-

Fidelity National Financial, the nation's largest title insurance underwriter, added a new digital title insurance opening package to its WireSafe homebuyer and seller program.

March 2 -

Mortgage industry hiring and new job appointments for the week ending Feb. 28.

February 28 -

There is a real possibility of a large, nonmortgage brand coming into the industry and consolidating a disjointed loan origination process.

February 27 LodeStar Software Solutions

LodeStar Software Solutions -

Mortgage application volume rose last week, but with the 10-year Treasury yield tanking in recent days, growth in refinancings for the current period is quite likely, according to the Mortgage Bankers Association.

February 26 -

With interest rates and unemployment at rock-bottom lows and home values rising, the part of JPMorgan's retail business that sells home loans to consumers made money last month, marking the first profitable January in five years, according to people familiar with the matter.

February 24 -

Mortgage industry hiring and new job appointments for the week ending Feb. 21.

February 21 -

Low mortgage rates are setting the stage for growth, not just in refinancings, but in purchase volume as well during 2020, according to Ellie Mae.

February 19 -

A dip in conventional mortgage refinance demand drove mortgage application volume down compared with one week earlier, according to the Mortgage Bankers Association.

February 19 -

Newly constructed home purchase application volume continued its upward momentum during January, with unexpectedly low mortgage rates encouraging consumers to start shopping now, according to the Mortgage Bankers Association.

February 18 -

For the first time since the start of the housing crisis, mortgage origination volume could top $2 trillion for three consecutive years, according to Fannie Mae.

February 18 -

State and local governments are clearing the policy hurdles that stand in the way of mortgage e-closings and that could pave the way for more progress toward this goal.

February 14 -

Mortgage industry hiring and new job appointments for the week ending Feb. 14.

February 14 -

Mortgage rates ticked up slightly, marking the first increase in four weeks, but they remain at levels which encourage borrowers to refinance, according to Freddie Mac.

February 13 -

While boosting origination volume for lenders and providing financial benefits for borrowers, the refinance boom could have adverse effects down the road, according to TransUnion.

February 12 -

Refinance application activity last week was the highest in nearly seven years, with more than triple the volume from one year ago, according to the Mortgage Bankers Association.

February 12 -

Banks' lowering of origination fees and loosening of underwriting standards often foreshadow a downturn.

February 11 Nations Lending Corp.

Nations Lending Corp. -

Despite a drop in multifamily loan volume, industrial, health care, office and retail originations pushed overall multifamily and commercial mortgage lending to unprecedented heights, according to the Mortgage Bankers Association.

February 10 -

Ocwen Financial Corp. is on track to become profitable on a pretax basis by the third quarter without any special items enhancing earnings, according to a preliminary release of its fourth-quarter results.

February 7 -

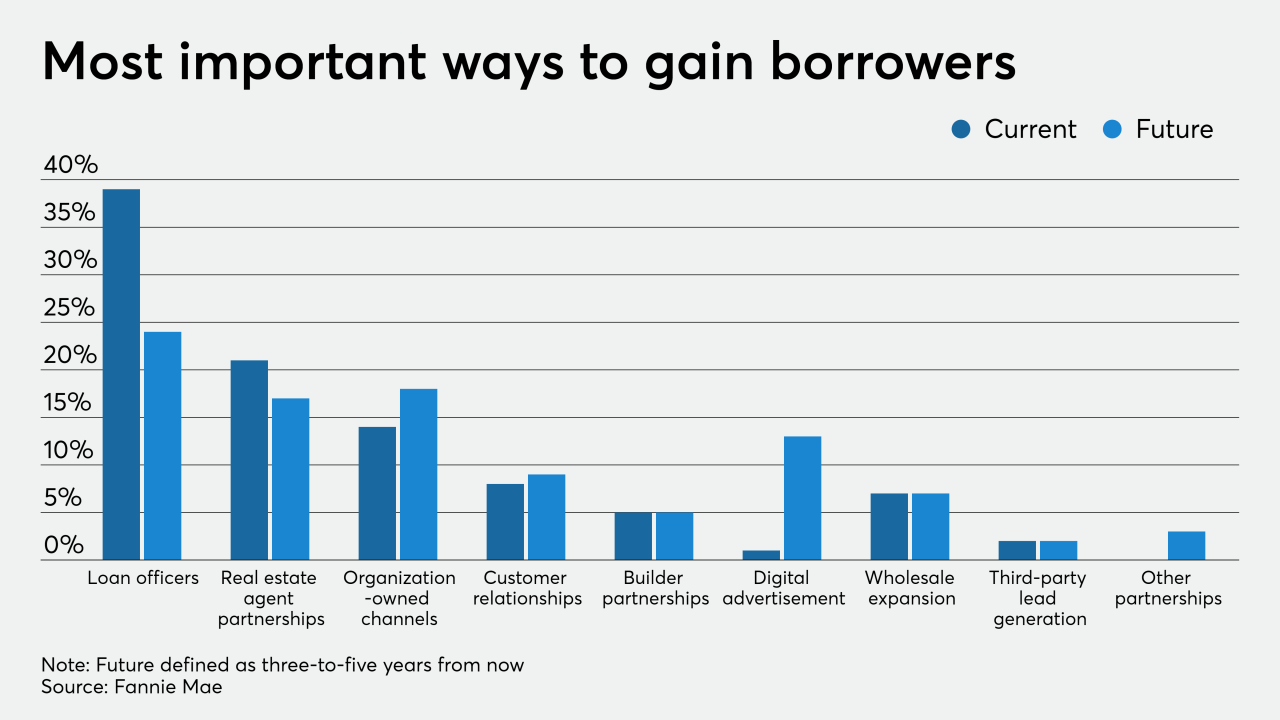

While loan officers will remain mortgage lenders' leading business development tool in the future, those originators believe business will come from a more diversified source pool, a Fannie Mae survey found.

February 7 -

Mortgage industry hiring and new job appointments for the week ending Feb. 7.

February 7