-

As mortgage brokers gain more leverage in the market, concerns about borrower poaching and retention are making channel conflict with lenders more prevalent.

March 12 -

Today's mortgage broker is tech savvy, sophisticated and better equipped to thrive in a wholesale channel that's far more competitive than in the past.

March 8 -

The digital-only Ally Bank has taken several steps to deepen customer relationships through electronic channels, including use of personalized emails and websites that have yielded strong click-through and loyalty rates.

February 26 -

The company that holds Washington Mutual's legacy reinsurance business has agreed to purchase a controlling interest in Nationstar Mortgage and invest in its growth.

February 13 -

Churchill Mortgage is building the "preunderwriting" process used to give borrowers a stronger sense of preapproval into its workflow to make financed offers on homes more competitive.

February 5 -

Mortgage lead generation costs are notoriously variable and tough to control, especially when lenders are trying to save money with origination call centers.

January 29 -

Borrowers with a problem during the mortgage origination process likely had multiple issues with their lender and a high percentage of those consumers felt the glitch was not resolved.

January 29 -

The 2018 Top Producers Survey is now open for submissions. This year's program features a number of new and exciting features designed to provide insights into key industry trends and feature the accomplishments and successes of individual loan officers.

January 26 -

Roostify has integrated its mortgage transaction technology into LendingTree's lead generation system, creating a seamless path from product search through closing.

January 26 -

Changes by the National Labor Relations Board ease the tension between one agency requiring lenders to monitor their social media presence and their employees' free speech rights.

January 25 Offit Kurman

Offit Kurman -

While the majority of lenders feel mortgage industry data initiatives have been valuable, their cost is clouding some originators' viewpoint, a Fannie Mae survey found.

January 24 -

LoanDepot Inc., a mortgage lender basing its growth around digital applications, isn't giving up on humans' role in the home-buying process just yet.

January 23 -

NewDominion Bank and M&F Bank are among the institutions willing to leave the industry's comfort zone to reach younger prospects.

January 11 -

CMG Financial is offering a new affinity marketing portal on its crowdfunding platform for down payments and positioning it as a way for employers to retain millennials.

January 10 -

With mortgage originations on the decline, lenders that want to regain lost volume or grow market share must work harder to identify and reach underserved borrower segments.

November 24 -

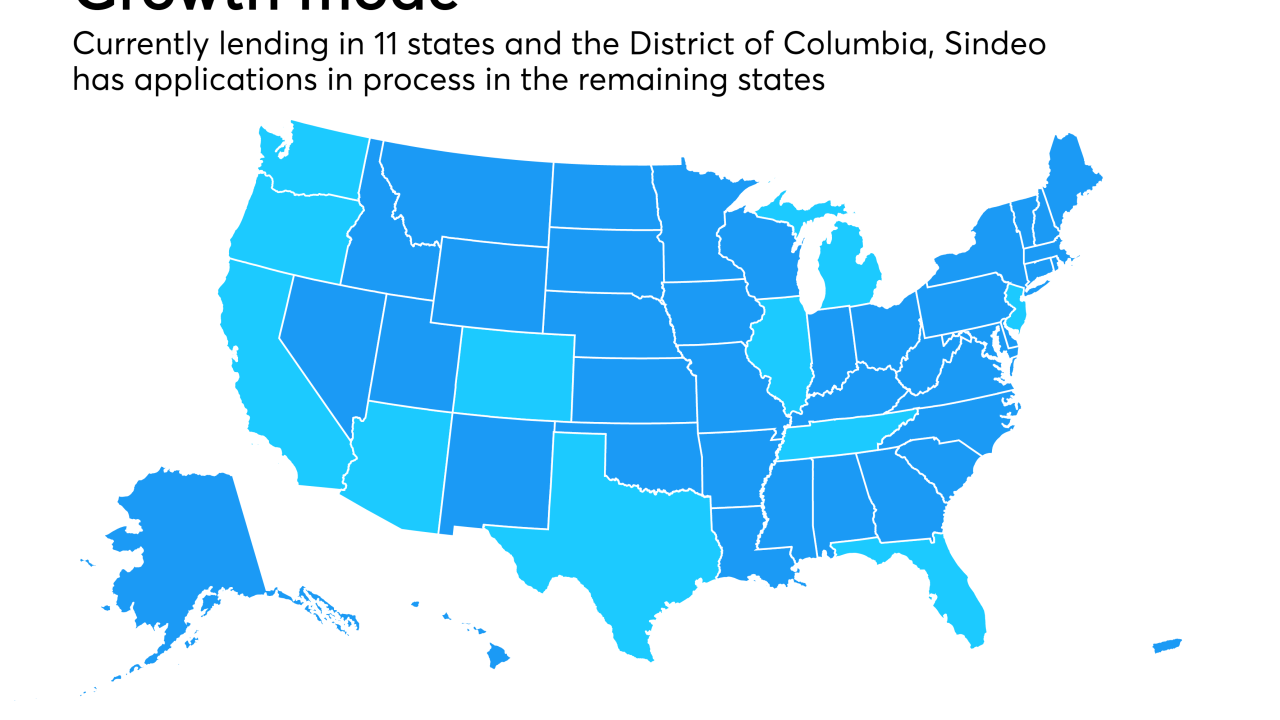

When a $40 million round of venture funding fell through at the last minute, digital mortgage broker Sindeo all but shut down this summer. Now recapitalized and rejuvenated, founder and CEO Nick Stamos explains why Sindeo is ready to grow again.

November 21 -

Mid America Mortgage will sponsor the Richard Petty Motorsports No. 43 NASCAR team to promote the speed of Click n' Close, its new digital mortgage rival to Quicken Loans' Rocket Mortgage.

November 3 -

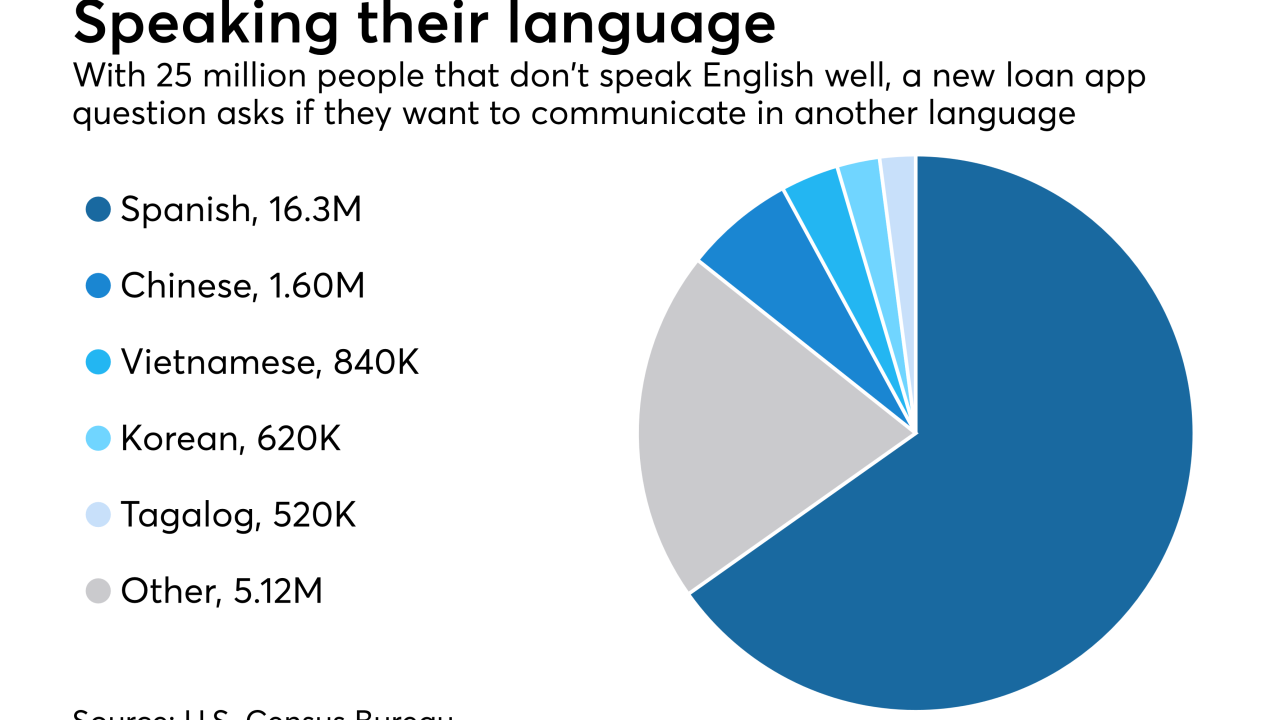

The Federal Housing Finance Agency added a language preference question to the loan application, rejecting the mortgage industry's wishes.

October 20 -

Originators and real estate agents are considered more trustworthy and credible by home purchasers than online sources about mortgage information, a Fannie Mae study found.

October 19 -

From recruitment strategies to leveraging technology without losing the personal touch, here's a look at four challenges and opportunities for the resurgent mortgage broker channel.

October 12