-

But the percentage of weekly applications in that category was closer to 60%, the Mortgage Bankers Association found.

April 14 -

There’s a 20 percentage-point gap between Black and white consumers who have the income necessary to qualify for a mortgage on a new median-priced home.

April 13 -

However, companies were largely unable to use that cash infusion to make investments that lower their costs, since they had to pay out more in compensation.

April 13 -

A loan officer logging a billion-dollar volume topped the ranking for the first time in the 23-year history of the survey.

April 12 -

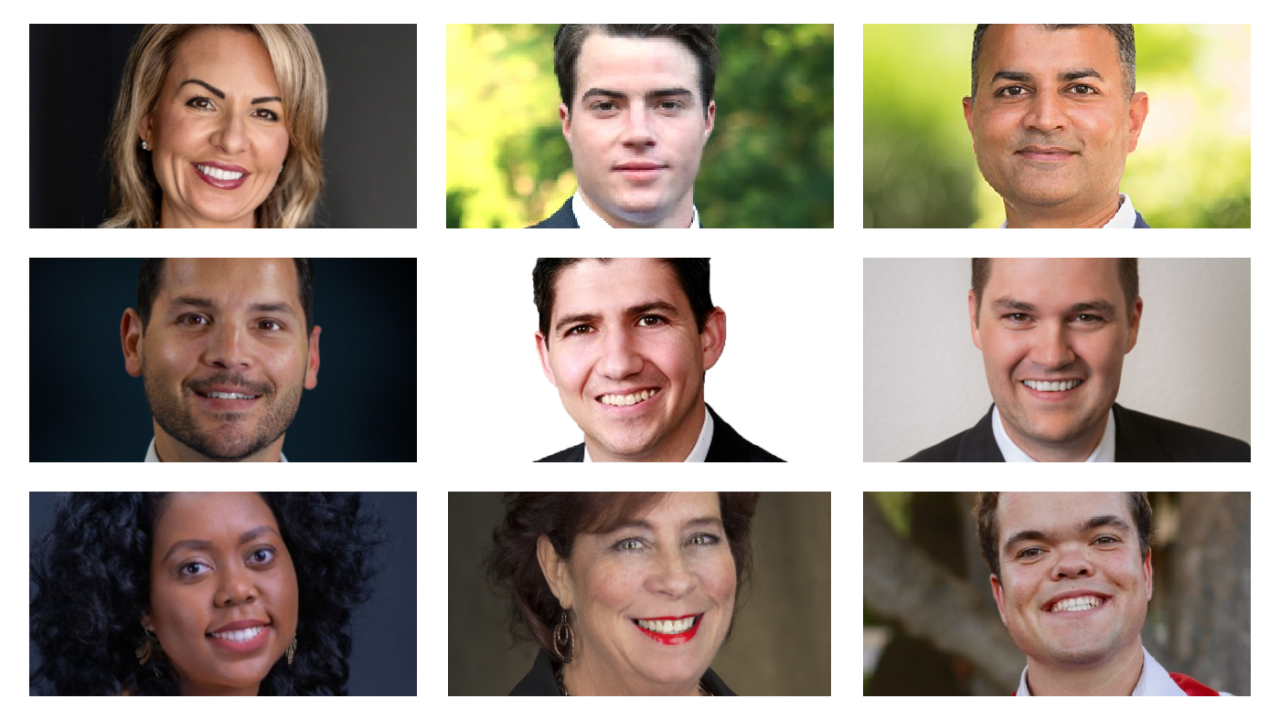

During a record-breaking year for lending, these loan officers brought in the highest volumes of the 400 on the list.

April 12 -

With independent title companies scoring the largest market share gain last year, the sector saw a 22% increase in premiums overall, the American Land Title Association said.

April 9 -

Nonbanks claimed more of the top slots based on loan volume, while the origination gains experienced by Hispanic, Black and Native American borrowers were weaker than those of other groups.

April 9 -

The shift ended a long run of higher rates that have depressed loan application activity, and it temporarily creates a new refinancing incentive for some borrowers.

April 8 -

Mortgage rates that are rising in tandem with a recovering economy dampened borrower activity, even with prime homebuying season underway.

April 7 -

That means depreciation is a risk that could creep back into some regions, potentially requiring lenders and government-related agencies to consider it when setting down payment requirements or managing loan workouts once forbearance ends.

April 6 -

Banks can mitigate damage from slowing origination activity by putting excess cash to work, Keefe, Bruyette & Woods said.

April 6 -

The increase won’t hurt the incentive for the average home shopper, but it means those who were looking to “buy the dip” in prices amid the pandemic may have missed their chance.

April 5 -

Known for giving away its signature canary-hued Converse to employees and clients, this small API-centric fintech is poised to become a significant player in open banking thanks to parent company Mastercard and its vendor status with Fannie Mae and Freddie Mac.

March 31 -

In an increasingly volatile market, lenders need to come to terms with the fact that outsourcing might be the best option, writes Rob Wilson of Merchants Mortgage.

March 31 Merchants Mortgage, a division of Merchants Bank of Indiana

Merchants Mortgage, a division of Merchants Bank of Indiana -

While there were fewer new mortgages sought on a week-to-week basis, the index was higher than it has been during the same week in the last two years.

March 31 -

Point of sales providers are bringing improvements to their systems as loan officers look for ways to keep their pipelines active.

March 30 -

Five transactions in the past week provided cash infusions for tech companies that are developing products for real estate finance.

March 26 -

That growth could be attractive to a housing finance industry that needs to find new loan sources as easy rate-and-term refinances dwindle.

March 25 -

But UWM says the provision is designed to protect against a broker double-locking the loan and is used by other lenders.

March 24 -

Despite a 3% increase in new mortgages, overall applications dropped 2% on a consecutive-week basis due to a 5% decline in refis, according to the Mortgage Bankers Association.

March 24