M&A

M&A

-

The deadline for China Oceanwide to complete its acquisition of Genworth Financial was extended for a 13th time, following completion of the sale of Genworth MI Canada to Brookfield Business Partners.

December 23 -

HomeTrust Bancshares in Asheville, N.C., sold a portfolio of residential mortgages as part of a balance sheet restructuring, with plans to sell more.

December 20 -

Florida-based depository Capital City Bank has struck a deal to purchase a 51% share in regional lender BrandMortgage.

December 11 -

Taylor Morrison Home Corp. has agreed to buy William Lyon Homes in a deal that would combine the two companies' in-house mortgage divisions and make the resulting entity the fifth-largest U.S. homebuilder.

November 6 -

Ocwen Financial's cost-cutting initiatives are bearing fruit toward returning to profitability, management said, although the company's third-quarter loss was slightly higher than the same period one year ago.

November 5 -

Orix Corp. has agreed to buy U.S. commercial real estate lender Hunt Real Estate Capital, its latest acquisition in the field.

November 4 -

CIT Group has agreed to lend and invest the money mostly in California as well as in the eight states where Mutual of Omaha Bank has branches.

November 1 -

More private mortgage insurers reported significant year-over-year gains in new business during the third quarter, mainly driven by the increase in refinance volume.

October 31 -

Record originations helped Mr. Cooper Group generate its first full-quarter profit since its formation through a merger between WMIH and Nationstar last year.

October 31 -

Loan origination system provider Ellie Mae has agreed to purchase mortgage technology firm Capsilon, citing the growing appeal of artificial intelligence-driven automation and interest in becoming more active as an acquirer.

October 29 -

The acquisition of the Ditech forward mortgage business will double New Residential's year-to-date origination volume in the fourth quarter alone, and further double that next year.

October 25 -

The unexpected rise in refinancings during the third quarter affected mortgage industry business results in a mostly positive fashion for the period.

October 23 -

Count Citizens Financial’s Bruce Van Saun among those who think interest rate cuts could halt by mid-2020. The key, he says, is to focus on delivering services customers are willing to pay fees for and to skillfully reprice deposits until then.

October 18 -

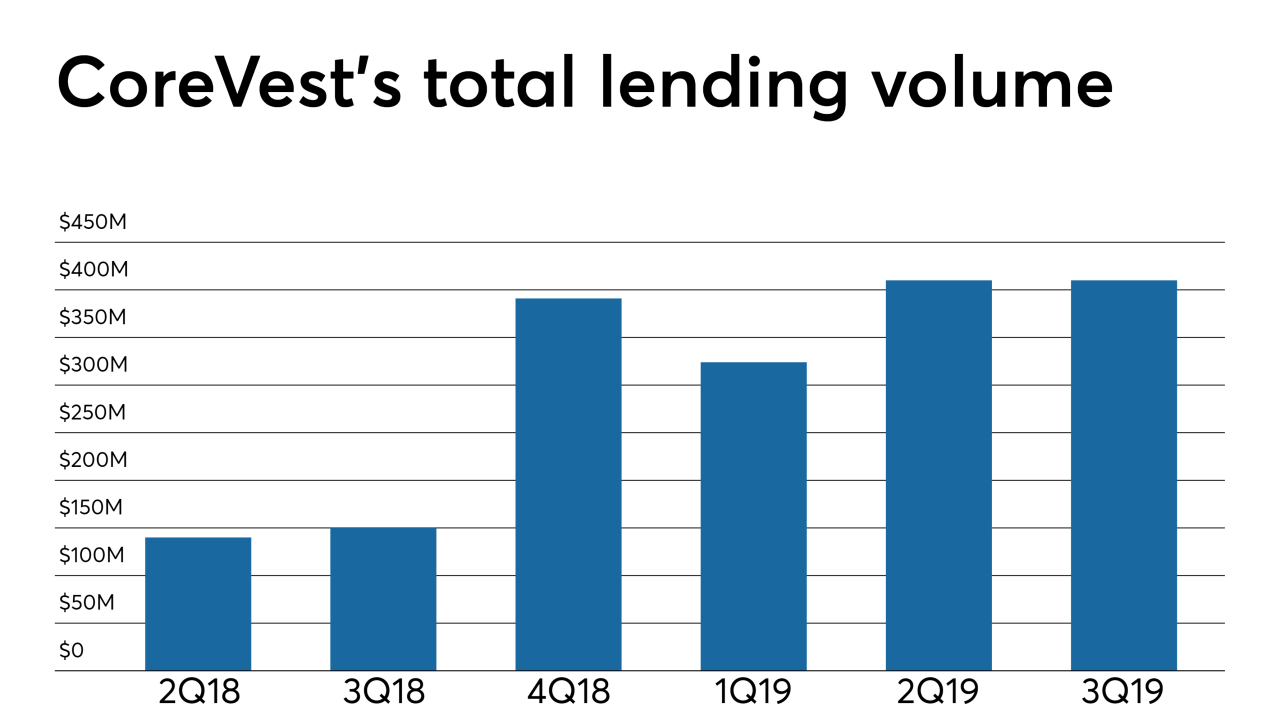

Redwood Trust is adding to its single-family rental lending business by purchasing CoreVest American Finance Lender from its management team and affiliates of Fortress Investment Group.

October 16 -

Vista Equity Partners is considering the potential sale of a stake in Finastra in a deal that could value the financial technology company at more than $10 billion including debt, people familiar with the matter said.

October 7 -

Commercial real estate transaction volume rebounded in the second quarter from a poor first three months of 2019, although property price growth plateaued, according to Ten-X Commercial.

September 20 -

Stearns Lending canceled plans for an auction after almost two-thirds of its noteholders approved a bankruptcy reorganization proposal that would solidify Blackstone's ownership of the company.

September 11 -

Bankrupt mortgage servicer Ditech Holding Corp. cleared the way for the $1.8 billion sales of its businesses by agreeing to preserve some homeowner claims like the right to fix mistakes on their loans.

September 11 -

Stewart Information Services has decided to make some big changes at the top following the dissolution of a planned merger with Fidelity National Financial.

September 10 -

The Federal Trade Commission wants to block the merger of Fidelity National Financial and Stewart Information Services stating the deal would reduce competition for title insurance, including for large commercial real estate transactions.

September 9