-

Flagstar Bancorp, one of the nation's biggest lenders to mortgage providers, has stopped funding most new home loans without government backing.

March 23 -

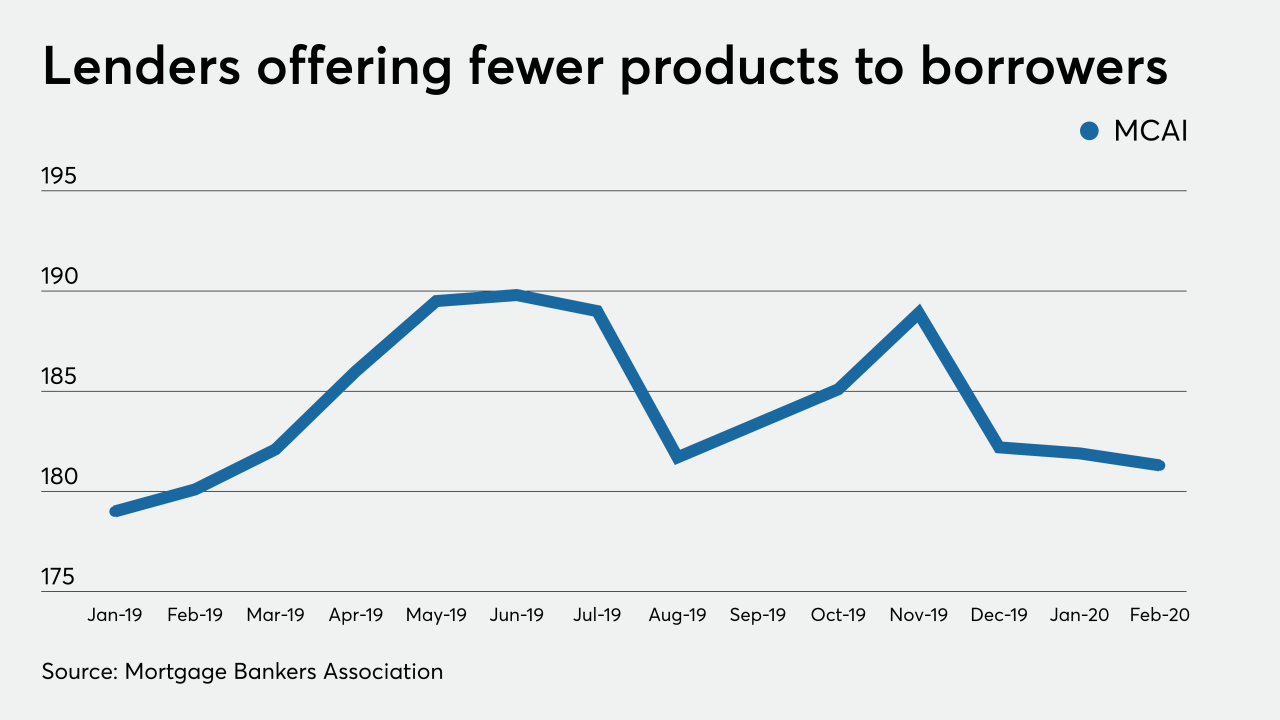

Mortgage credit availability dropped slightly in February, making three consecutive months of tightening, but that streak will likely end with falling interest rates, the Mortgage Bankers Association said.

March 10 -

Quontic has rolled out a streamlined non-qualified mortgage refinance product that will not require the borrower to provide verifications or documentation.

February 19 -

Default rates for prime jumbo mortgages will increase, but a strong economy and rising home prices will bail most borrowers and lenders out, Moody's said.

February 3 -

There was less credit available for the first time in four months in December, when lenders offered fewer conventional and government products, particularly Veterans Affairs-guaranteed loans, the Mortgage Bankers Association said.

January 13 -

California homeowners with big home loans and vacation properties would owe higher taxes under new legislation to raise money for programs to get the state's homelessness crisis under control.

January 9 -

Massachusetts cities and towns would have new options for funding local affordable housing under a proposal rolled out on Jan. 8: a fee of up to 2% on real estate sales above the statewide median sales price, and a higher fee on certain "speculative" property sales.

January 9 -

The new owner of a 12-bedroom, $94 million home purchased in October received a $58 million, 10-year mortgage from HSBC.

January 9 -

The nomination deadline for the 2020 Top Producers program is coming up soon.

January 8 -

Redwood Trust’s next mortgage-backed securitization consists almost entirely of older mortgages it originally sold off, but has since reacquired to assign to its first deal of the new year.

January 3 -

Finance of America Reverse has launched a revolving credit line product that allows borrowing power to increase over time by allowing 75% of funds to grow for future use.

December 18 -

A larger share of Manhattan high-end residential property purchasers took out a mortgage during the third quarter rather than pay all cash for their condominium

December 16 -

Last month, brokers anticipated local residential markets swinging, if ever so slightly, to give buyers more bargaining power.

December 6 -

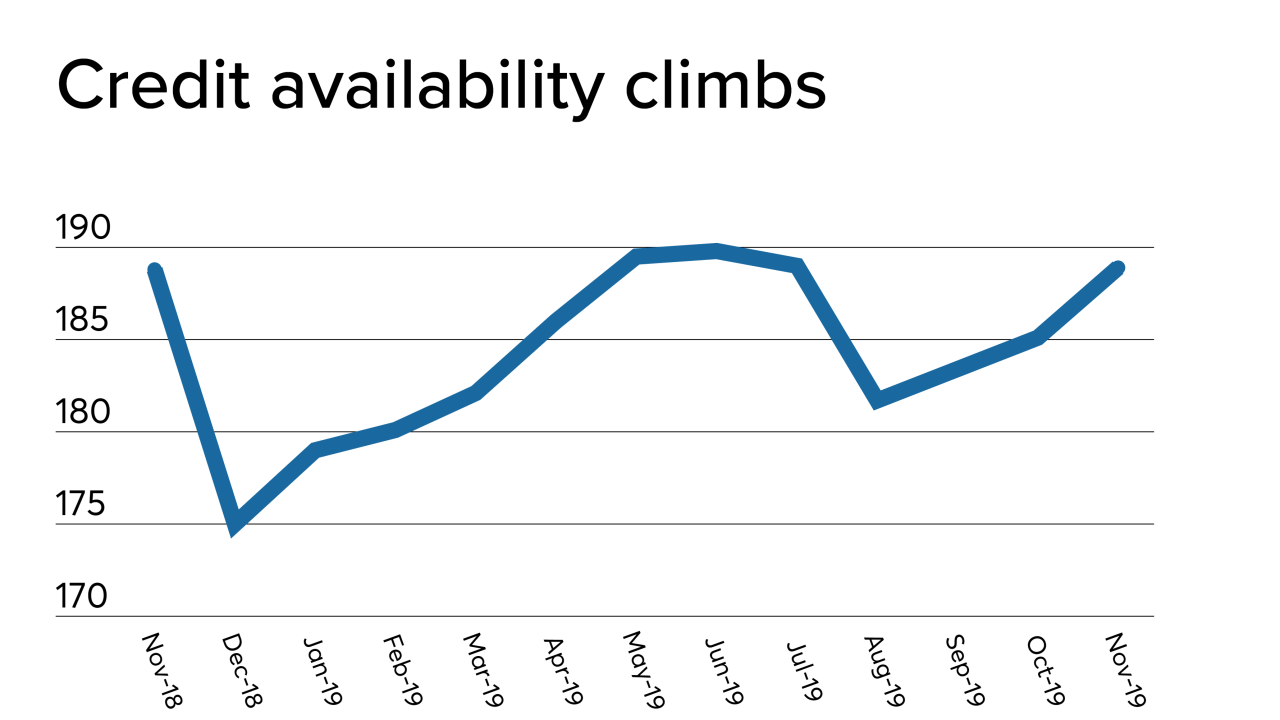

The availability of mortgage credit jumped in November from the previous month as jumbo activity and refinancing in the government market increased, according to the Mortgage Bankers Association.

December 5 -

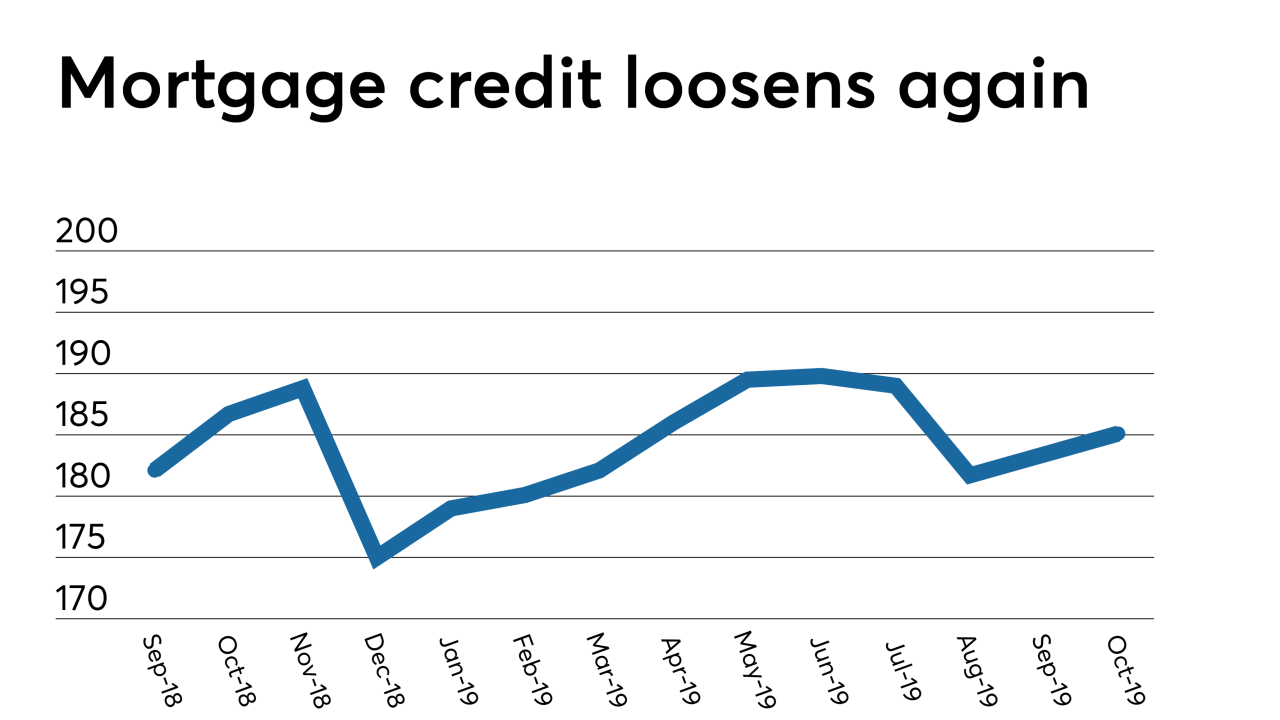

Mortgage credit availability increased in October from the previous month, as mortgage lenders increased their product offerings outside the government market, according to the Mortgage Bankers Association.

November 12 -

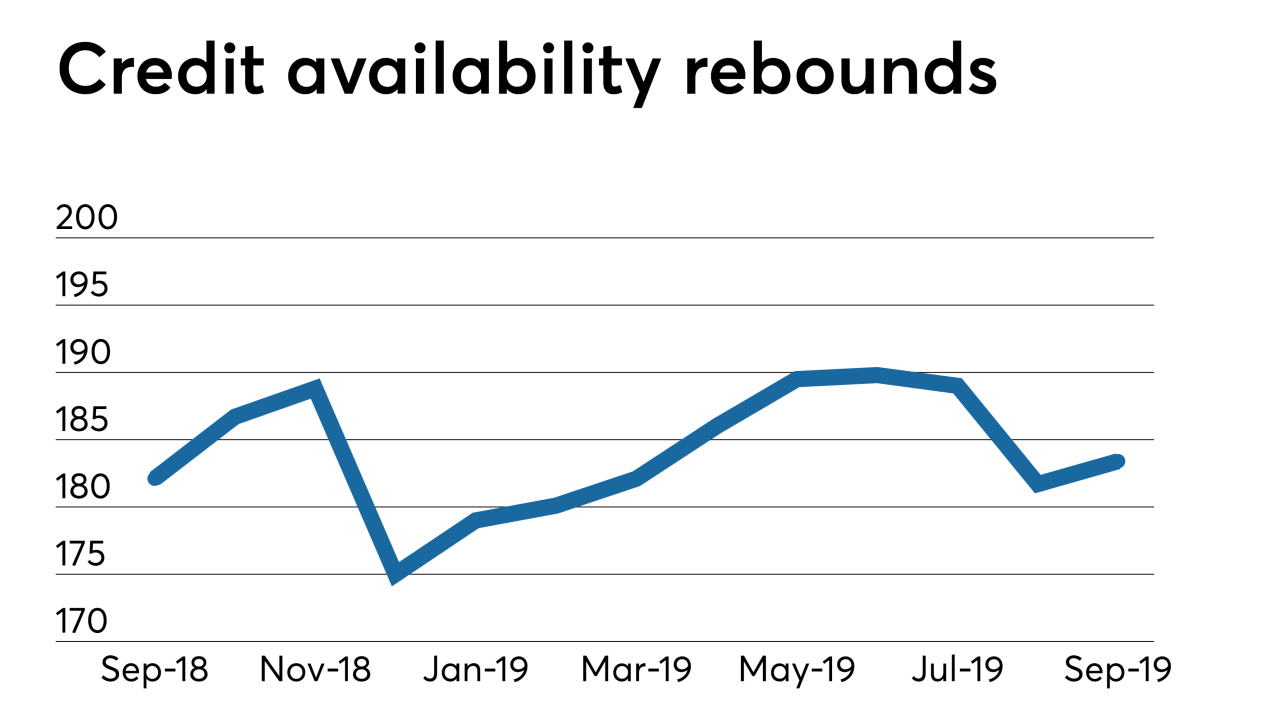

September's increase in mortgage credit availability was driven by the expansion of jumbo products to record levels, which overcame a retrenchment in both conforming and government programs, the Mortgage Bankers Association said.

October 8 -

Mortgage credit availability tightened in August by the most since the end of last year, even though falling interest rates sparked a strong uptick in refinancings, the Mortgage Bankers Association said.

September 12 -

A swell of refinance demand amid a low mortgage rate environment pushed lender profit margin outlooks to the highest level since the first quarter of 2015, according to Fannie Mae.

September 11 -

HSBC anticipates its mortgage underwriting volume ramping up significantly after recent initiatives to provide loan officers with more tools and time to address the complex needs of affluent customers, often from overseas.

August 8 -

Jumbo loan product availability continued climbing and reached an all-time high in July, but it wasn't enough to stop overall credit standards from tightening, according to the Mortgage Bankers Association.

August 8