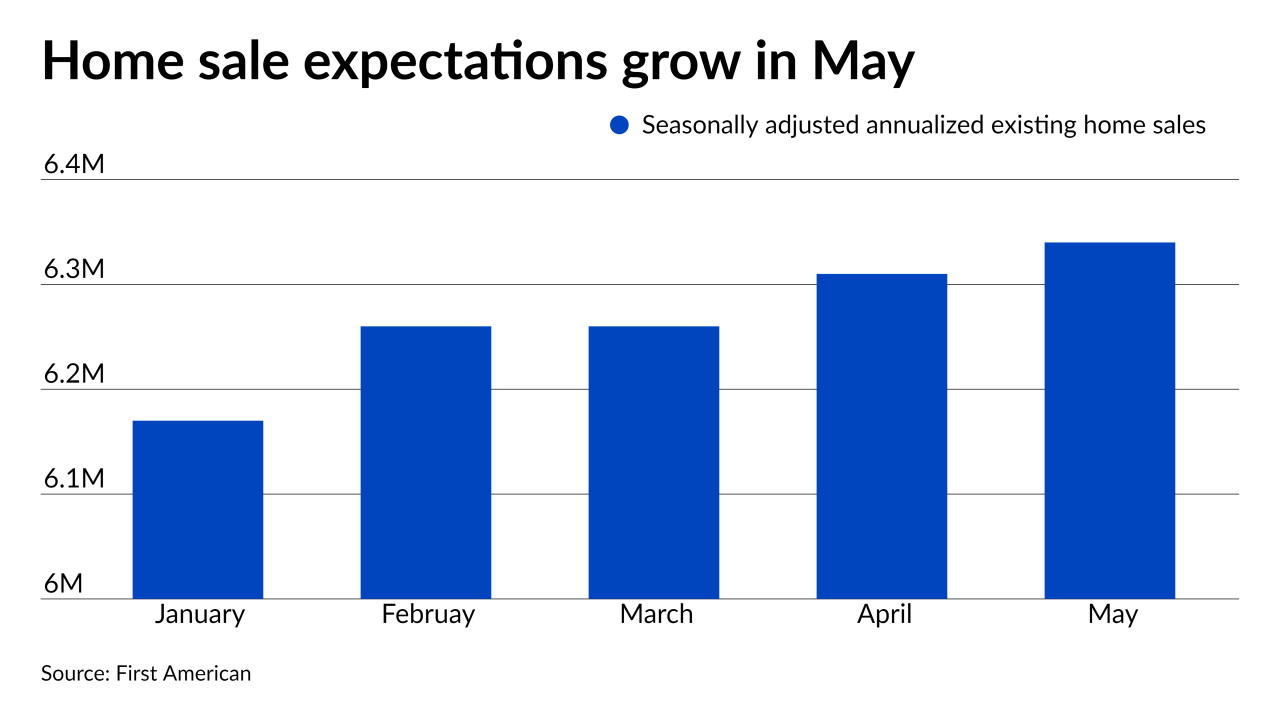

Estimated activity exceeded projections as consumer purchasing power rose, although inventory continued at a record nadir and otherwise held back potential home sales, according to First American.

May 20 -

The month saw the highest median home sales price ever along with the quickest time ever to sell a new listing.

May 19 -

Economic recovery should soar into the summer as vaccination rates climb and restrictions loosen up, but low inventory is likely to limit mortgage activity into the next year, according to Fannie Mae.

May 19 -

Mortgage activity fell across the board despite analysis that 14.5 million current qualified borrowers would benefit from a refinance, according to Black Knight.

May 17 -

Homebuyer competition reached new heights right as the purchase market hits its busiest time of year, according to Redfin.

May 14