-

As mortgage rates recently hit their highest point in seven years, closed refinances fell back to their low point of 2018, according to Ellie Mae.

October 19 -

Mortgage industry hiring and new job appointments for the week ending Oct. 19.

October 19 -

Despite mortgage rates at a seven-year high and rising home prices and low inventory that are keeping consumers from buying homes, rental prices are declining in many markets.

October 18 -

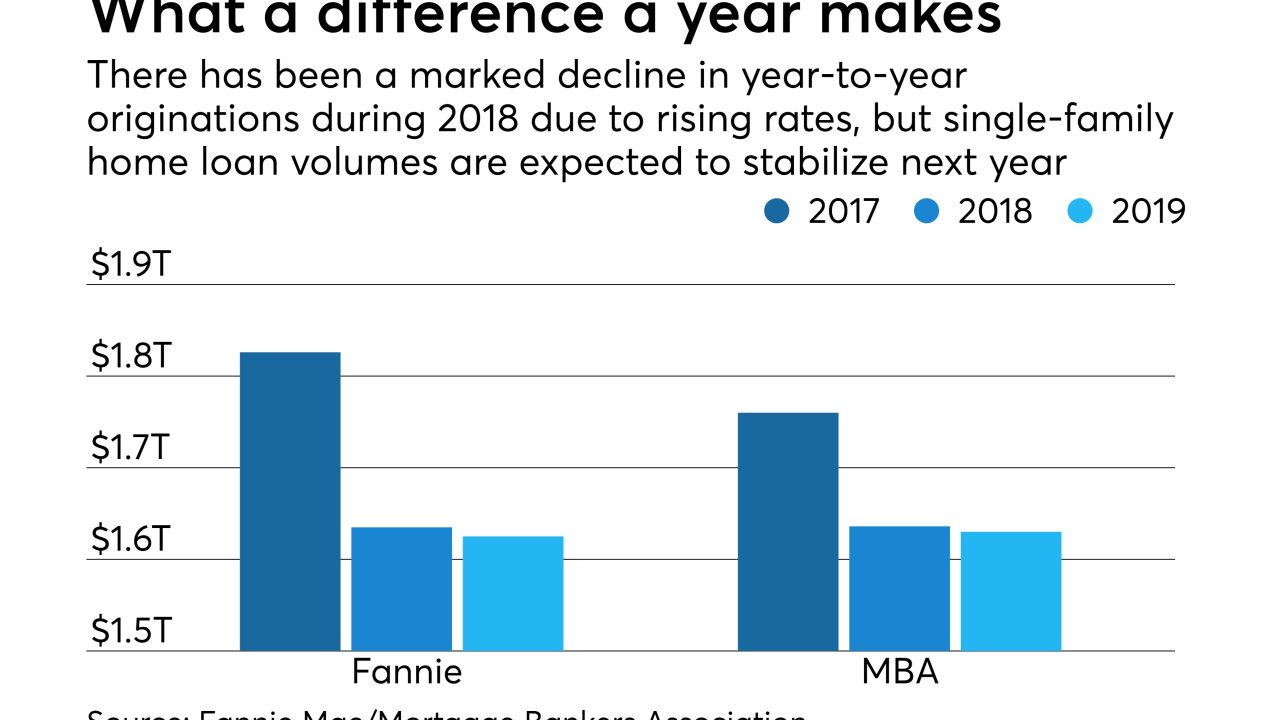

Increasing pessimism about housing is driving Fannie Mae's estimates for originations this year down a little further.

October 18 -

Mortgage applications decreased sharply from one week earlier as key interest rates stayed above 5%, although purchase volume grew from a year ago, the Mortgage Bankers Association reported.

October 17 -

As the mortgage industry confronts tight margins, shifting market share and regulatory uncertainty, a new leader emerges at the Mortgage Bankers Association.

October 14 -

Mortgage-related earnings at five banks were lower due to the effect of higher interest rates on loan volume this year, even though late-season homebuyers improved consecutive-quarter origination numbers at three companies.

October 12 -

Mortgage industry hiring and new job appointments for the week ending Oct. 12.

October 12 -

Hurricane Michael is putting mortgage transactions with a combined value of over $400 million in jeopardy, according to ClosingCorp estimates.

October 11 -

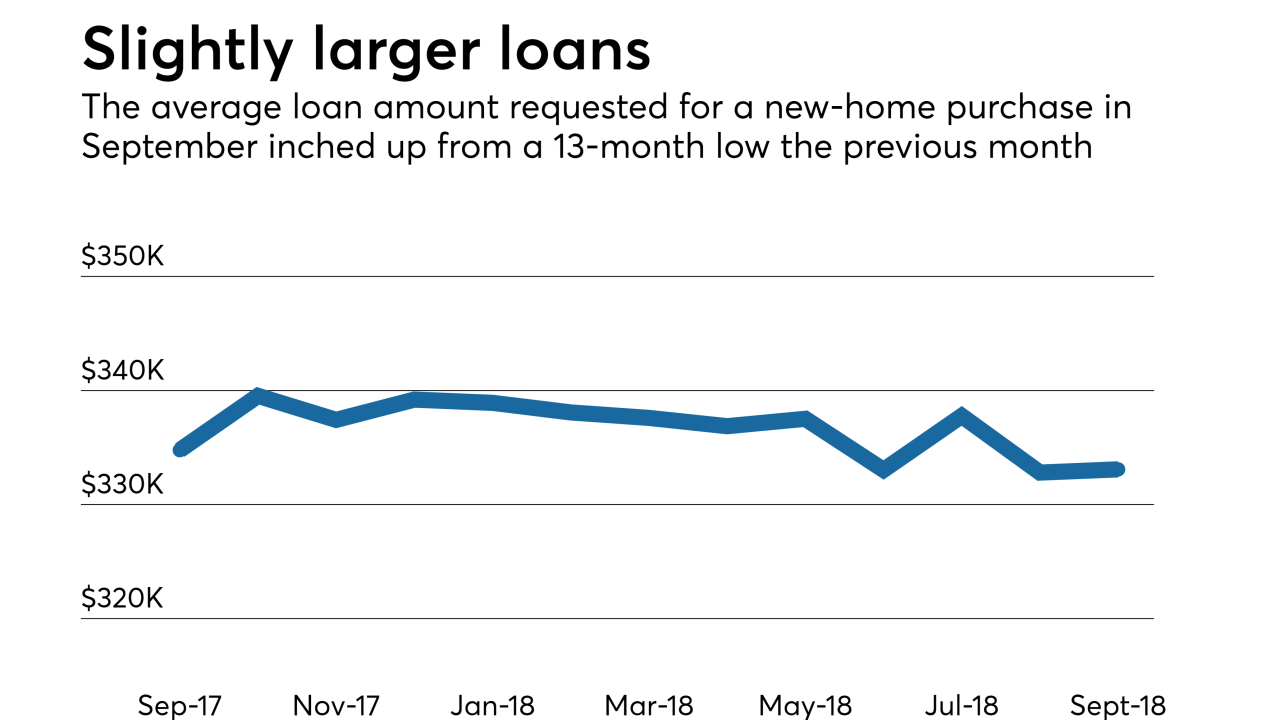

Mortgage borrowers buying new homes generated more loan applications this September than they did a year ago, even though interest rates are higher this year.

October 11 -

Mortgage applications fell last week as rates for the 30-year fixed conforming loan topped 5% for the first time since 2011, the Mortgage Bankers Association reported.

October 10 -

JPMorgan Chase is eliminating 400 positions in its mortgage banking unit, the latest lender to trim staff as a result of lower-than-expected demand in 2018.

October 5 -

Mortgage industry hiring and new job appointments for the week ending Oct. 5.

October 5 -

Mortgage application activity was relatively flat compared with the previous week, as long-term interest rates held steady following the recent Fed rate hike, according to the Mortgage Bankers Association.

October 3 -

Consumer demand for “ease of information and ease of interaction” is driving the digital mortgage era, says John Schleck, senior vice president at Bank of America.

October 2 -

LoanDepot is using scale and technology to its advantage by evaluating borrower demands through surveys and real-time assessments of customer profiles, says Chief Technology Officer Dominick Marchetti.

October 2 -

Bank of America is taking what consumers are accustomed to on the banking side and applying that to its lending division to offer a consistent digital experience, says John Schleck, the bank’s senior vice president.

October 2 -

Dominick Marchetti, chief technology officer at loanDepot, explains how the digital mortgage era is being driven by borrowers seeking a more dominant role in the process.

October 2 -

Technology will help compile and assess property data so that the future of real estate appraisers is that they won’t exist, says Matt Rider, chief information officer at Franklin American Mortgage.

October 2 -

After being acquired by Citizens Bank, Franklin American Mortgage has an expanded customer base and product offerings, but is also better positioned to embrace digital mortgage technology, says Franklin Chief Information Officer Matt Rider.

October 2