-

A rise in reverse occupancy fraud is contributing to the uptick, a CoreLogic report found.

February 16 -

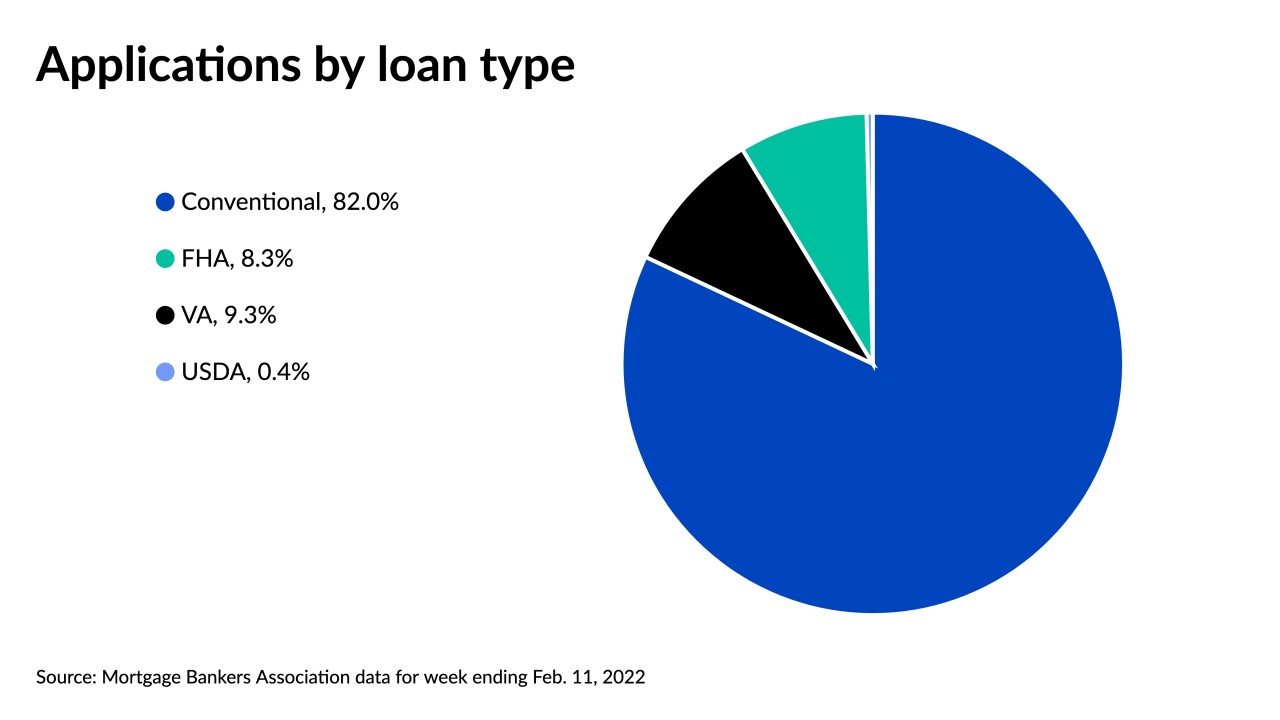

Credit availability also tightened in January, contributing to early 2022’s lending slowdown, according to the Mortgage Bankers Association.

February 16 -

Current president Joe Nackashi will become CEO in place of Anthony Jabbour who will be taking the role of executive chairman.

February 15 -

Guidelines first eased during the coronavirus pandemic have been signed into law.

February 14 -

These cities offer lucrative tech job markets, affordable listings and rising real estate equity.

February 13 -

Danny Yen, owner of Real Estate Educational Services, received a permanent ban on conducting future related training and agreed to testify in any legal proceedings against originators he assisted.

February 11 -

The nation's second largest title insurer reported lower fourth quarter earnings, but the shift to purchase transactions pushed revenue higher.

February 10 -

Inflation data showing a 7.5% increase in consumer prices will likely lead to Federal Reserve moves that apply continued upward pressure.

February 10 -

The changes follow the company’s acquisition by Pretium in November of last year.

February 9 -

Steadily climbing rates have contributed to a 40% decline in loan activity from one year ago.

February 9 -

Using digital methods also saves time for the actual closing, which also contributes to the lower costs, the Notarize study found.

February 8 -

The company said it would increase efforts in non-QM lending and dropped hints about further acquisitions.

February 8 -

United Wholesale Mortgage’s litigation could prompt regulators, including the Federal Trade Commission, to examine the contract that bars third-party originators from doing business with Rocket and Fairway.

February 7 -

Compounding factors of low inventory and high costs also helped lead to another decline in Fannie Mae’s Home Purchase Sentiment Index.

February 7 -

Pretax income in the servicing segment outpaced its loan production unit in the fourth quarter, as the company launches new branding initiatives.

February 4 -

Employment numbers suggest that interest in home purchases is bearing up well despite some limits on consumer spending and normalization in the mortgage market after two banner years.

February 4 -

Zip codes with the biggest share of children under 18 saw faster increases in house prices about two-thirds of the time, a Zillow study found.

February 4 -

But the company was able to increase the share of its top line that came from recurring income streams while minimizing the impact of more volatile transactional-based ones.

February 3 -

But the current lack of movement is likely only a temporary reprieve, according to Freddie Mac.

February 3 -

If approved, the new loan would unlock $120 million in badly needed funds for the sprawling Bronx multifamily complex.

February 3