-

Mortgage industry hiring and new job appointments for the week ending Nov. 27.

November 27 -

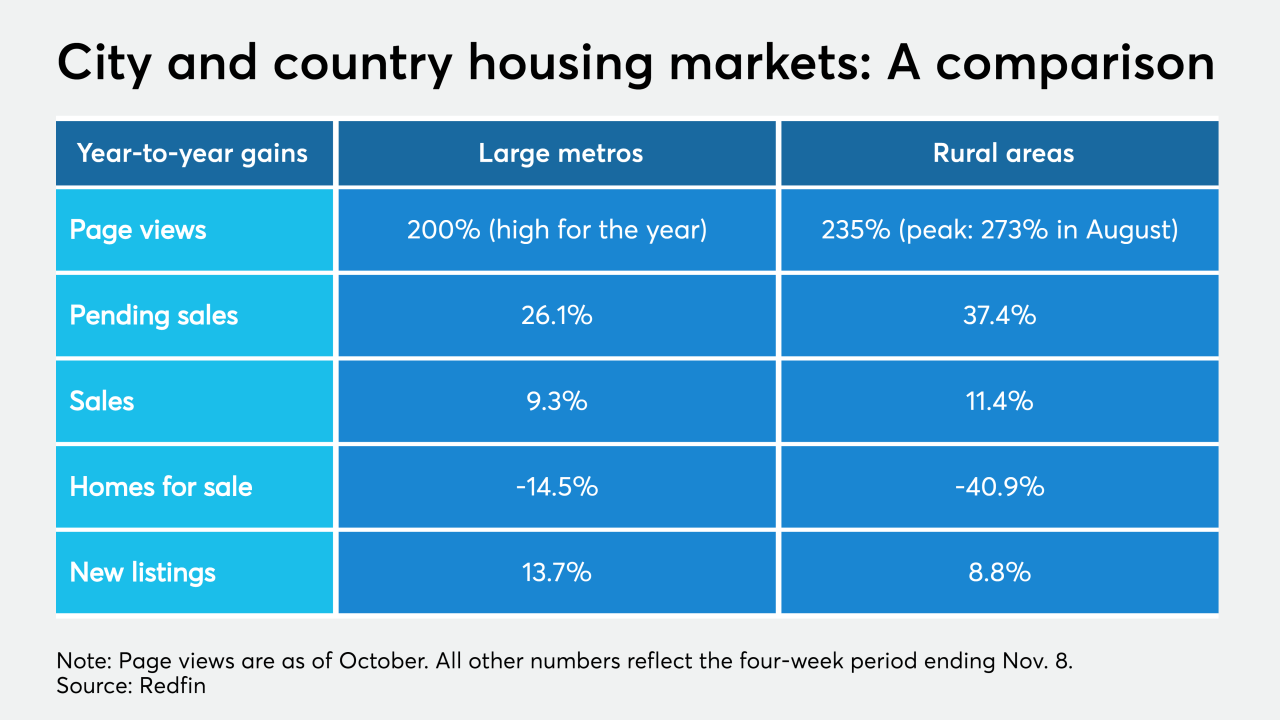

The year-over-year increase in monthly page views for properties hit a high for the year in large metropolitan areas as gains in rural locations decelerated.

November 25 -

Mortgage applications increased 3.9% from one week earlier as another week of record low rates drew more borrowers into the market, according to the Mortgage Bankers Association.

November 25 -

Consumer demand for larger properties is driving the market in an atypical year that featured a delayed selling season, the Mortgage Bankers Association said.

November 23 -

As mortgage rates stayed below 3% in the third quarter, originations spiked to the highest quarterly total since 2007 and highest dollar volume since 2005, according to Attom Data Solutions.

November 20 -

Company CEO Michael Nierenberg previously commented the real estate investment trust's parts could be worth more than the whole.

November 20 -

Mortgage industry hiring and new job appointments for the week ending Nov. 20.

November 20 -

To truly manage risk, banks must invest in more sophisticated modeling, reporting and analytics to track market movements and ultimately maximize profitability, Vice Capital Markets’ Christopher Bennett says.

November 19 Vice Capital Markets

Vice Capital Markets -

Mortgage applications slipped 0.3% from one week earlier, as refinance volume, particularly for Federal Housing Administration and Veterans Affairs loans, shrank significantly, according to the Mortgage Bankers Association.

November 18 -

The remarks from the National Association of Realtors’ incoming president followed a vote by its board to ban “harassing or hate speech” within its code of conduct.

November 17 -

The Mortgage Bankers Association sees rates rising over the next two years, while Fannie Mae expects the average to remain under 3%.

November 17 -

There have been several extensions of the policy since it was put into place as a way to sustain originations amid a wave of forbearance allocated to borrowers with government-related loans.

November 13 -

The teams include people who previously worked for the Treasury and the Federal Housing Finance Agency as well as HUD.

November 13 -

Mortgage industry hiring and new job appointments for the week ending Nov. 13.

November 13 -

The third quarter’s higher share of purchase applications, which followed the refinance wave that crested in the second, caused a rise in mortgage application fraud risk, according to CoreLogic.

November 12 -

With an unusually high number of unknowns to factor in, mortgage industry leaders offer a peek at their playbooks for the next year.

November 12 -

Mortgage rates moved off of their all-time low this week as a result of reports that Pfizer's coronavirus vaccine was potentially 90% effective, according to Freddie Mac.

November 12 -

The draft IPO filing for its Class A shares follows speculation that it would follow the lead of Rocket Cos. and other nonbank lenders in going public.

November 11 -

The company reached a new record high for closed loan volume, and reported a cyclical drop in gain-on-sale margins reflecting changes in its product and channel mix.

November 11 -

Mortgage applications decreased 0.5% from one week earlier as inadequate housing supply is putting upward pressure on home prices and affecting purchase activity, according to the Mortgage Bankers Association.

November 11