-

The data also showed that more purchase loans were made to low- and moderate-income borrowers last year, but fewer refinances.

June 18 -

Investors appear to support the notion that lending to borrowers who don’t have traditional incomes could be a growth engine for lenders as other sources of volume weaken.

June 17 -

Demand was strongest at the high end of the market, which pushed loan amounts up for the fourth straight month.

June 17 -

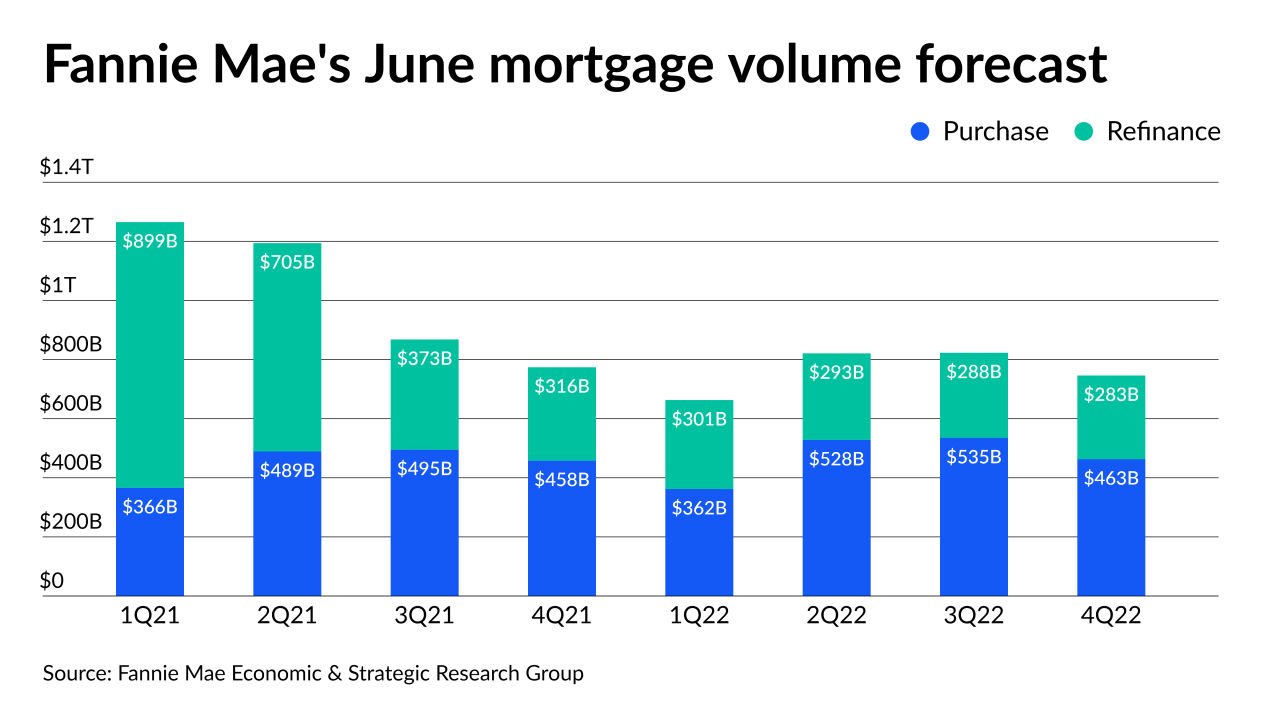

But the government-sponsored enterprise raised its total origination volume forecast for 2021 based on slightly stronger than expected refinance activity.

June 16 -

A spike in government-sponsored applications helped lead indexes to their largest gains in several weeks.

June 16 -

The move makes it easier for borrowers who don’t have standard W-2 incomes and those that do to get loans from the same outlets, and reflects broader trends.

June 15 -

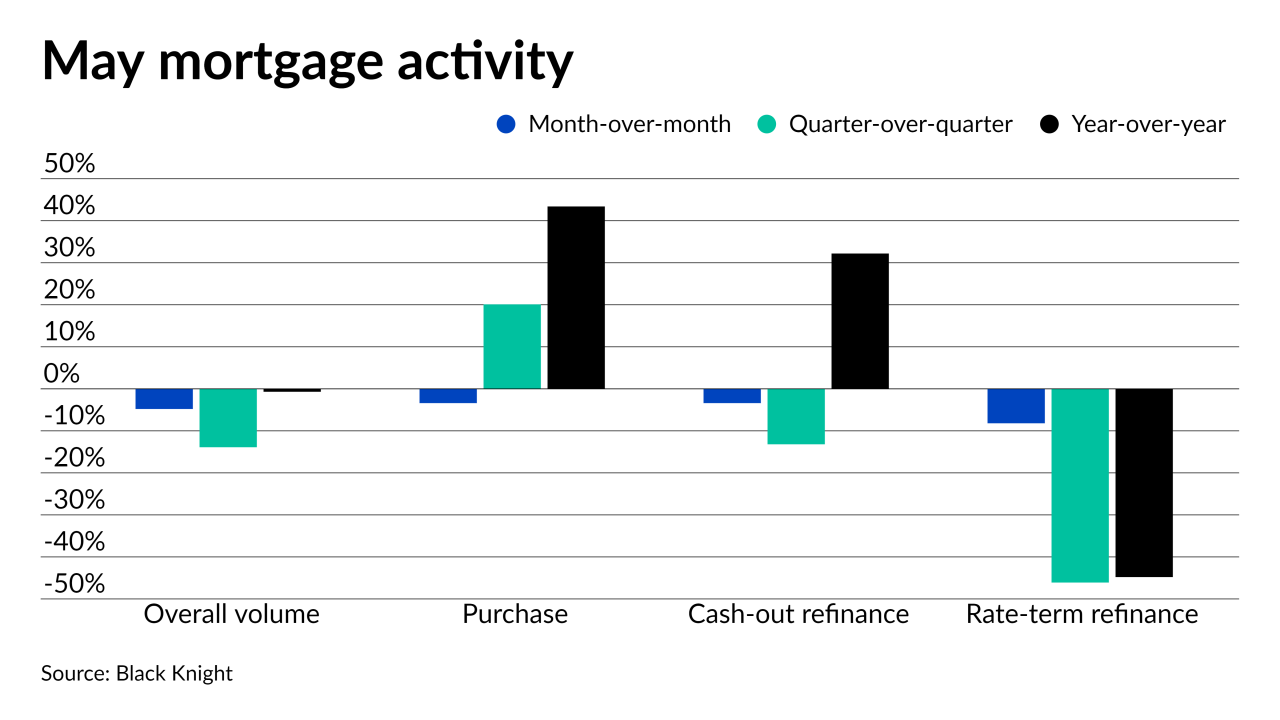

Changed borrower psychology and the severe housing inventory shortage dropped lending activity across the board, according to Black Knight.

June 14 -

There’s now a unique, additional source of demand that’s opening up in an already fiercely-competitive housing market that VA lenders have to solve for.

June 14 -

Also: Residential delinquencies reach a pandemic low, groups seek to keep mortgage origination and securitization rules aligned

June 11 -

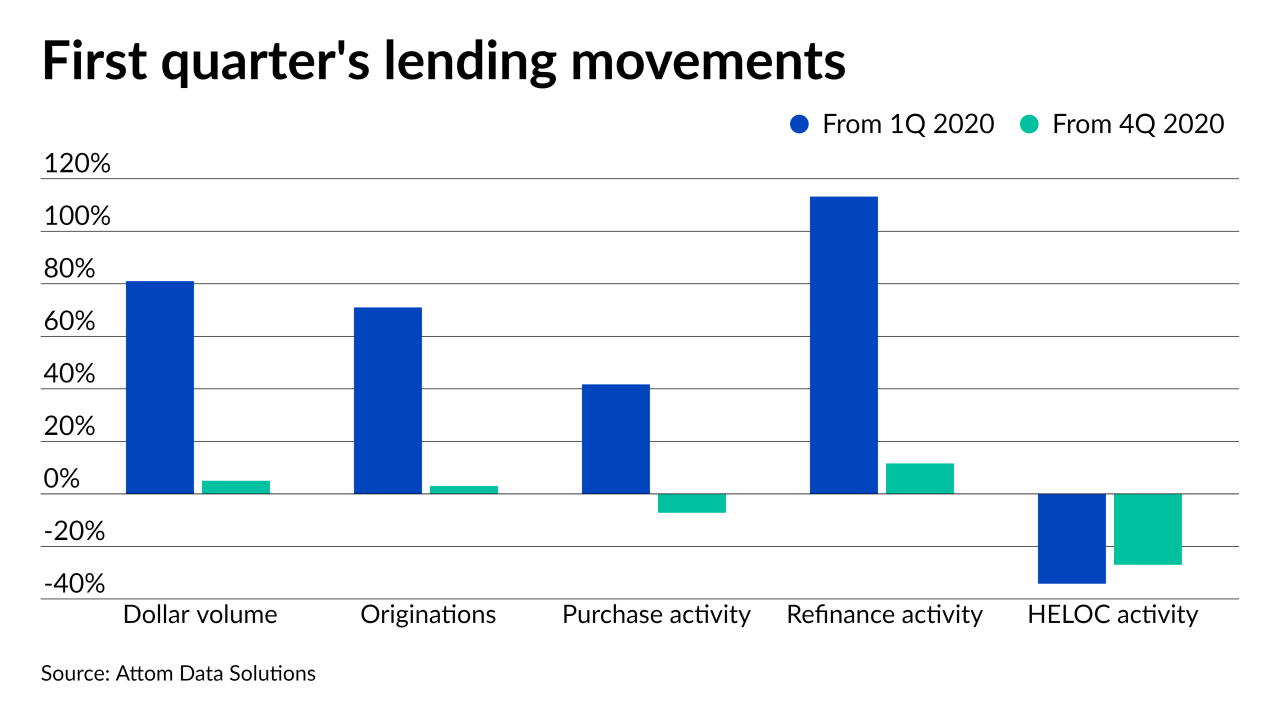

Purchase loans tick upward, even as housing demand pushes prices well above 2020 levels.

June 9 -

In addition to earning ancillary fee income, it provides originators with an opportunity to connect with current and potential clients mired in student loan debt.

June 9 -

In the aftermath of 2020’s historic year of mortgage originations, lenders are concerned with keeping employees and insulating themselves from the negative effects of the boom and bust cycle, according to a survey from The Mortgage Collaborative.

June 8 -

The government-sponsored enterprises have been returning to normal underwriting and are buying more loans than last year, but annual limits they have in place could become a concern.

June 8 -

The more gradual upward drift in job numbers this year may hint at a slight softening in the market that analysts have flagged.

June 4 -

Net production income was down from its peak in the third quarter of last year, but it set a survey record for the period between January and March.

June 3 -

Refinancings more than doubled the year-ago amount and made up for the slowed purchase activity, according to Attom Data Solutions.

June 3 -

Many put aside their own financial planning during the boom year of 2020 and some, as independent contractors, have no retirement savings at all. Here’s why they shouldn’t rely on selling their own companies or client lists to support themselves after they exit the workforce.

June 3 -

The reopening of the economy may only go so far toward reversing the intensified shift toward building in areas with longer commutes.

June 2 -

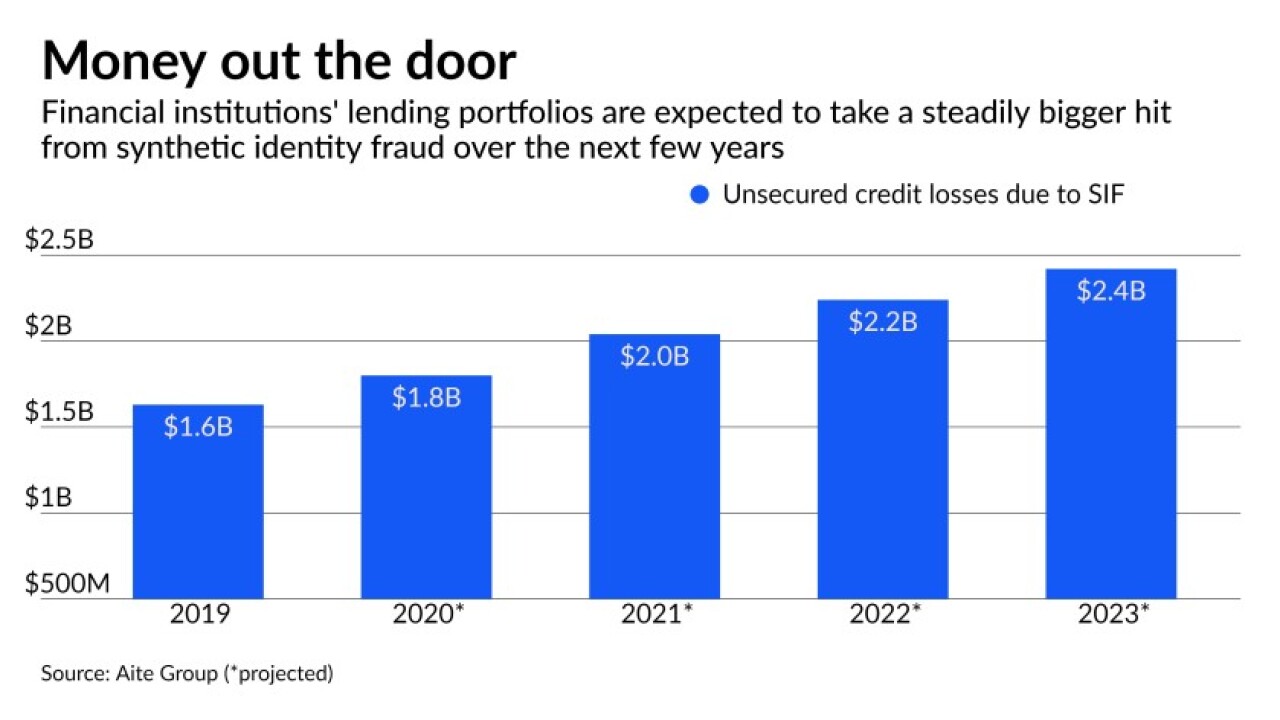

Scams in which a real person’s information is used to create fictitious businesses or individuals have led to $6 billion in credit losses. The Federal Reserve has developed a standard definition for synthetic identity fraud so lenders can distinguish it from traditional identity theft.

June 2 -

The MBA’s Market Composite Index decreased a seasonally adjusted 4% last week, dropping to a point not seen since February 2020.

June 2