-

With over 4 million millennials entering prime home buying age each year through 2023, purchase activity will be driven much higher, according to Ellie Mae.

August 5 -

Housing prices continued to grow in June, maintaining a streak in monthly increases that began in February 2012. But the trend could be reversed in 2021 with the resurgent effects of the coronavirus, according to CoreLogic.

August 4 -

Down payment assistance programs remain an important tool for increasing minority homeownership, but especially more so because of the pandemic.

July 14 Mountain Lake Consulting

Mountain Lake Consulting -

As the country wrestles economic volatility, millennial homeownership demand rises, fueled by historically low mortgage rates.

July 1 -

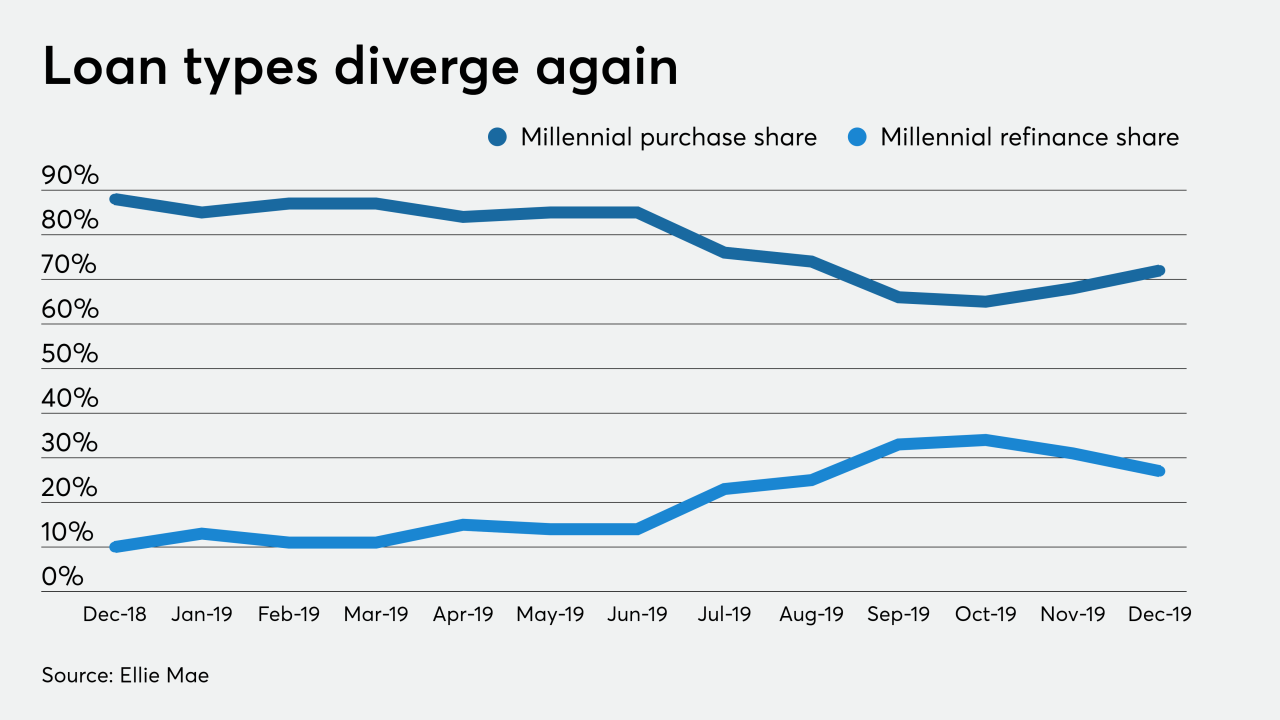

Millennial refinance activity hit a new high-water mark behind historically low mortgage rates, up 40 percentage points from the year before, according to Ellie Mae.

June 3 -

With would-be sellers too spooked to list their homes and would-be buyers held up due to social distancing orders, home price appreciation accelerated in April. And it could continue into the summer.

June 2 -

With mortgage rates plummeting, the refinance share of closed loans from millennial borrowers rose for the third straight month, to the highest level since Ellie Mae began tracking the data in 2016.

May 6 -

The S&P CoreLogic Case-Shiller home price index hasn't yet reflected the impact of the coronavirus, but an independent market maker has some thoughts on how it might.

April 30 -

From the crossroads of America down to the bayou, here's a look at 12 housing markets where it's the most financially prudent to buy a home rather than rent, according to First American.

April 16 -

Consumer sentiment about home price growth during a potential recession flipped because of the coronavirus scare. Now, just one-third expect an increase in value, according to Redfin.

March 20 -

With the economy and job market both healthy before the COVID-19 crisis, first-time homebuyers took advantage of low mortgage rates and hit their highest volume in two decades.

March 17 -

January's plummeting mortgage rates led to a spike in the share of millennials refinancing their home loans, a trend that should carry into February and March, according to Ellie Mae.

March 5 -

Women are becoming more and more empowered in home purchasing, thanks in part to the digitization of the mortgage and real estate industries, according to a report from Compass and Better.com.

March 4 -

While home price appreciation has lost some momentum, tight inventory and low rates could drive housing values further upward this spring if the coronavirus remains contained, according to CoreLogic.

March 3 -

Reduced construction and domestic migration in search of better job markets caused housing supply deficits in over half of the U.S., according to Freddie Mac.

March 2 -

Sales are up across Miami-Dade County and Broward. And it's not just snowbirds from the northeast driving activity. Millennials, and their parents, are also driving sales.

February 26 -

It is the start of a new decade, and here are six trends that will play a critical role in reshaping the mortgage industry.

February 19 Ally Home

Ally Home -

Low mortgage rates are setting the stage for growth, not just in refinancings, but in purchase volume as well during 2020, according to Ellie Mae.

February 19 -

A larger percentage of newly originated mortgages to millennials shifted toward purchase loans as interest rates stayed low, according to Ellie Mae.

February 7 -

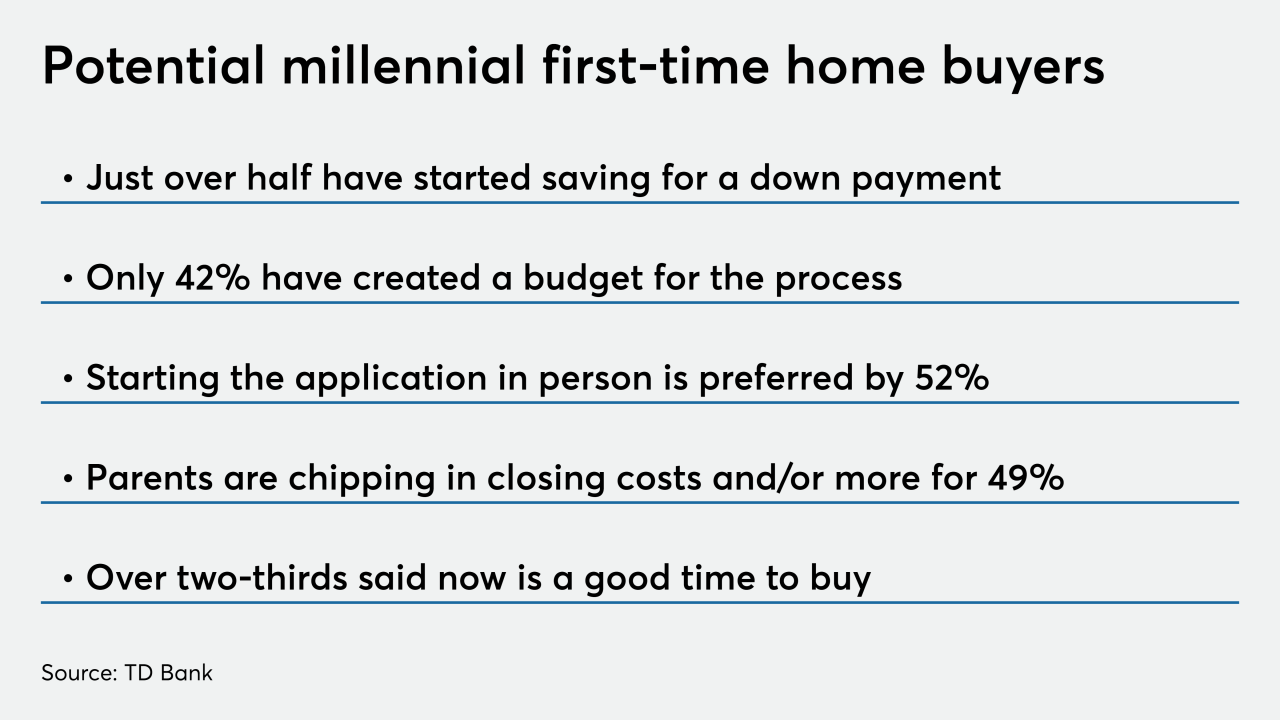

A significant number of millennials planning to purchase their first home during 2020 have not yet taken the financial steps necessary to successfully complete the process, a TD Bank survey found.

January 27