-

Financial services groups are calling for more funding for the Internal Revenue Service that could fix flaws in the agency's system for verifying the income of mortgage applicants.

February 22 -

The deadline to participate in the Top Producers Survey is Wed. Feb. 28 at 6 p.m. EST. The 20th annual loan officer ranking has a number of new features to highlight the accomplishments of the industry's top performers.

February 21 -

With 30-year mortgage rates reaching a four-year high, loan application activity was lower this past week, according to the Mortgage Bankers Association.

February 21 -

Mortgage industry hiring and new job appointments for the week ending Feb. 16.

February 16 -

Rising rates, largely tied to the stock market turmoil, took their toll on mortgage application volume during the past week.

February 14 -

Mortgage industry hiring and new job appointments for the week ending Feb. 9.

February 9 -

Nine lenders have been warned by the U.S. that they will be kicked out of a top mortgage program within months unless they find ways to stop costly rapid refinances of veterans' loans.

February 8 -

Warburg Pincus has agreed to buy a majority stake in a mortgage and consumer loan origination and servicing platform owned by Fiserv.

February 7 -

Even as rates hit their highest levels in nearly four years, mortgage application volume increased compared with one week earlier, according to the Mortgage Bankers Association.

February 7 -

Todd Chamberlain, the former CEO of PNC Mortgage, is joining SunTrust Banks to head up its home lending business.

February 2 -

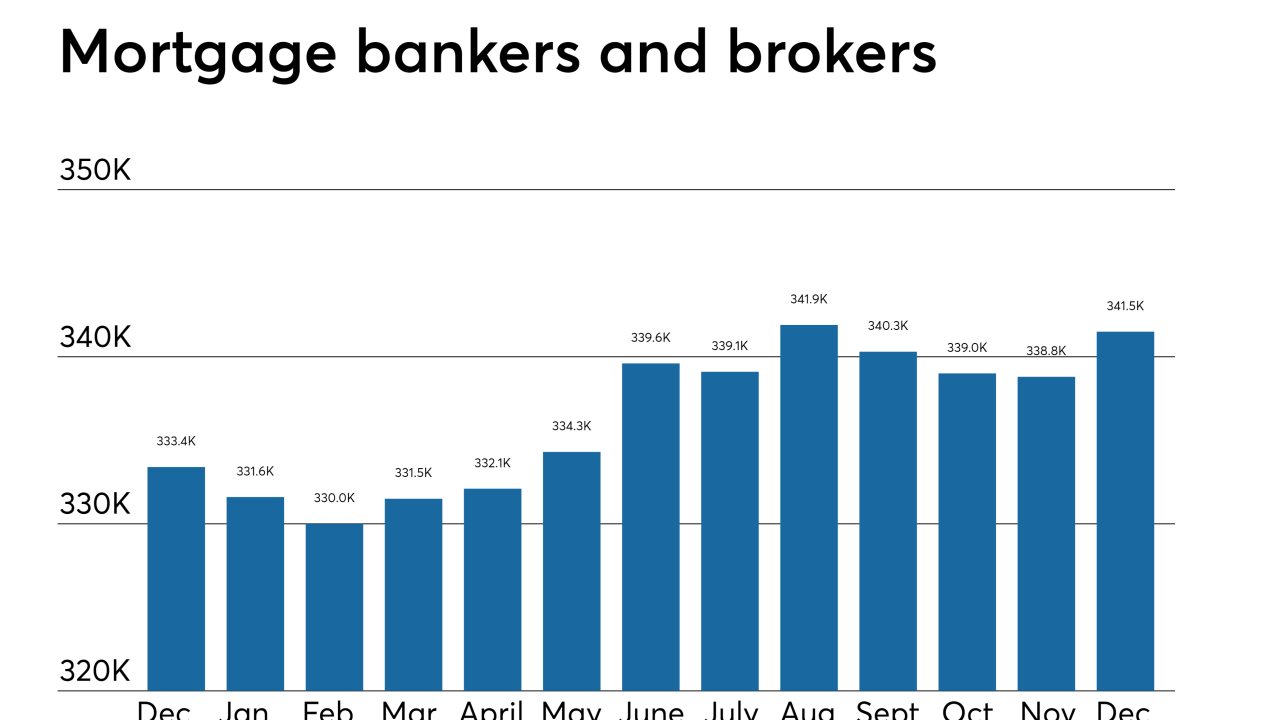

A December hiring spike at nondepository mortgage originators ended a three-month skid and solidified the fourth straight year of job gains in the sector. But with loan volume projected to decline again in 2018, it remains to be seen whether nonbanks will add more workers or start making cuts.

February 2 -

Problems with the IRS-managed Income Verification Express System, or IVES, have stoked concerns about delayed mortgage closings when volume picks up this spring.

February 2 -

Mortgage industry hiring and new job appointments for the week ending Feb. 2.

February 2 -

Rising rates suppressed total mortgage application activity, which decreased 2.6% from one week earlier, according to the Mortgage Bankers Association.

January 31 -

Michael DeVito, who was named Wells Fargo's interim head of home lending after the bank fired consumer lending head Franklin Codel, is now officially leading the residential mortgage unit.

January 30 -

Compliance is a significant cost center for mortgage lenders. But with bulk rates, technology and better process management, some lenders have found new ways to reduce the burden.

January 29 -

Social Finance has acquired the engineering and product teams of mortgage startup Clara Lending, bolstering the financial technology company's offerings beyond student-loan refinancing, according to people familiar with the matter.

January 26 -

The 2018 Top Producers Survey is now open for submissions. This year's program features a number of new and exciting features designed to provide insights into key industry trends and feature the accomplishments and successes of individual loan officers.

January 26 -

Fannie Mae's multifamily volume hit another record high of $67 billion in 2017 as former top producer Wells Fargo nearly halved its volume and nonbank competitors increased their market share.

January 26 -

Roostify has integrated its mortgage transaction technology into LendingTree's lead generation system, creating a seamless path from product search through closing.

January 26