Title firms swoop in to help victims of Cloudstar ransomware attack

Cloudstar, which acts as a container for the data generated by title production software,

"We have retained third-party experts to assist us in our recovery efforts and have also informed law enforcement," a Cloudstar spokesperson said. "Due to the nature of this attack, at this time our systems are currently inaccessible, and although we are working around the clock, we do not have a definitive restoration timeline."

Read the

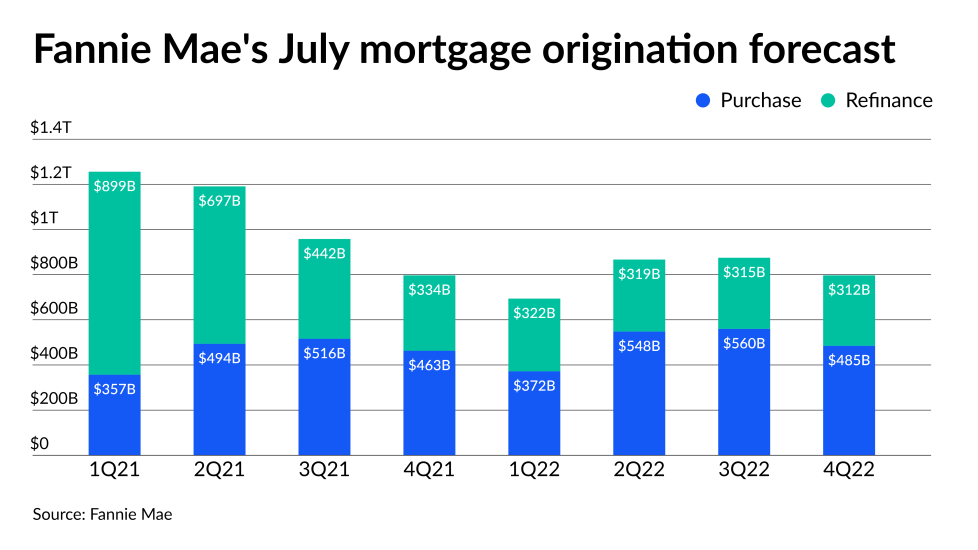

Fannie Mae expects lower rates to boost mortgage originations in 2H

The improved outlook does not take into account the Federal Housing Finance Agency's cancellation of its

Fannie Mae now expects over $4.2 trillion in production this year, versus its June prediction of $4.1 trillion. Its outlook is more bullish than Freddie Mac's, whose

Read the

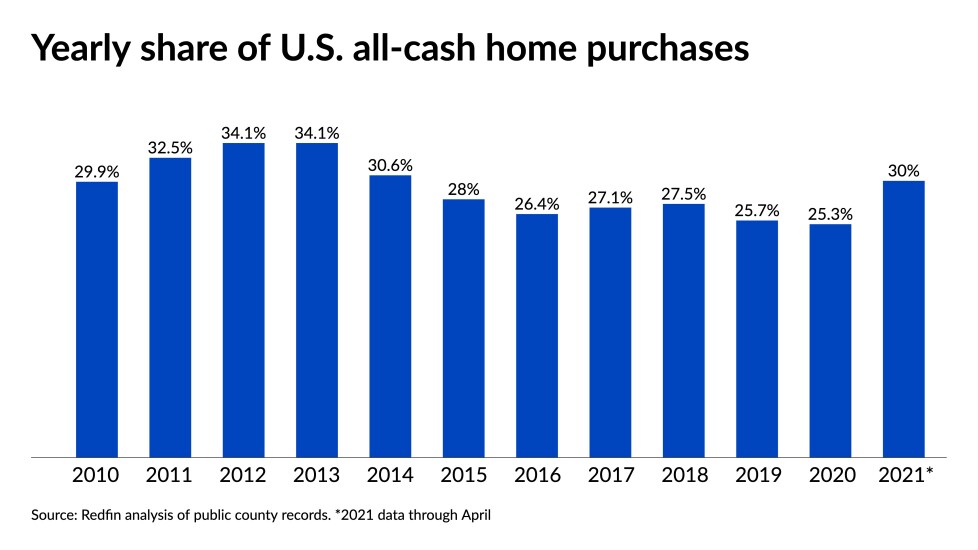

5 things to know about cash offer financing products

The evidence shows up in the rising number of

“Supply is very tight. Cash offers are what sellers prefer just because the deal will go through faster — you don't have to have an appraisal. And so that's what we've seen tracking at about 25%,” she said.

Read the

Predicted for H2: Signs of a housing bubble, non-agency lending growth

Both are big concerns for Bruno Pasceri, the president of Incenter, which provides lender services. "I hate to use that word because it's scary, but I think we're

The annual price gains alarm him because of their effect on house sales.

Read the

MeridianLink announces pricing of its IPO

The cloud-based loan origination and decision-making software provider will put out 12 million shares of common stock, with 10 million from the company itself and 2 million sold by existing stockholders. It’s also giving its underwriters a 30-day option to purchase an additional 1.8 million shares. The company first announced a proposed IPO on April 30.

The stock’s anticipated price range should fall between $24 and $26 per share when it starts trading at some point next week, according to the Securities and Exchange Commission S-1 document. It would raise between $331.2 million and $358.8 million if the share prices stay within that range.

Read the

Mortgage rates fall following COVID-19 worries, FHFA change

According to Freddie Mac’s Primary Mortgage Market Survey, the 30-year fixed-rate average dropped 10 basis points for the weekly period ending July 22 — the steepest single-week decline this year — falling to 2.78% from 2.88%. During the same period one year ago, the average came in at 3.01%.

Read the

Investors bought more single-family homes than ever in 2Q

Investors — any institute or business that deals in real estate — bought 67,943 homes in the second quarter, a surge from 59,017 in the first quarter and 32,873 the year before, according to Redfin. Those purchases amounted to $48.5 billion, up from $38.9 billion quarterly and $20.9 billion annually, though many investors pulled back during the pandemic’s early stages.

Investor-owned units make up 15.9% of all U.S. properties, an increase from 14.8% in 1Q, 10.2% a year ago and just below the record of 16.1% in 2020’s first quarter. The

Read the

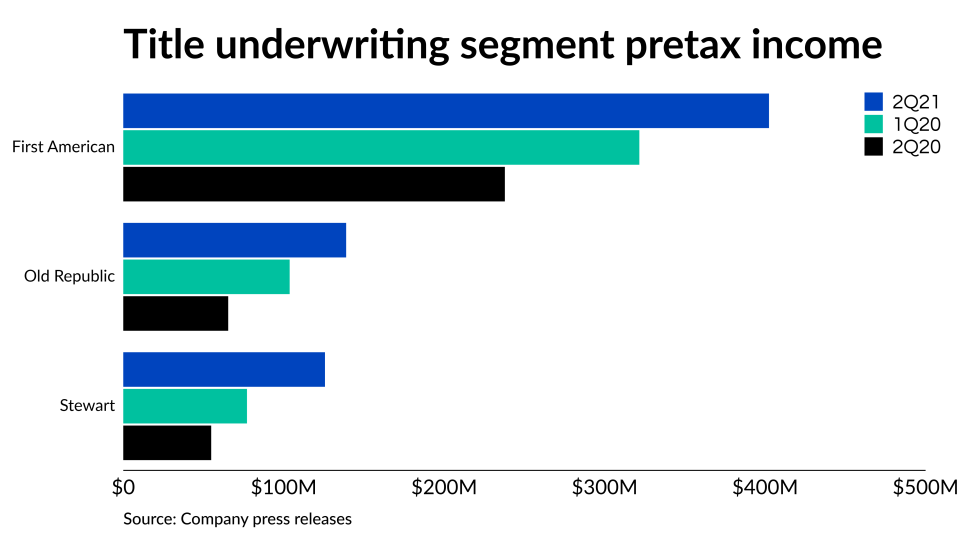

Title company earnings rise in 2Q even as business slips

During the first quarter, the title insurers had unusually high activity due to the refinance boom. However, most home purchases, whose title orders have higher margins, typically take place in the spring, which helps to explain the increased earnings in the second quarter.

The Mortgage Bankers Association's forecast issued on Wednesday estimated the second quarter's total volume at $1.05 trillion, slightly down from the first quarter's $1.09 trillion. But purchase originations rose on a quarter-to-quarter basis to $460 billion from $320 billion. During the second quarter of 2020, mortgage originators had purchase volume of $348 billion

Read the

Mortgage volume drops again after a one-week surge

The MBA’s Market Composite Index, which tracks application volume through a survey of members, declined 4% on a seasonally adjusted basis for the week ending June 16, compared to the prior period that included the July 4th holiday. The unadjusted index came in 20% higher for the week. Volume showed a seasonally adjusted 17.7% decrease from the same week a year ago.

Read the

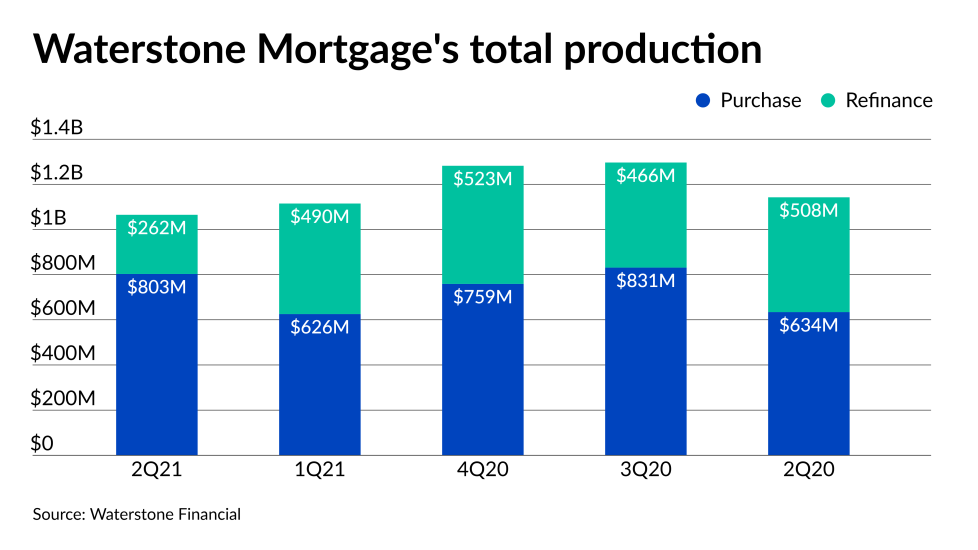

Waterstone Mortgage's mortgage volume declines in 2Q21

The subsidiary of Wauwatosa, Wis.-based Waterstone Financial had a net income of $10.4 million in the second quarter, compared with $14 million in the first quarter and

Mortgages account for the bulk of net income at the parent company. Waterstone Financial, which also operates a community bank, had total net income of $17.9 million for the second quarter, down from $21.3 million in the first quarter and $20.9 million in the second quarter of 2020.

Read the

Delinquency rate falls to pre-Great Recession average: Black Knight

June’s 4.4% delinquency rate, which includes borrowers with payments forborne due to coronavirus-related hardships, is well within the range that passed for normal in the period leading up to the mid-aughts housing crash, according to Black Knight’s latest First Look report. That rate, which excludes foreclosures, was down from 4.7% the previous month and 7.6% a year ago. Prior to the coronavirus’ arrival in the United States, the delinquency rate was 3.4%.

Read the

New-home loan volume drops to 13-month low in June

June applications

June’s seasonally adjusted annual estimate of 704,000 sales declined 5% from May’s 741,000 units. It represented the lowest amount since May 2020. The annual rate of sales over the past three months sits about 7% lower than 2020’s average, according to Joel Kan, MBA’s associate vice president of economic and industry forecasting.

Read the

Home buyers drive condo sales prices to 9-year high

Condos also sold at the fastest pace ever, 22 days compared to 43 days in June 2020 and 36 days in June 2019. With more consumers returning to cities, June condo sales spiked 59.7% annually and pending sales rose 38.2%. This

Read the

Black borrowers more likely to make financial sacrifices to buy homes

White homeowners were 23% more likely to make no financial sacrifices to buy their first home, while only 14% of Black homeowners could say the same, according to the Redfin survey, which was based on more than 1500 responses from homeowners.

“African Americans are much less likely to come from families, communities that have strong homeownership,” said Dedrick Asante-Muhammad, chief of membership, policy and equity at the National Community Reinvestment Coalition. “They're going to get a lot less assistance through generational wealth.”

Read the

Biden nominates progressive for Treasury financial policy job

Steele is currently the director of the Corporations and Society Initiative at Stanford University’s Graduate School of Business, which looks to “promote more accountable capitalism and governance,” the White House said in a news release.

Steele also worked from 2010 to 2017 on the Senate Banking Committee, where he was a legislative assistant for the committee’s current chair, Sen. Sherrod Brown, D-Ohio, and the minority chief counsel. He also served for four years as the staff director for the subcommittee on financial institutions and consumer protection.

Read the