-

The individuals allegedly defrauded Freddie Mac and CBRE Capital Markets by misrepresenting information used to refinance a small-balance loan.

May 20 -

Remote workers looking across the country for an inexpensive house have a wide net to cast, but a few important socioeconomic factors can narrow the search.

May 20 -

Groups active in low-income and rural housing expressed frustration that the post-pandemic resumption of long-term goal-setting didn’t do more to raise the bar.

May 19 -

Average loan size also continues to increase, as demand remains high and costs in homebuilding materials rise this year.

May 19 -

Economic recovery should soar into the summer as vaccination rates climb and restrictions loosen up, but low inventory is likely to limit mortgage activity into the next year, according to Fannie Mae.

May 19 -

Mortgage lenders have much riding on a yearslong effort to overhaul a program that requires homeowners to hold policies in flood-prone areas. A congressional panel meeting to discuss the issue was once again split between lawmakers from storm-threatened states and those concerned about government costs.

May 18 -

With little transitional disruption, the bigger players on the non-agency side could gain a hefty share of non-owner-occupied mortgage volume as a result of Fannie Mae and Freddie Mac’s caps on such purchases, a KBRA analysis finds.

May 17 -

Mortgage activity fell across the board despite analysis that 14.5 million current qualified borrowers would benefit from a refinance, according to Black Knight.

May 17 -

Patience and vigilance are virtues when using certain social media for marketing, writes the CEO of Paragon Digital Marketing Group.

May 14 Paragon Digital Marketing Group

Paragon Digital Marketing Group -

The newly public company expects a 20% overall loss in adjusted earnings this year.

May 13 -

Purchase loan volume also increased, as borrowers tried to take advantage of rate dips across all loan types

May 12 -

It’s getting easier to close bigger loans for higher-priced properties, but credit is expanding slower for first-time buyers.

May 11 -

While the first quarter is typically the weakest period for the title business, the sector benefited from strong refinance volumes that were driven by low interest rates.

May 10 -

The real estate investment trust has been buying residential business-purpose loans from the company since 2017.

May 6 -

The company, like many publicly-traded nonbanks, is looking for ways to address the downward pressure that a battle between two large competitors is putting on the wholesale channel’s profitability.

May 6 -

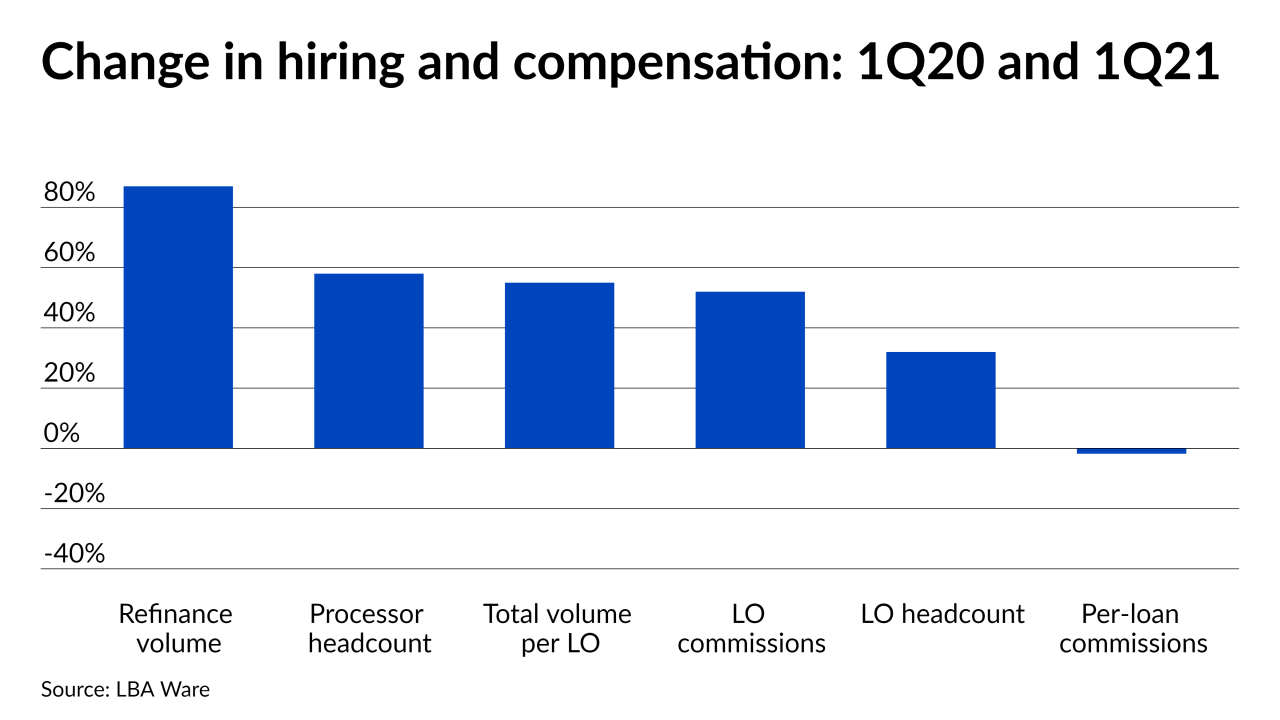

Also, per-loan compensation keeps dropping due to the persistence of refinancing in the mix but it could rise as the purchase share of the market increases.

May 5 -

The recent increase in loan size across all application types reflects rising prices, which contributed to a drop in applications, Mortgage Bankers Association economist Joel Kan said.

May 5 -

Loans bought on the secondary market have become increasingly important as borrower demand has ebbed and companies have sought to obtain mortgages through additional outlets to maintain production levels.

May 4 -

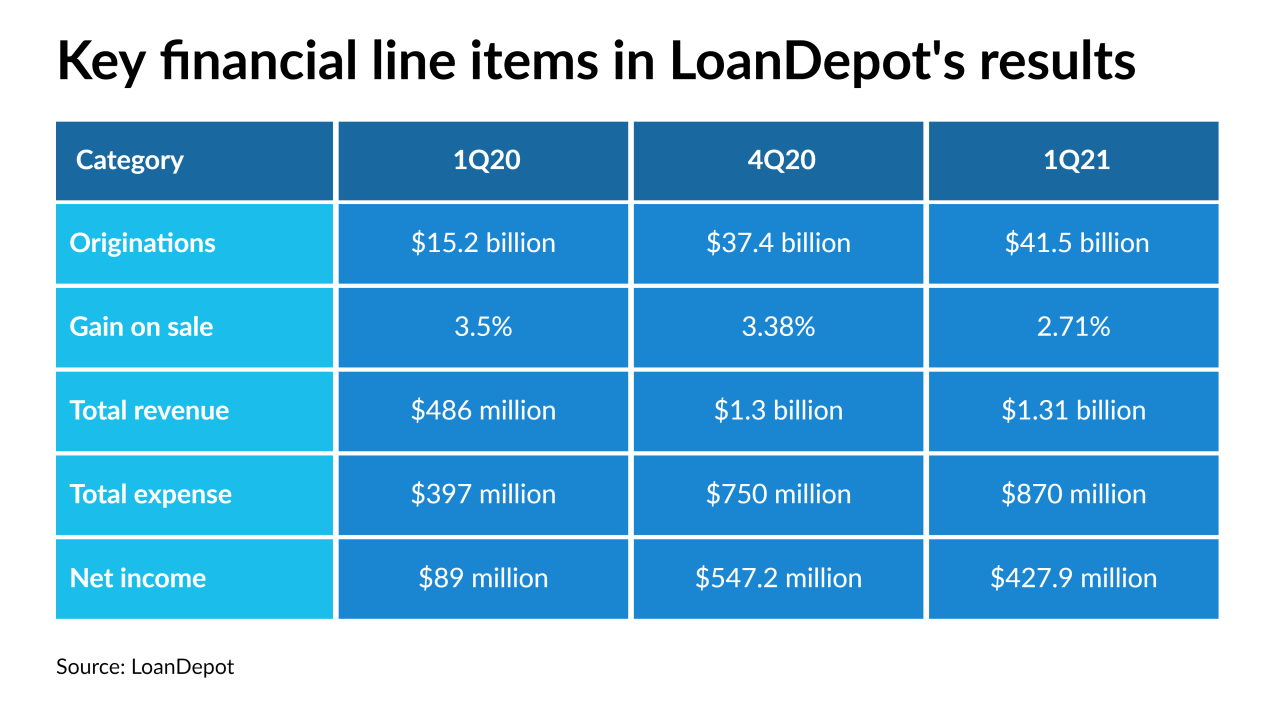

The unusually strong production numbers seen in the first quarter of this year show loanDepot is emerging as a contender in the battle for loan volume and market share amid an industry price war.

May 3 -

This is the first deal that serial acquirer FOA has announced since it went public on April 5.

April 28