-

Many banks reported sharp declines in income from home loans during the second quarter. The large gains they enjoyed last year thanks to a surge in refinancing activity are unlikely to return, according to bankers and analysts.

August 4 -

Despite declining rates, refinancing volume fell, while purchases slowed even further after dipping to its lowest point in over a year.

August 4 -

The gain on sale in the retail channel dropped by more than half annually, as the wholesale and joint venture channel endured an even tighter squeeze due to competitive pressures

August 3 -

While the hot market’s actual and forecast home price gains were key drivers of Fannie’s results, they also present a challenge to the affordable housing mission that it’s working to address.

August 3 -

Also: Doma launches IPO, FHFA and other agencies prepare for end of pandemic-driven measures and more

July 30 -

The REIT also reveals plans to expand in the single-family rental market with a new brand and target of $5 billion in acquisitions over five years.

July 29 -

New customer growth and increased adoption of a digital workflow by mortgage lenders resulted in better than expected results for the Intercontinental Exchange unit.

July 29 -

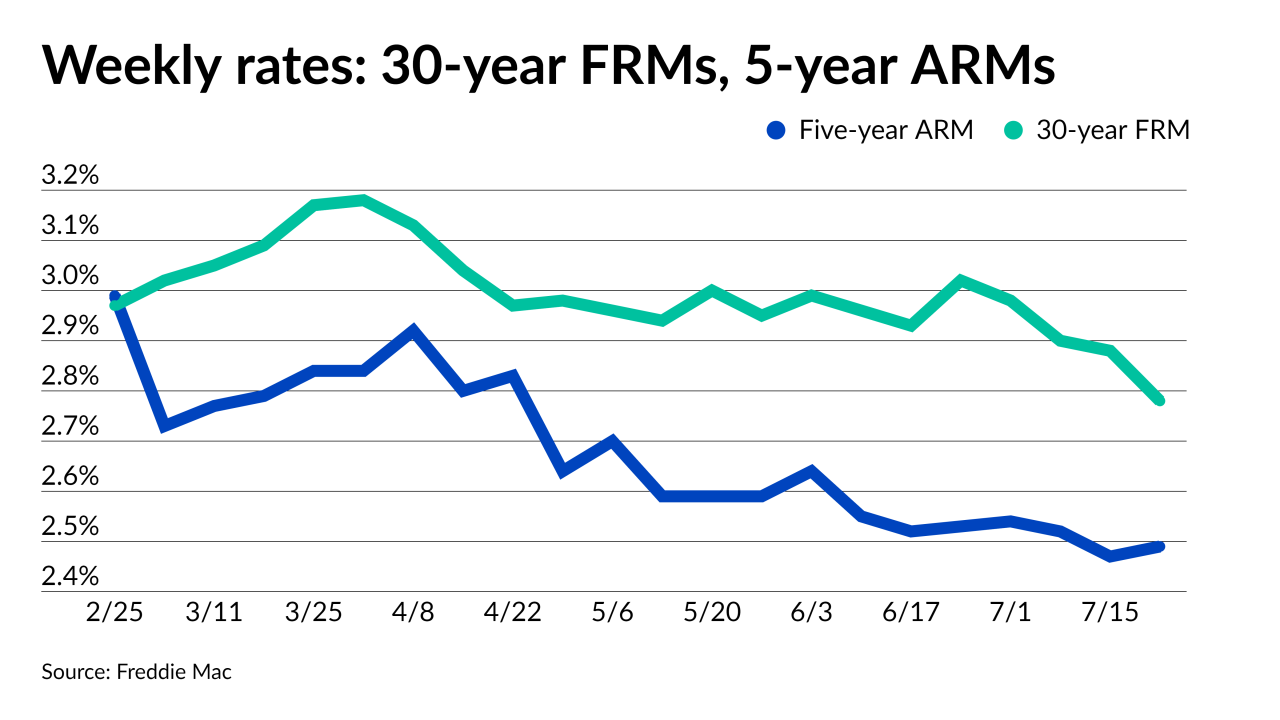

A change in the relationship between fixed and adjustable loans has increased some consumers’ interest in the latter market.

July 28 -

The bank produced $1 billion less in originations while its gain on sale fell 49 basis points from the first quarter.

July 28 -

Such applications have declined on an annual basis for the past three months, but overall weekly numbers increased due to a jump in refinances amid plummeting rates.

July 28 -

Less than a year after a Series C capital raise, the title insurer formerly known as States Title is about to complete a merger with a special purpose acquisition company.

July 27 -

Also: MeridianLink announces pricing of its IPO, mortgage rates fall following COVID-19 worries, FHFA change

July 23 -

In 2011 Congress paid for payroll tax relief by raising secondary market guarantee fees for 10 years. The Mortgage Bankers Association, and others, don’t want to see that happen again.

July 23 -

Despite lower numbers, refi applications continued trending strongly, while purchases fell close to lows from more than a year ago.

July 21 -

The cloud IT provider for settlement services companies has no timeline on when services will be restored following its shutdown Friday.

July 20 -

Meanwhile, the average new-home mortgage price climbed to a new all-time high, according to the Mortgage Bankers Association.

July 20 -

As rising home valuations force first-time home buyers out of the market, expect to see non-owner-occupied loans to increase.

July 20 -

Also: Fannie Mae, Freddie Mac loan modifications reach a pandemic high, Recreational marijuana is a gateway drug to higher home prices

July 16 -

“One” is the first in a series of non-agency mortgages the wholesaler plans to introduce this year.

July 15 -

Purchase loans also increase, as their average size shrinks

July 14