-

Mortgage industry hiring and new job appointments for the week ending Feb. 8.

February 8 -

SunTrust’s merger with BB&T is the largest bank deal since the financial crisis, and mortgages will play a critical role in the execution of this transaction.

February 7 -

Fourth-quarter increases in Fannie Mae and Freddie Mac mortgage origination volume helped Walker & Dunlop reach a new quarterly high in revenue of $215 million.

February 6 -

Mortgage applications decreased 2.5% from one week earlier, even as interest rates fell to their lowest levels in 10 months, according to the Mortgage Bankers Association.

February 6 -

Popular TV shows about house fixers and flippers have sparked consumer interest in remodeling, creating an opportunity for lenders to build a specialty in renovation loans while traditional mortgage lending is weak.

February 4 -

The Consumer Financial Protection Bureau has published a new "frequently asked questions" tool to help mortgage lenders with TILA-RESPA integrated disclosures compliance.

February 1 -

Mortgage industry hiring and new job appointments for the week ending Feb. 1.

February 1 -

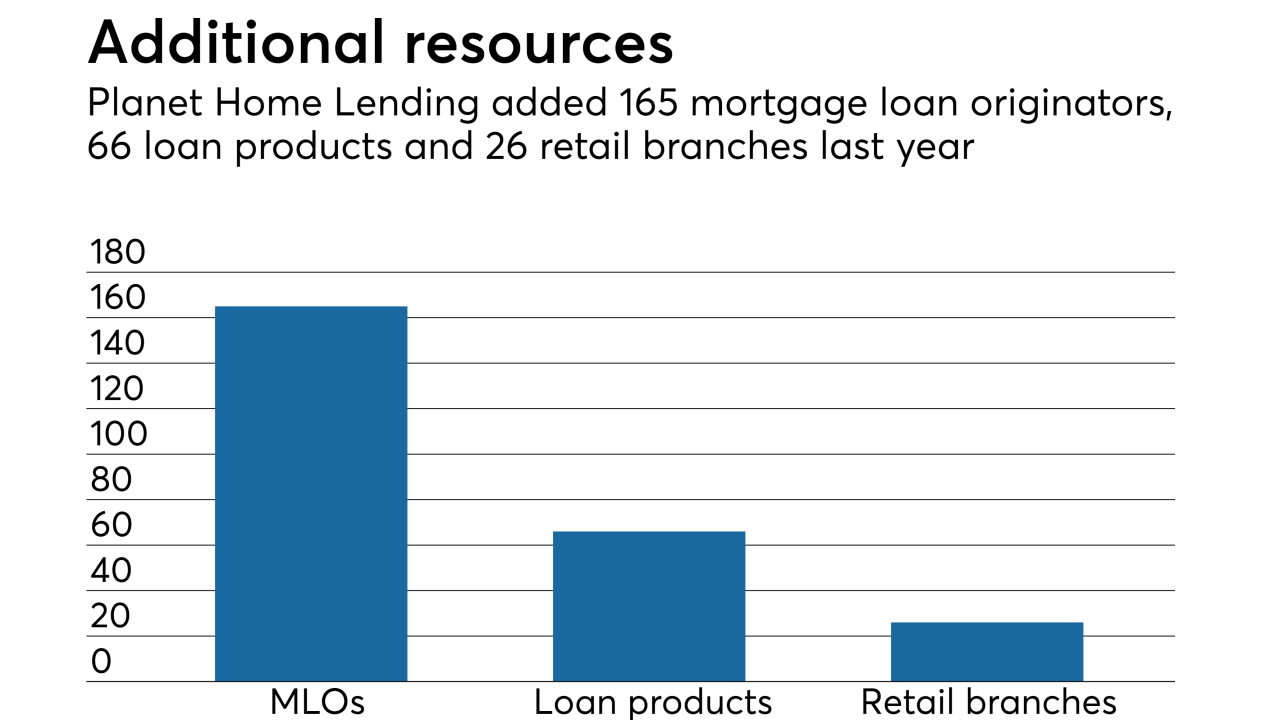

Planet Home Lending is finding ways to grow in an uncertain rate environment by diversifying its products and expanding its retail branch network.

January 30 -

Mortgage originations for the next two years will be higher than previously expected as lower interest rates at the end of 2018 will lead to more refinance volume, Freddie Mac said.

January 30 -

Mortgage application activity decreased 3% from one week earlier as rates for conventional loans continued to move higher, according to the Mortgage Bankers Association.

January 30 -

Some hopeful souls in Washington believe the commercial banking industry will return to originating and servicing higher-risk mortgages, but most banks are more likely to continue withdrawing from the sector.

January 29 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

As 30-year fixed-rate mortgages rose 30 basis points year-over-year, non-QM originations are estimated to grow 400% in 2019.

January 28 -

Independent mortgage banks have been instrumental in filling the void left by banks that have retreated from the home lending market since the Great Recession.

January 25 Mortgage Bankers Association

Mortgage Bankers Association -

Plans to begin rating securitizations backed by fix-and-flip mortgages may help lenders create new capacity and satisfy growing demand for short-term financing of house flipping projects.

January 25 -

While Fannie Mae's multifamily origination volume took a step back from 2017's record high of $67 billion, its delegated underwriting and servicing program provided $65 billion in financing in 2018, led by Wells Fargo.

January 25 -

Mortgage industry hiring and new job appointments for the week ending Jan. 25.

January 25 -

Financial consultancy Richey May has purchased mortgage business analytics provider Amata Solutions in a deal that will help the acquiring company further build out the technology-consulting division it started last year.

January 24 -

Mortgage application activity decreased from one week earlier as rising interest rates cooled borrowers' interest in getting a loan, according to the Mortgage Bankers Association.

January 23 -

The deadline for the 2019 Top Producers has been extended to Friday, Feb. 22 at 6 p.m. EST. Loan officers are encouraged to take the survey and participate in the annual ranking program that recognizes the accomplishments and successes of the industry's best originators.

January 22 -

While most single-family Federal Housing Administration lending is somewhat insulated from the government shutdown, the impasse is doing more to hurt funding in niches like nursing home loans and reverse mortgages.

January 18