-

MGIC reported higher-than-expected earnings, seen as a positive for the other mortgage insurers, plus Flagstar and KeyCorp had strong quarters for their mortgage businesses.

July 23 -

Black Knight created a pair of tools for its MSP servicing system in order to help mortgage services identify loans in their portfolio tied to areas affected by natural disasters.

July 22 -

Damage related to flash flooding from Tropical Storm Barry has the potential to affect about 340,000 homes, according to CoreLogic. Reports estimate a worst-case total of $10 billion in reconstruction cost value.

July 15 -

Some commercial mortgage-backed securities due next year could have difficulty refinancing due to the recent Ridgecrest earthquake, according to a new Morningstar report.

July 11 -

Not a single state posted annual gains in overall or serious mortgage delinquency rate in April as the national rate plummeted to a low not reached in over 20 years, according to CoreLogic.

July 9 -

Mortgages using alternative documentation like bank statements for underwriting performed stronger than expected, but uncertainty remains about their default rates in stressed environments, Fitch Ratings said.

July 2 -

The mortgage industry is calling for better alignment between the federal government and state of New York regarding proposed regulatory revisions that would affect local servicers.

July 1 -

The number of properties in some stage of mortgage default has fallen to its lowest level in 14 years as most types of delinquencies have declined, according to Black Knight.

June 20 -

Completed foreclosures shot down 50% in May from the year before, with overall activity also declining by 22% during the same period, according to Attom Data Solutions.

June 14 -

Foreclosure rates in March hit their lowest reading for the month in at least 20 years, while overall and serious delinquency rates also achieved 13-year lows for the same period, according to CoreLogic.

June 11 -

Covius Holdings plans to buy several businesses from Chronos Solutions that support mortgage servicing and origination processes, including three delivery platforms that will increase the breadth of its technology offerings.

June 4 -

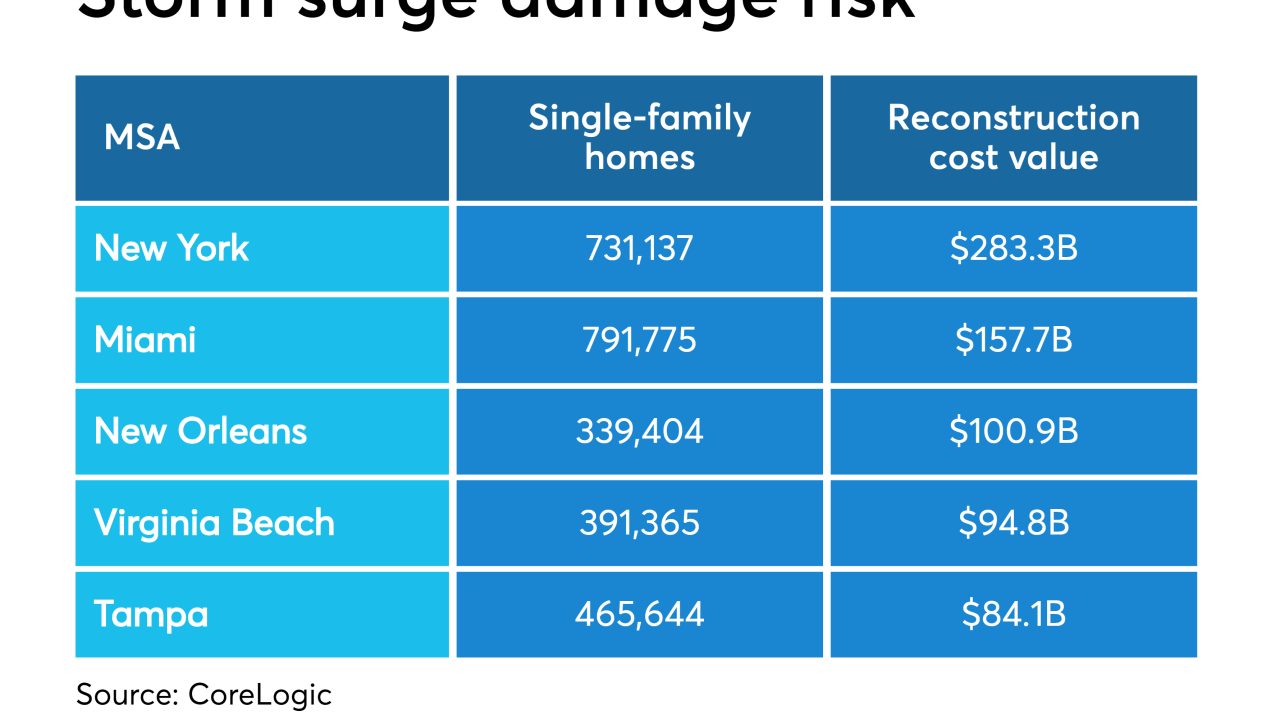

In the worst-case scenario, $1.8 trillion in reconstruction costs could result from coastal storms in 2019, even as hurricane experts predict a near-normal year for this season, according to CoreLogic.

June 3 -

Investors shouldn't overreact to the first-quarter shift in private mortgage insurer market share, said the CEO of the company that benefited most from the change.

May 31 -

The large number of overleveraged commercial mortgage-backed securities loans coming due in 2019 is likely to cause the payoff rate to drop an additional 9 percentage points by December, a Morningstar report said.

May 29 -

First-time homebuyers face growing competition from out-of-state investors and corporate landlords looking to capitalize on Boise's increasing rents.

May 29 -

Delinquencies associated with the government-sponsored enterprises high loan-to-value ratio programs that target low-to-moderate income homebuyers are slightly better than expected, at least early on, according to Fitch.

May 23 -

The distressed mortgage market continues to dry up, with delinquencies shriveling to a record low rate and foreclosure filings dropping annually for 10 consecutive months.

May 21 -

One of the hardest financial parts of buying a new home is coming up with the initial down payment on the mortgage loan.

May 20 -

The rise in home prices in North Texas has pushed home foreclosure rates to some of the lowest levels ever recorded.

May 20 -

Generation X is in its prime earning years, but the financial profiles of those renting are distinctly different from those who own a house, according to LendingTree.

May 20