-

When the former vice president and Massachusetts senator appear together in Houston, they could present two contrasting visions of financial policy within the presidential field.

September 9 -

Public orders are an effective way to discourage violations of consumer protection law, the bureau's director said at a credit union conference.

September 9 -

Live Well Financial CEO Michael Hild has been charged with misrepresenting the value of a bond portfolio in parallel actions by the U.S. Attorney's Office and the Securities and Exchange Commission.

August 30 -

Bankrupt mortgage servicer Ditech Holding Corp. saw its reorganization plan rejected on Wednesday after a federal judge ruled the company couldn't sell its mortgage-servicing rights and reverse-mortgage business free and clear of consumer claims.

August 29 -

The industry has long worried that the ability-to-repay rule gives borrowers an avenue to fight foreclosure, but one plaintiff’s experience may discourage others from trying.

August 15 -

New York Attorney General Letitia James is monitoring how the bankrupt Ditech Holding Corp. handles borrower-sensitive issues like foreclosure proceedings, and is backing the involvement of a consumer creditors' committee.

July 23 -

The agency had decided not to challenge a recent court ruling that its structure violates the separation of powers, but newly confirmed Director Mark Calabria now appears willing to the fight the case.

July 9 -

Stearns Holdings and certain subsidiaries have filed for Chapter 11 bankruptcy as part of a restructuring agreement that could reduce debt, increase Blackstone's stake in the company and preserve jobs.

July 9 -

A developer behind projects in the Maine cities of Portland and Saco was sued by a business partner as properties there are scheduled to be sold at foreclosure auctions.

July 8 -

Live Well Financial's creditors are seeking a court-supervised bankruptcy, but the mortgage lender is opposing the move, saying it can get more for certain assets if it sells them before filing.

June 19 -

Ditech Holding Corp. has entered into purchase agreements with New Residential Investment Corp. and Mortgage Assets Management, in which each would acquire certain assets in the company's Chapter 11 bankruptcy.

June 18 -

BSI Financial agreed to pay a $200,000 fine along with restitution to settle allegations from the Consumer Financial Protection Bureau that it mishandled mortgage servicing rights transfers for loans in the loss-mitigation process.

May 29 -

Ocwen Financial, Fidelity Information Services and Fidelity's corporate parent have agreed to settle a lawsuit over regulatory audit expenses Fidelity submitted to Ocwen for reimbursement.

May 9 -

Director Kathy Kraninger said the agency will emphasize a confidential supervisory process instead of just doling out public enforcement actions. But skeptics worry this will let companies escape punishment.

April 29 -

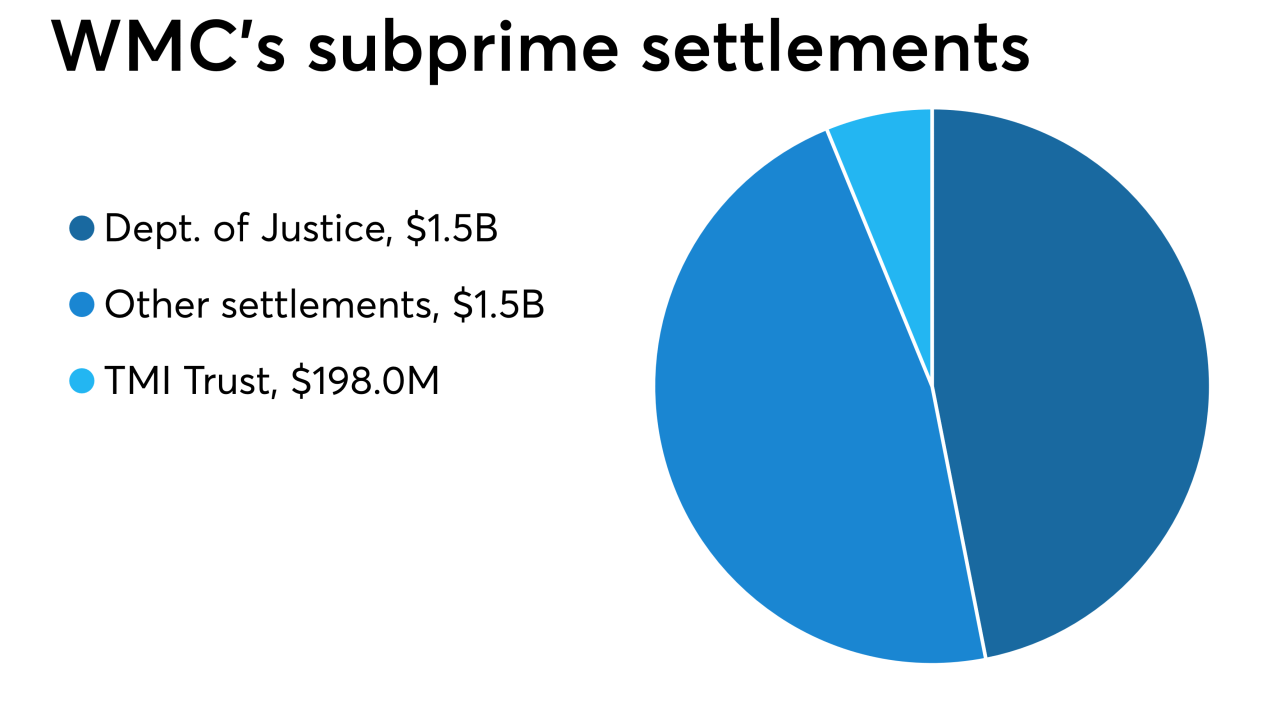

General Electric placed its WMC Mortgage unit into Chapter 11 bankruptcy protection as it has nearly $1.7 billion in legal settlements agreed to or pending.

April 24 -

Homeowners in Chicago cheated by a mortgage fraud scheme are seeking to form a committee to protect their interests in the bankruptcy of Ditech Holding Corp., the company that owns their loans.

April 23 -

The civil rights activist Jesse Jackson is pushing a proposal that the billions banks have paid in fines be given to Americans who lost homes or suffered in other ways during the financial crisis.

April 16 -

In a unanimous ruling, the court placed new limits on the ability of consumers to sue law firms that handle foreclosures on behalf of mortgage servicers.

March 20 -

Wells Fargo CEO Tim Sloan said that the megabank has worked to address past issues and is equally committed to preventing new problems from arising, despite reports suggesting otherwise.

March 11 -

The agency has required restitution in just one of six settlements under its new director, raising questions about whether the pattern will continue.

February 20