-

Purchase application volume increased, both week-to-week and year-over-year, as high-end buyers as well as those that need government loans entered the market, according to the Mortgage Bankers Association.

March 13 -

Mortgage industry hiring and new job appointments for the week ending March 8.

March 8 -

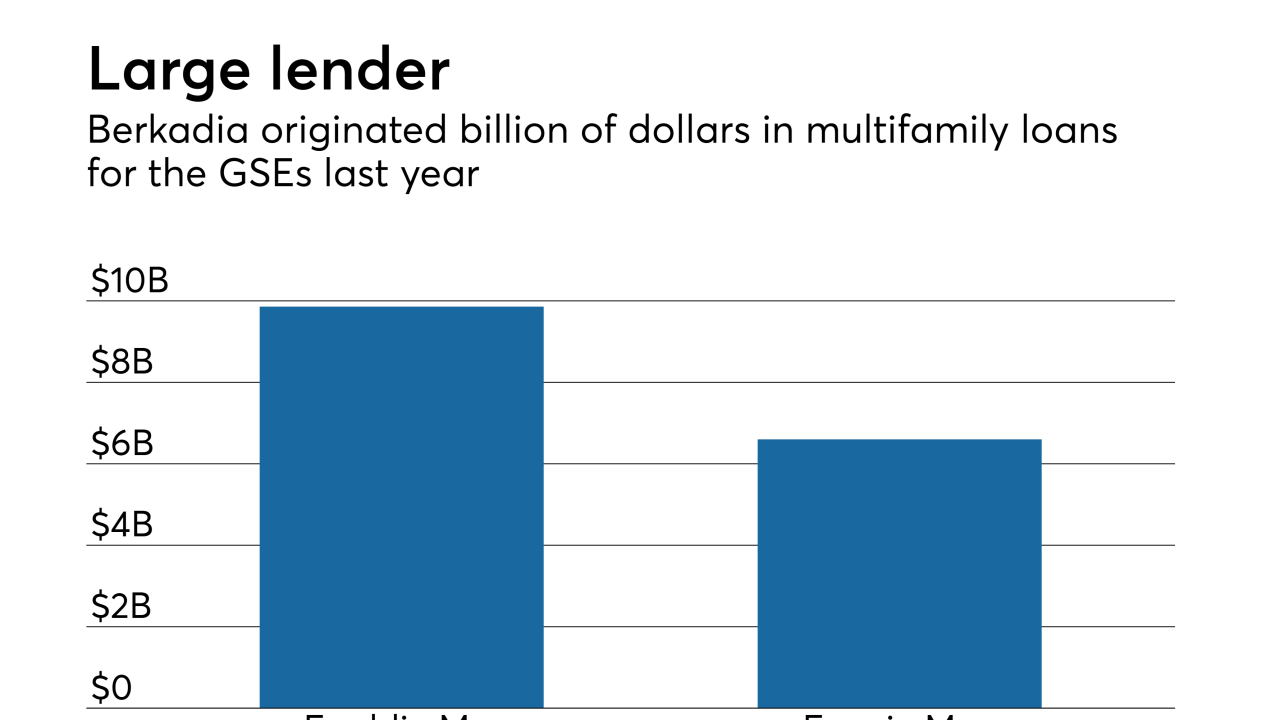

Berkadia, a joint venture run by Berkshire Hathaway and Jefferies Financial Group, is acquiring real estate capital advisory firm Central Park Capital Partners to diversify its capital sources.

March 6 -

Mortgage applications decreased 2.5% from one week earlier, although conventional purchase loan volume and amount is on the rise, according to the Mortgage Bankers Association.

March 6 -

Mortgage industry hiring and new job appointments for the week ending March 1.

March 1 -

Only a fraction of mortgage borrowers return to their servicers to originate or refinance a mortgage loan, and it may be the industry's fault for not exhausting enough effort to keep them around.

February 27 -

Mortgage applications increased 5.3% from one week earlier, as the stable rate environment enticed homebuyers into the market, according to the Mortgage Bankers Association.

February 27 -

Mortgage industry hiring and new job appointments for the week ending Feb. 22.

February 22 -

The company will shutter the offices it inherited when it bought EverBank in 2017 and focus on lending to existing customers through digital channels. U.S. Bank will assume the leases on about 25 properties.

February 21 -

Zillow Group Inc., the housing search website that's taken a hit to its stock price as it pursues an ambitious plan to buy homes and originate mortgages, is bringing back its first chief executive officer to lead the transformation.

February 21 -

From FICOs to purchase volume, here's a look at seven mortgage lending trends that will shape the housing market this year.

February 20 -

New Residential priced its second stock offering in four months, looking for gross proceeds of nearly $665 million.

February 20 -

Mortgage applications rose for the first time in five weeks as key interest rates held steady, according to the Mortgage Bankers Association.

February 20 -

HomeStreet Bank will attempt to sell its stand-alone mortgage business and portfolio of servicing rights, a move that comes amid growing pressure from an activist investor to exit home lending and concerns about declining demand and regulatory challenges.

February 15 -

Mortgage industry hiring and new job appointments for the week ending Feb. 15.

February 15 -

The private equity acquisition of the fintech vendor Ellie Mae will give it some breathing room in a declining originations market because it will have a more patient and strategic investor than its myriad shareholders as a public company.

February 13 -

Mortgage applications decreased 3.7% from one week earlier, because of consumer concerns over the direction of the economy outweighed lower interest rates, according to the Mortgage Bankers Association.

February 13 -

The mortgage loan origination system developer Ellie Mae is going private, agreeing to be acquired by the private equity firm Thoma Bravo in an all-cash transaction valued at $3.7 billion.

February 12 -

Stable equity and debt availability should keep multifamily and commercial real estate originations in line with 2017's peak, according to the Mortgage Bankers Association.

February 11 -

A lawsuit alleging Wells Fargo improperly compensated its California-based mortgage loan officers could have broader ramifications now that it has been granted class certification.

February 8