M&A

M&A

-

New Fed Mortgage's pending acquisition of Commonwealth Mortgage LLC will allow it to expand its geographic footprint outside of New England.

January 2 -

These days, no wedding is complete without a hashtag combining the happy couple's names. It got us thinking: Why not give mortgage industry M&A deals the same treatment?

December 26 -

A year ago, National Mortgage News made five predictions regarding how the mortgage industry would fare in 2018 — and we got four of them right.

December 21 -

Selling $1.6 billion in mortgages, and paying off a similar amount of wholesale borrowings, will allow the company to expand its net interest margin in 2019.

December 21 -

New American Funding expects to add $1 billion to its annual production next year by purchasing Marketplace Home Mortgage.

December 19 -

Class Valuation, a Troy, Mich.-based appraisal management company, acquired Landmark Network, which specializes in providing valuation services for reverse mortgages.

December 18 -

D.R. Horton Inc. is planning to buy Terramor Homes' building operations for $60 million in cash, expanding the potential customer base for the larger company's in-house lending unit.

December 11 -

Merchants has agreed to buy NattyMac, a company it has been in business with since 2014.

December 6 -

Clayton Properties Group, a builder specializing in prefabricated modular and manufactured homes, acquired Mungo Homes in a move to bolster the scale of its site-built housing.

December 3 -

Hometown Lenders Inc. will acquire TotalChoice Mortgage in a move to expand its geographic footprint and meet its goal of growing annual originations from $1 billion to $5 billion.

November 30 -

Guaranteed Rate is gearing up to acquire certain assets of Honolulu HomeLoans and Hawaii Lending Alliance and expand its existing footprint in a growing Hawaii housing market.

November 28 -

Altisource Portfolio Solutions plans to discontinue its buy-renovate-lease-sell business for single-family homes and sell its short-term inventory in order to cut costs and repay debt.

November 26 -

Mr. Cooper Group — the new name following the combination of Nationstar Mortgage and WMIH Corp. — posted a $54 million third-quarter profit and announced plans to buy Pacific Union Financial, as well as make other strategic acquisitions.

November 8 -

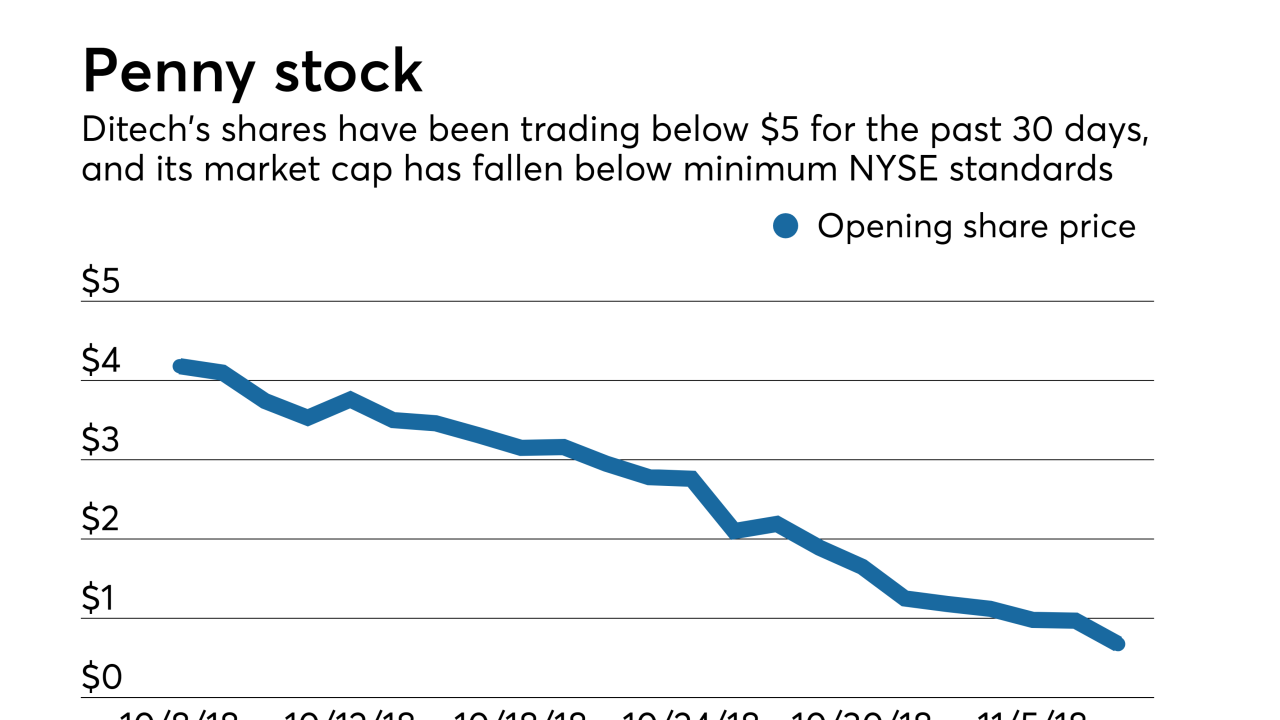

Ditech Holding Corp.'s stock is being delisted from the New York Stock Exchange, and the company is recommitting itself to finding an acquirer or other option that could improve investor value.

November 7 -

Black Knight added to its mortgage loan data product offerings by acquiring Ernst Publishing, an Albany, N.Y.-based provider of recording fee, transfer tax and title premium fee information.

November 7 -

Ocwen Financial Corp. recorded a deeper quarterly loss of $40 million after acquiring PHH Corp., but still expects the deal's economies of scale to eventually lower costs and restore profitability.

November 6 -

Walker & Dunlop acquired commercial mortgage banker iCap Realty Advisors as part of its strategic plan to increase its annual originations by at least one-third in the next two years.

November 2 -

Mutual of Omaha Bank company Synergy One Lending is preparing to acquire certain assets of BBMC Mortgage, a national mortgage company and division of Bridgeview Bank, which will expand its Midwest footprint and improve its strategic direction.

November 1 -

Lennar Corp. is selling a portion of its Rialto business to Stone Point Capital for $340 million, adding to Stone Point's holdings in the real estate and financial industries.

October 30 -

Rising interest rates and the continued slowdown in mortgage originations prompted Ellie Mae to cut its revenue forecast for the full year by at least $18 million.

October 25