-

Record originations helped Mr. Cooper Group generate its first full-quarter profit since its formation through a merger between WMIH and Nationstar last year.

October 31 -

Mortgage applications increased slightly from one week earlier even as rates reached their highest level since July, according to the Mortgage Bankers Association.

October 30 -

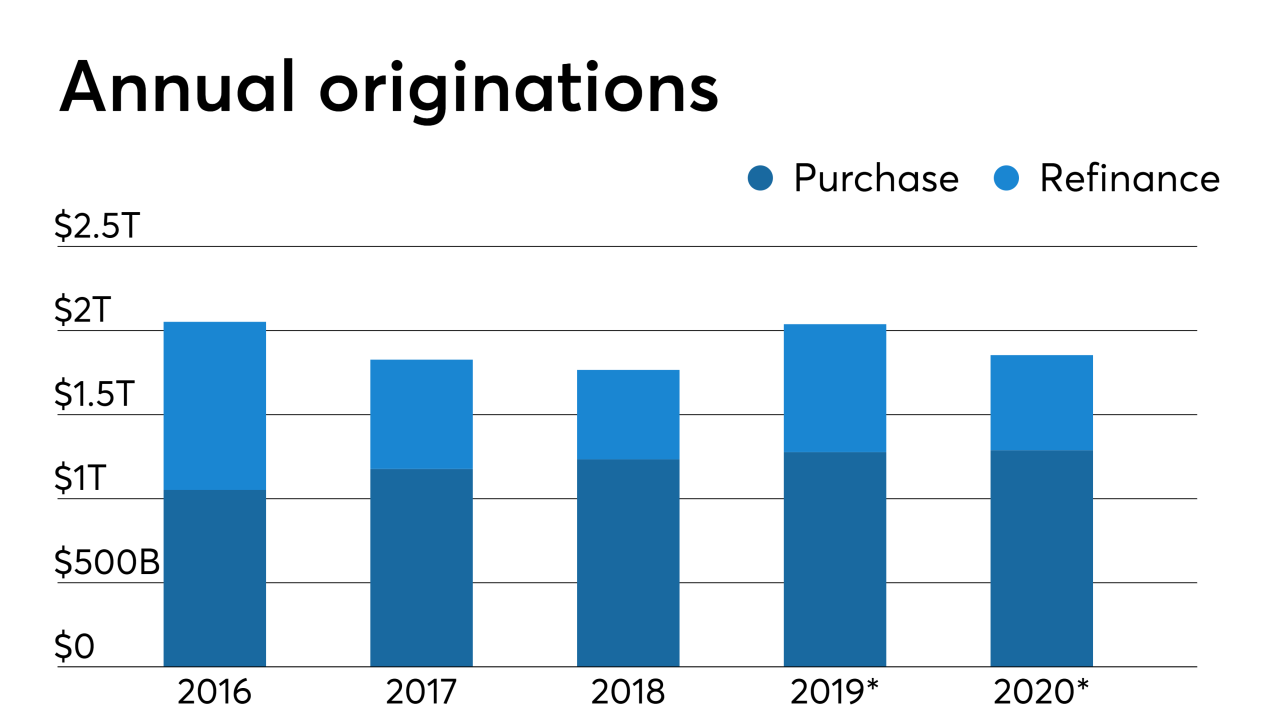

Home lenders will benefit from elevated refinance activity through the first half of next year, but volume may then fall off quickly, according the Mortgage Bankers Association's latest forecast.

October 30 -

VantageScore totaled 12.3 billion scores across consumer credit loan categories over a 12-month period between 2018 and 2019 with minimal mortgage volume, leaving potential for a major ramp up.

October 29 -

Fewer people are lying when buying or selling a home in South Florida.

October 28 -

PointPredictive has rolled out IncomePASS, which uses machine learning technology to determine if the borrower's income as stated on the application is realistic.

October 25 -

The acquisition of the Ditech forward mortgage business will double New Residential's year-to-date origination volume in the fourth quarter alone, and further double that next year.

October 25 -

Mortgage industry hiring and new job appointments for the week ending Oct. 25.

October 25 -

Denver beat out Salt Lake City to snag another technology firm looking to escape the Bay Area's escalating costs.

October 24 -

The government-sponsored enterprises are moving ahead with a new mortgage application that omits a previously planned language question, but are looking to serve limited English proficiency borrowers in another way.

October 24 -

-

The latest round of earnings reports from home lending businesses and vendors continue the positive vibe for the sector as most reported year-over-year improvement in profitability.

October 24 -

Economic uncertainty continued to affect mortgage rates, which rose to their highest level in 12 weeks, according to Freddie Mac.

October 24 -

The next phase of the digital mortgage revolution is starting and lenders need to use a holistic process to create their plans in order to get up to speed.

October 23 Capco Consulting

Capco Consulting -

The unexpected rise in refinancings during the third quarter affected mortgage industry business results in a mostly positive fashion for the period.

October 23 -

Interest rate swings during this past week resulted in a decline in both refinance and purchase mortgage applications compared with the previous period, according to the Mortgage Bankers Association.

October 23 -

Compass launched its bridge loan services program, aimed at giving homeowners more purchasing power and opportunity to buy a new house before selling theirs.

October 22 -

Home sales continued to perform in line with their potential in September and indicators suggest housing will keep flourishing through the fourth quarter, according to First American.

October 18 -

Mortgage industry hiring and new job appointments for the week ending Oct. 18.

October 18 -

Single-family mortgage production this year is expected to be 3% higher than anticipated last month, according to Fannie Mae, which revised its estimates based partly on a stronger housing outlook.

October 17