-

Freddie Mac will make automation it has been testing in conjunction with servicing-released cash sales available to the broader market next month.

July 3 -

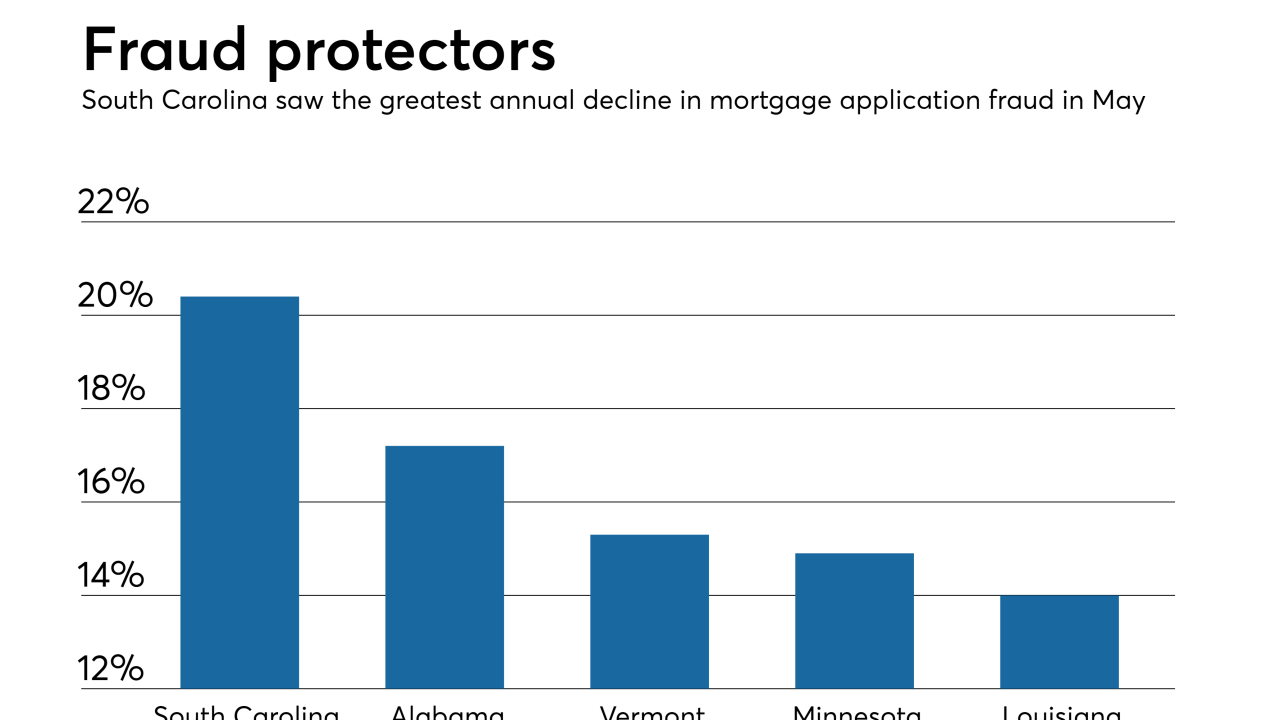

While purchase mortgages account for a growing share of overall volume, industrywide investments in more automated and efficient underwriting processes have helped lower instances of fraud.

June 28 -

Fannie Mae and Freddie Mac are making condominium loans eligible for automated appraisal waivers that could reduce mortgage borrowers' fees and shorten closing times for lenders.

June 28 -

Most mortgage lenders and banks do not maintain a comprehensive vendor management strategy, exposing institutions to increased compliance risk, according to a recent survey.

June 26 -

While the digital mortgage movement has primarily focused on the originations side of lending, Black Knight's latest release seeks to apply those principles to servicing to help improve borrower retention and engagement.

June 25 -

Fannie Mae is lowering down payment requirements and lender fees on manufactured housing loans to improve affordable housing access.

June 6 -

Promontory MortgagePath fills management roles for bank relations, technology and outsourced services opportunities.

May 31 -

To make its technology more relevant to the mortgage industry, Fannie Mae is taking a new approach to developing tools that engages lenders earlier in the process and makes lending more efficient.

May 29 Fannie Mae

Fannie Mae -

A new integration between Blend and Ellie Mae seeks to improve the use and accessibility of electronic mortgage documents, the latest in an ongoing industry effort to create a more simplified and consistent borrower experience.

May 24 -

Government-sponsored enterprises Fannie Mae and Freddie Mac are in a race to offer services and technology that help mortgage bankers raise cash from mortgage servicing rights.

May 23 -

Reducing unnecessary compliance burdens will pave the way for economic growth, larger job creation and wage increases, and re-evaluating technology will play an important role in doing so, according to Craig Phillips, counselor to the secretary at the Department of the Treasury.

May 21 -

Demands for loan quality aren't just coming from regulators and the government-sponsored enterprises. Secondary market partners and investors don't want to be left holding the bag if loans that lenders create have quality issues.

May 4 LoanLogics

LoanLogics -

Fannie Mae's first-quarter profits were enough for it to rebuild its minimum capital buffer and pay the Treasury Department dividend after being forced to take a draw during the previous fiscal period.

May 3 -

As the mortgage industry makes more strides with technology, the time it took millennials to close loans for new-home purchases shrank to its fastest time yet.

May 2 -

Mortgage industry vendors' earnings varied based on the effectiveness of the strategies they used to contend with origination declines and other factors.

April 26 -

A data validation integration Freddie Mac is adding to its technology platform could also deliver representation and warranty relief to lenders when it verifies self-employed borrowers' incomes.

April 20 -

Mortgage companies should model cybersecurity protocols after their compliance strategies to avoid being underprepared in the event of a data breach.

April 19 -

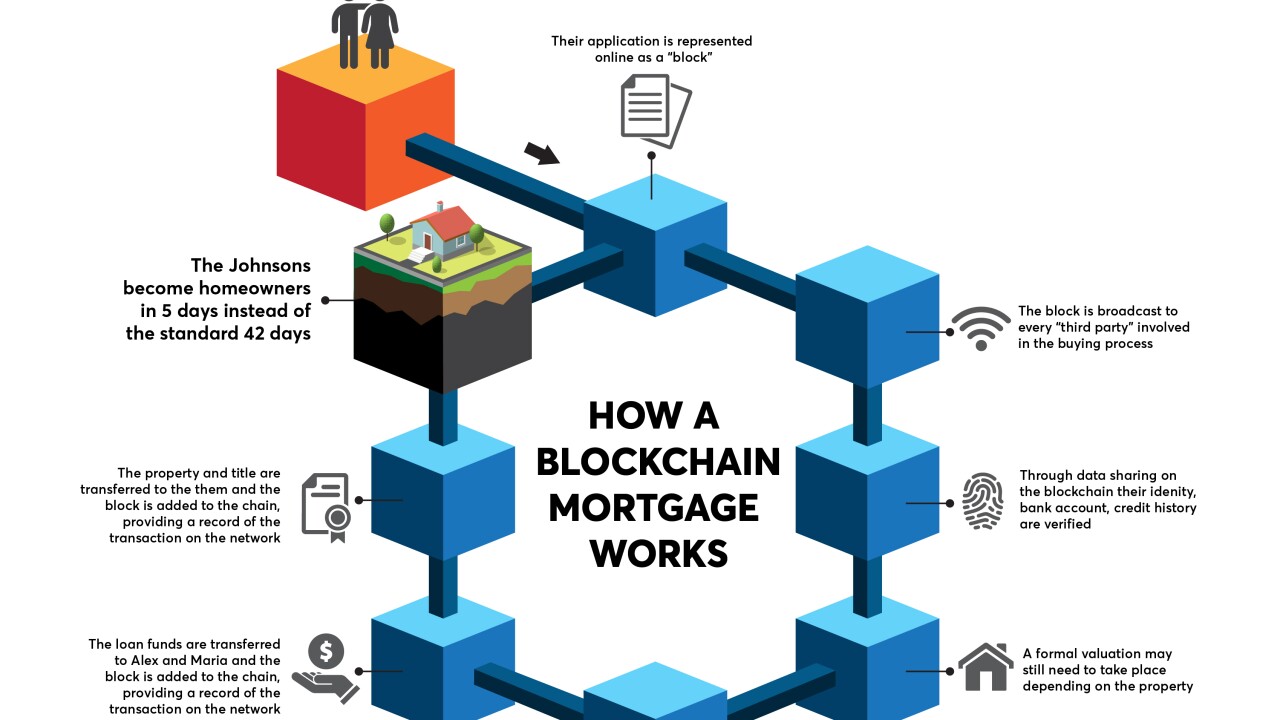

Blockchain technology promises to streamline how mortgages are managed at every point in their life cycle. But it will take an industrywide embrace for blockchains to reach their full potential.

April 18 -

Blockchain technology can support a number of core technology issues plaguing the mortgage industry, including data integrity, security, distribution and compliance.

April 16 -

CoreLogic, which has already acquired several appraisal technology and services vendors, snagged another one with its purchase of a la mode technologies.

April 12