-

With the economy and job market both healthy before the COVID-19 crisis, first-time homebuyers took advantage of low mortgage rates and hit their highest volume in two decades.

March 17 -

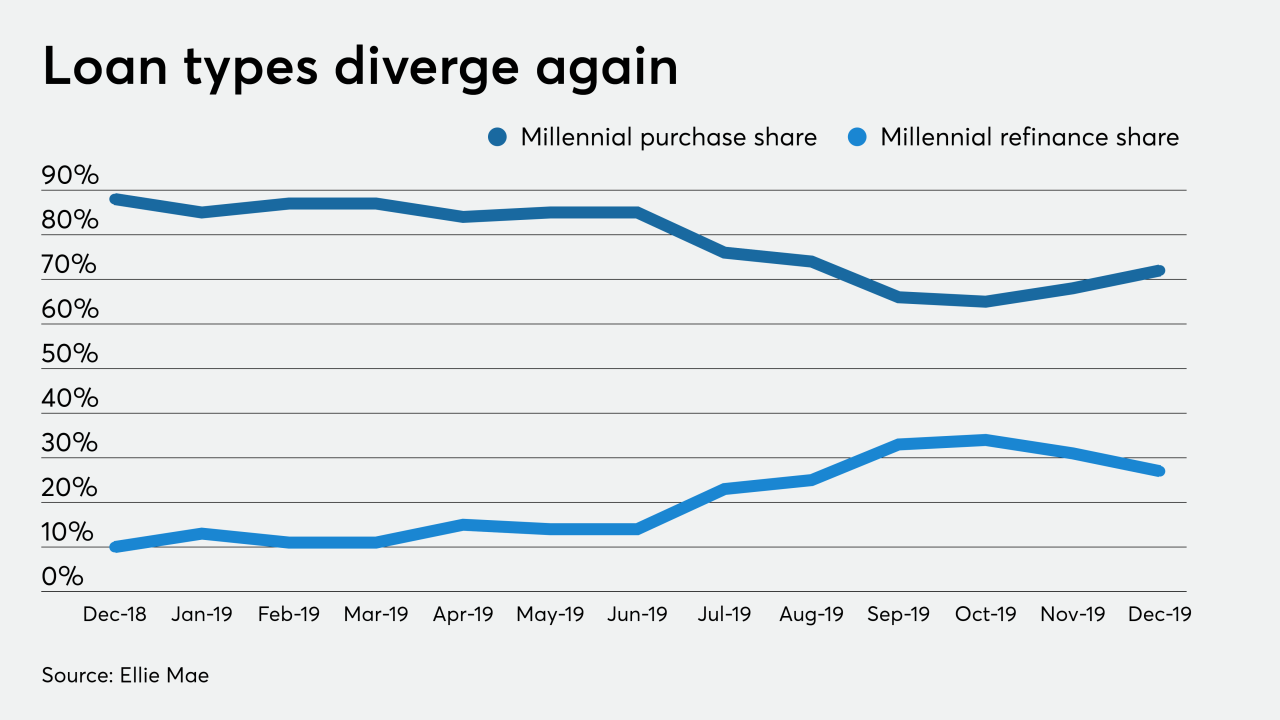

January's plummeting mortgage rates led to a spike in the share of millennials refinancing their home loans, a trend that should carry into February and March, according to Ellie Mae.

March 5 -

Women are becoming more and more empowered in home purchasing, thanks in part to the digitization of the mortgage and real estate industries, according to a report from Compass and Better.com.

March 4 -

While home price appreciation has lost some momentum, tight inventory and low rates could drive housing values further upward this spring if the coronavirus remains contained, according to CoreLogic.

March 3 -

Reduced construction and domestic migration in search of better job markets caused housing supply deficits in over half of the U.S., according to Freddie Mac.

March 2 -

Sales are up across Miami-Dade County and Broward. And it's not just snowbirds from the northeast driving activity. Millennials, and their parents, are also driving sales.

February 26 -

It is the start of a new decade, and here are six trends that will play a critical role in reshaping the mortgage industry.

February 19 Ally Home

Ally Home -

Low mortgage rates are setting the stage for growth, not just in refinancings, but in purchase volume as well during 2020, according to Ellie Mae.

February 19 -

A larger percentage of newly originated mortgages to millennials shifted toward purchase loans as interest rates stayed low, according to Ellie Mae.

February 7 -

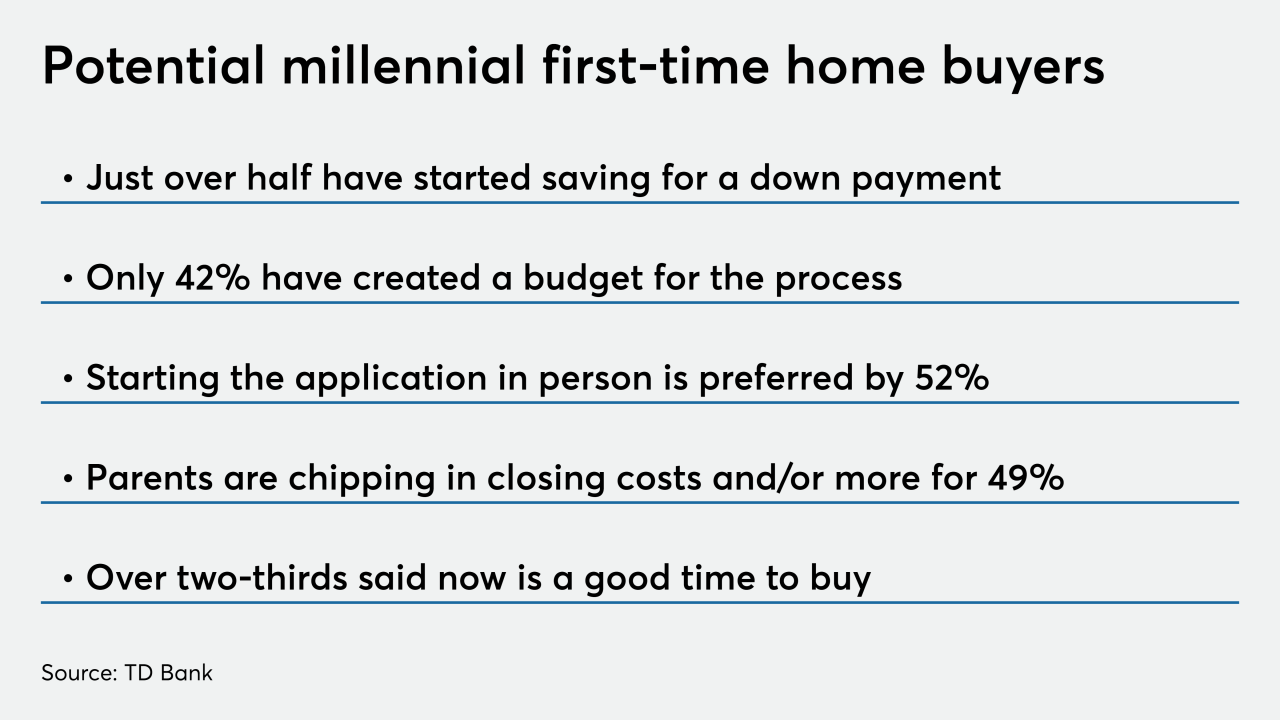

A significant number of millennials planning to purchase their first home during 2020 have not yet taken the financial steps necessary to successfully complete the process, a TD Bank survey found.

January 27 -

More than half of Columbus homebuyers are millennials, according to a new study from the mortgage lead generation company LendingTree.

January 14 -

While the refinancing boom took a step back, millennials purchasing power grows in the low mortgage rate environment, according to Ellie Mae.

January 9 -

Without the baggage of living through the Great Recession, homeownership rates for Gen Z should exceed that of millennials, a plurality of respondents to a Zillow survey said.

December 17 -

Better.com saw huge growth in mortgages to traditionally underserved customer bases in 2019 and believes digital applications led to the avoidance of discriminatory lending.

December 17 -

Millennials took advantage of the low mortgage rate landscape in October, boosting their refinance share to a survey-record high, according to Ellie Mae.

December 4 -

Most U.S. construction takes place in counties with millennial concentrations, but the rate that new homes are built in these regions is relatively slower than it is elsewhere.

December 3 -

October's deceleration in housing values could be followed by acceleration in 2020, but a growing subset of millennials nevertheless plan to become homeowners in the new year, according to CoreLogic.

December 3 -

From the Tennessee-Kentucky border through coastal North Carolina, here are the 15 metro areas where millennial VA purchase-loan activity increased the most over the past fiscal year.

November 5 -

Inventory shortages, favorable tax policies and a dearth of affordable options caused homeowners to increase the number of years lived in their home, according to a Redfin report.

November 4 -

Millennial homeownership rates declined between 2009 and 2016 before picking up in 2017, even as the number of households under the age of 35 dropped by over 1 million, a ValuePenguin study found.

October 10