-

Nearly half the loans were derived outside J.P. Morgan's retail channel, a level not seen in its conforming and prime jumbo securitizations since 2017.

August 15 -

Quicken Loans subsidiary One Reverse Mortgage is rolling out a private-label alternative to the Federal Housing Administration's Home Equity Conversion Mortgage that offers higher loan limits and more flexible underwriting terms.

August 8 -

Redwood Trust's net income was down 30% from the prior quarter as mortgage banking activities earnings fell by 60%.

August 8 -

Mortgage credit accessibility kept climbing in July, mostly thanks to an expansion of jumbo loan products offered, pushing that index to its historical high point, according to the Mortgage Bankers Association.

August 7 -

Some collateral attributes, such as non-full documentation and a high percentage of non-QM and HPQM loans, fall slightly outside the credit box seen in other recent prime transactions, according to Fitch.

July 26 -

Redwood Trust has priced a new stock offering that is aimed at increasing funding to new initiatives like investments in the single-family rental and multifamily sectors as well as routine business.

July 25 -

American Mortgage Consultants has acquired the right to hire 50 employees from The Barrent Group and will add 150 more in response to increased private-label securitization.

July 24 -

As property values continue appreciating, Caliber Home Loans added a jumbo loan product to its portfolio lending suite to support borrower needs in a climate of higher home prices.

July 17 -

Optimal Blue is expanding its reach in the secondary mortgage market by acquiring Resitrader, a whole-loan trading marketplace that has integrations with Fannie Mae and Freddie Mac.

July 10 -

Access to mortgage credit inched up in June, as competition for jumbo loans resulted in looser underwriting, but government lending standards got more restrictive, the Mortgage Bankers Association said.

July 10 -

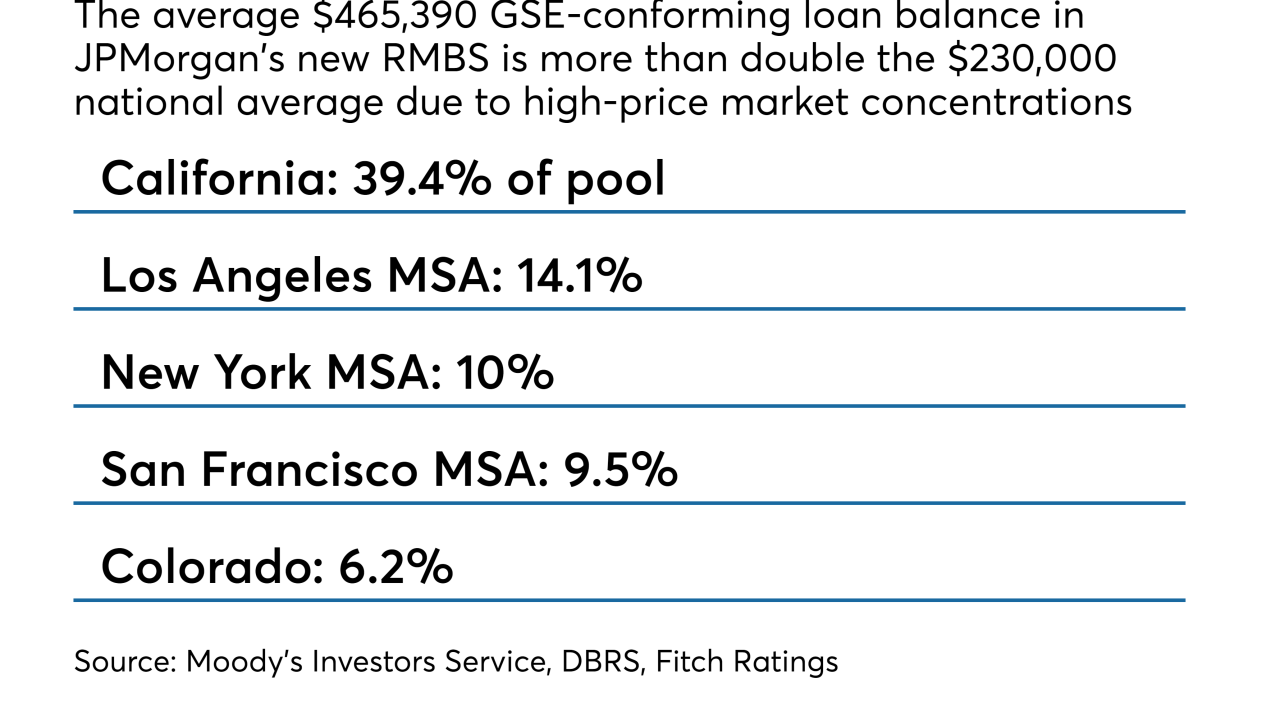

Fannie Mae and Freddie Mac enjoy considerable advantages because of their lower cost of capital and significant government subsidies. But with some conforming loans, the private market is finding a way to compete.

July 3 -

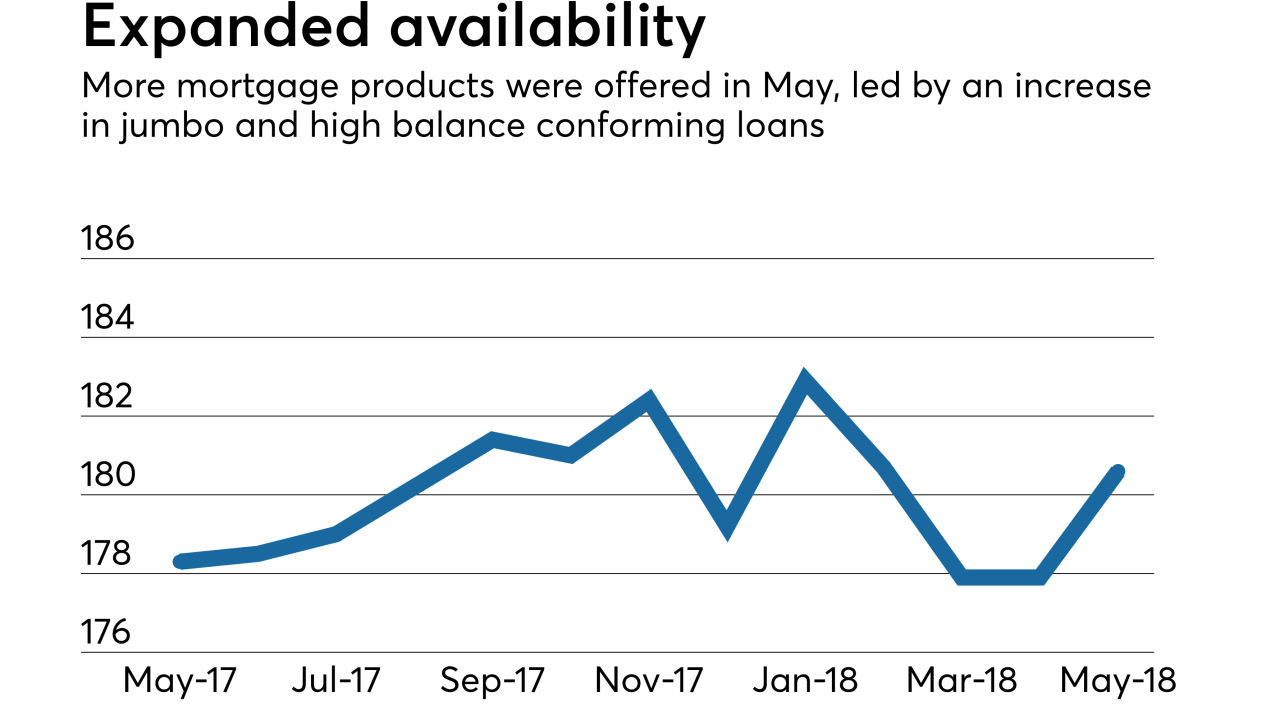

Mortgage credit availability increased in May by 1.5% as more jumbo and high-balance conforming loan products came on the market, the Mortgage Bankers Association said.

June 13 -

Mortgage credit availability was unchanged in April, as originators tightened their government lending programs but made more jumbo offerings available.

May 8 -

Lorie Shannon, recruited from SunTrust, will oversee a strategy that features large, non-QM mortgages in key markets.

May 7 -

Technology startup Eave is making a foray into Colorado's fast-moving, high-end mortgage lending market by offering software designed to quickly analyze jumbo borrowers' more complex incomes and assets.

April 9 -

Mortgage credit availability tightened during March to its lowest level in over a year, adding another headwind to a market challenged by rising interest rates and a shortage of homes for sale.

April 5 -

As policymakers take another crack at housing finance reform, federal leaders and the housing lobby are once again perpetuating the false notion that ending government guarantees would cause the 30-year, fixed-rate mortgage to vanish.

March 21 American Enterprise Institute

American Enterprise Institute -

If GSE reform leads to the 30-year mortgage's demise, homebuyers' monthly payments could soar by $400, according to a recent Zillow estimate. But lenders aren't convinced this housing finance staple is in any danger of being replaced.

March 12 -

Loan program revisions made by one large conventional mortgage investor led to a decrease in total residential home finance credit availability in February.

March 8 -

The $446 million Pearl Street Mortgage Company 2018-1 Trust is backed by 30-year, fixed-rate loans with credit characteristics in line with recent private-label prime jumbo transactions rated by Fitch Ratings.

March 5