-

Enact's stock offering priced on Sept. 16 in its expected range, at $19 per share, and quickly moved up to over $21.

September 21 -

The government-sponsored enterprise also expects purchase and refinancing volumes to drop in 2022.

September 20 -

Also: Sen. Warren and Wells Fargo spar, FHFA suspends Trump-era GSE restrictions and more.

September 17 -

Required use of the Federal Housing Administration’s Catalyst platform may accelerate data collection on valuations from a government agency that’s insuring nearly one-fifth of all purchase loans.

September 16 -

COVID-19 concerns, inflation hold back actions that might change current patterns.

September 16 -

But the pace of refinances was at its slowest since July, even as interest rates remained low.

September 15 -

All of the NTC employees will join Covius, including the company's senior management, following the deal's completion.

September 14 -

The companies talk through their products aimed at making the processes safer and more inclusive for consumers.

September 14 -

August’s increase in that loan type drove refinancings to take up a slim majority share of origination volume for the first time since February, according to Black Knight.

September 13 -

The fourth annual survey seeks to identify and recognize the best employers in the industry.

September 13 -

The pandemic, a refinancing boom and intensified appraiser shortage boosted appraisal alternatives in line with the rise in remote work. Now an overheating purchase market and policymaker scrutiny are shifting priorities.

September 13 -

The underwriter also agreed to assist in the New York Attorney General's investigation of no-poach agreements in the title industry.

September 10 -

The company will roll out the program it has been piloting, Appraisal Direct, nationwide on Oct. 1.

September 9 -

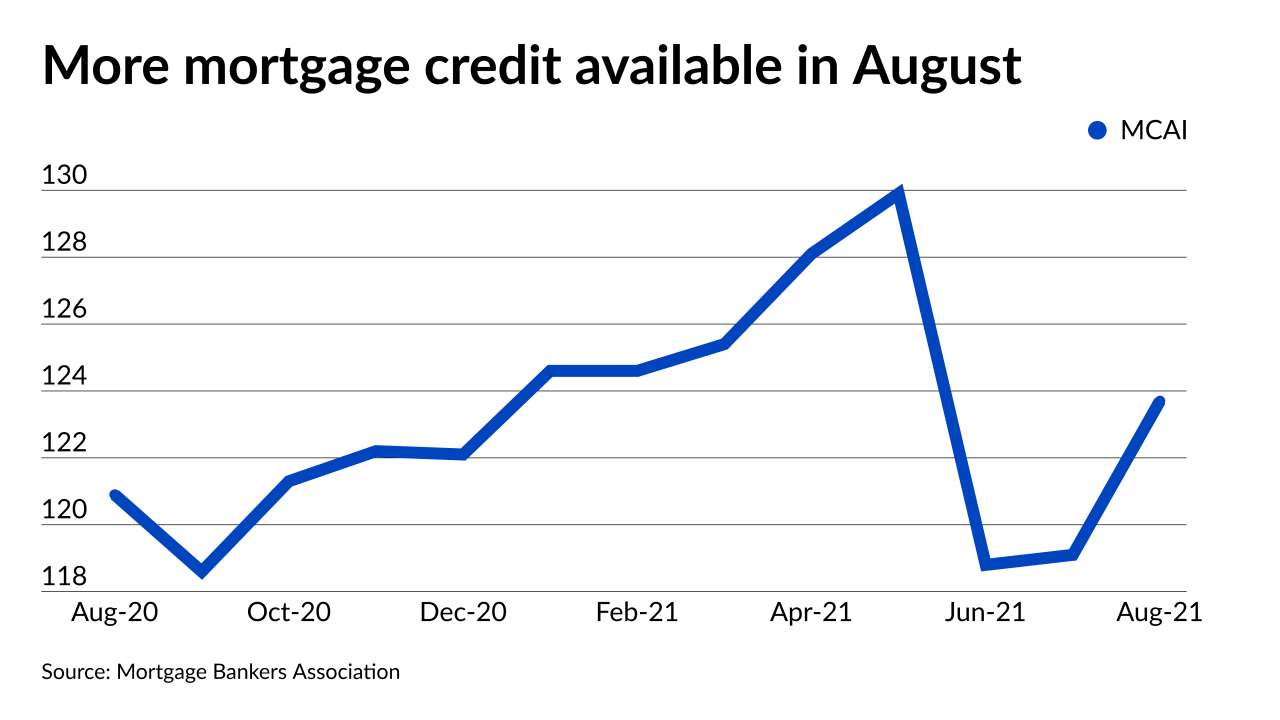

But refinance volume was constrained in recent weeks and many of the new offerings are aimed at low income borrowers, the Mortgage Bankers Association said.

September 9 -

Effects of major economic announcements this summer have had little impact on the lending market, with averages remaining under 3% since July.

September 9 -

But a greater number still expect decreased margins for the fourth straight quarter, due to competitive pressures and shifting demands in purchases and refinances

September 9 -

Both government-sponsored enterprises approve more borrowers across the board than the broader market but the relative progress each has made differs across racial groups, numbers released Wednesday show.

September 8 -

Refinance and purchase applications both declined, while average loan sizes shrunk for the fifth consecutive week.

September 8 -

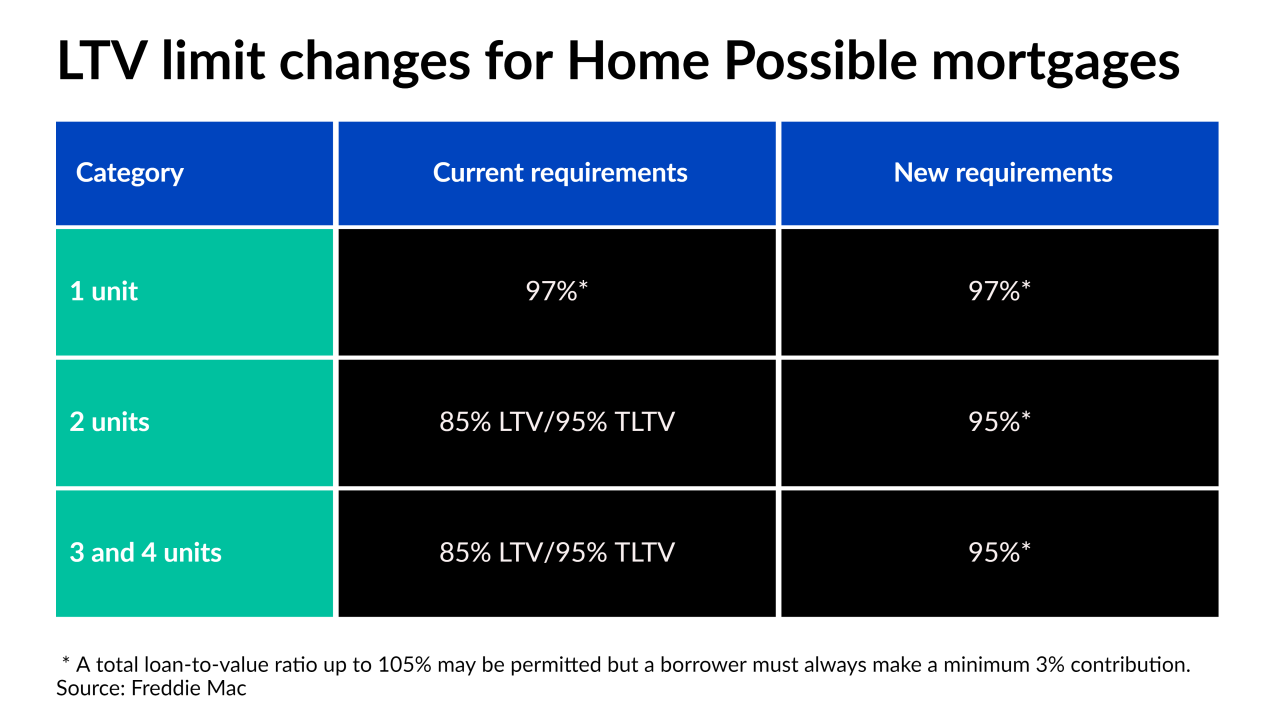

The changes could help one of the Biden administration’s affordable housing goals, which is aimed at making wealth-building through owner-occupied, 2- to 4-unit properties more attainable.

September 3 -

Improved capitalization and smaller balance sheets should help several weather the likely consolidation that is coming, Moody's said.

September 3