-

The company's second-quarter net income was $116 million, with mortgage banking revenue of $239 million.

July 28 -

However, those who aren't current bank customers need to have $1 million in a qualifying account.

July 10 -

As the coronavirus created uncertainty for the housing market, underwriting standards tightened further in June.

July 9 -

Compared with the week prior, approximately 57,000 fewer loans from all investor types were forborne.

June 19 -

Now the shutdown has stretched into mid-June, effectively canceling the long-anticipated Memorial Day listings bonanza.

June 10 -

Looming economic uncertainties forced mortgage lenders to tighten underwriting standards in May.

June 9 -

Many originators stopped making riskier products, including jumbo loans and low credit score offerings, during April.

May 7 -

As the coronavirus takes a major toll on housing inventory and credit availability, pent-up buyer demand could lead to market recovery, according to Redfin.

May 1 -

The wealthiest, most-reliable mortgage borrowers in the U.S. are hearing an unfamiliar word from lenders: No.

April 21 -

The Federal Reserve's $2.3 trillion loan stimulus includes plans for outstanding commercial mortgage-backed securities and newly issued collateralized loan obligations.

April 9 -

Flagstar Bancorp, one of the nation's biggest lenders to mortgage providers, has stopped funding most new home loans without government backing.

March 23 -

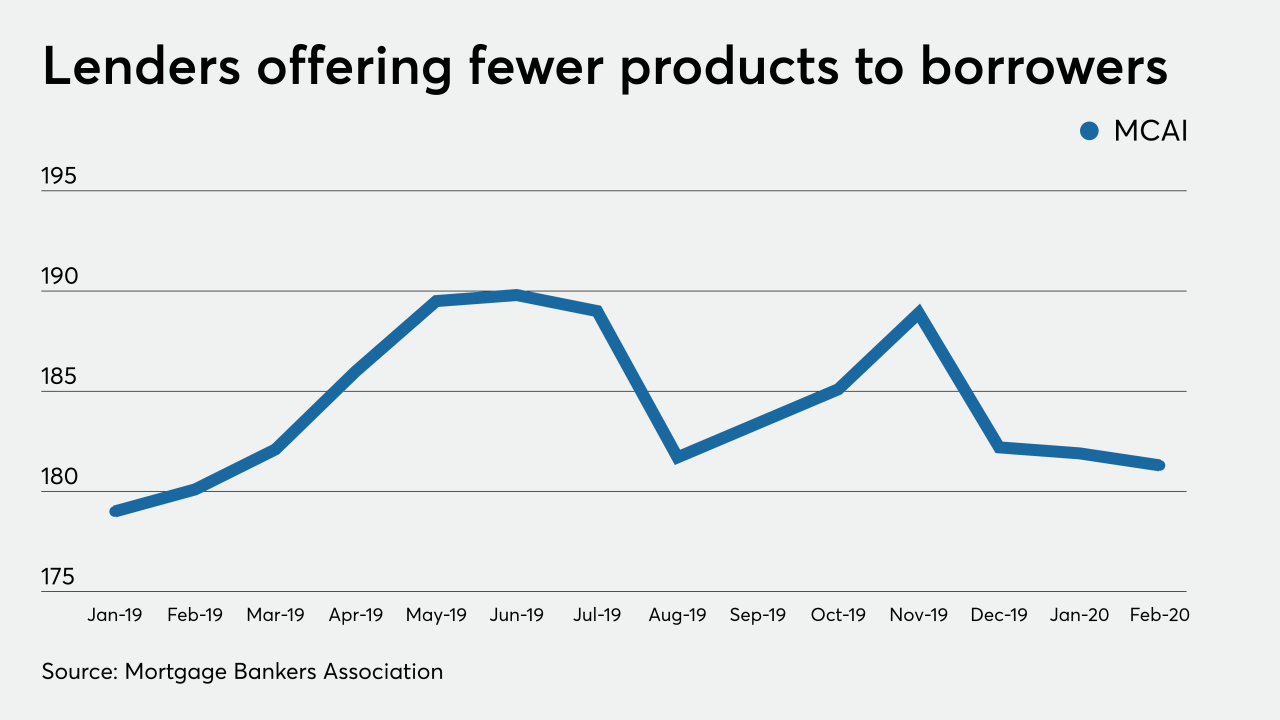

Mortgage credit availability dropped slightly in February, making three consecutive months of tightening, but that streak will likely end with falling interest rates, the Mortgage Bankers Association said.

March 10 -

Quontic has rolled out a streamlined non-qualified mortgage refinance product that will not require the borrower to provide verifications or documentation.

February 19 -

Default rates for prime jumbo mortgages will increase, but a strong economy and rising home prices will bail most borrowers and lenders out, Moody's said.

February 3 -

There was less credit available for the first time in four months in December, when lenders offered fewer conventional and government products, particularly Veterans Affairs-guaranteed loans, the Mortgage Bankers Association said.

January 13 -

California homeowners with big home loans and vacation properties would owe higher taxes under new legislation to raise money for programs to get the state's homelessness crisis under control.

January 9 -

Massachusetts cities and towns would have new options for funding local affordable housing under a proposal rolled out on Jan. 8: a fee of up to 2% on real estate sales above the statewide median sales price, and a higher fee on certain "speculative" property sales.

January 9 -

The new owner of a 12-bedroom, $94 million home purchased in October received a $58 million, 10-year mortgage from HSBC.

January 9 -

The nomination deadline for the 2020 Top Producers program is coming up soon.

January 8 -

Redwood Trust’s next mortgage-backed securitization consists almost entirely of older mortgages it originally sold off, but has since reacquired to assign to its first deal of the new year.

January 3