-

Equities move through a stack of intermediaries, from custodians and clearing firms to brokers. Figure's blockchain structure aims to cut out third parties.

November 19 -

The multi-year, $100 million agreement will allow users to take financial actions without leaving the ChatGPT app.

November 18 -

Quality Control Advisor Plus is an integrated system which brings together previously separate units, cutting months off of Freddie Mac's current QC process.

November 17 -

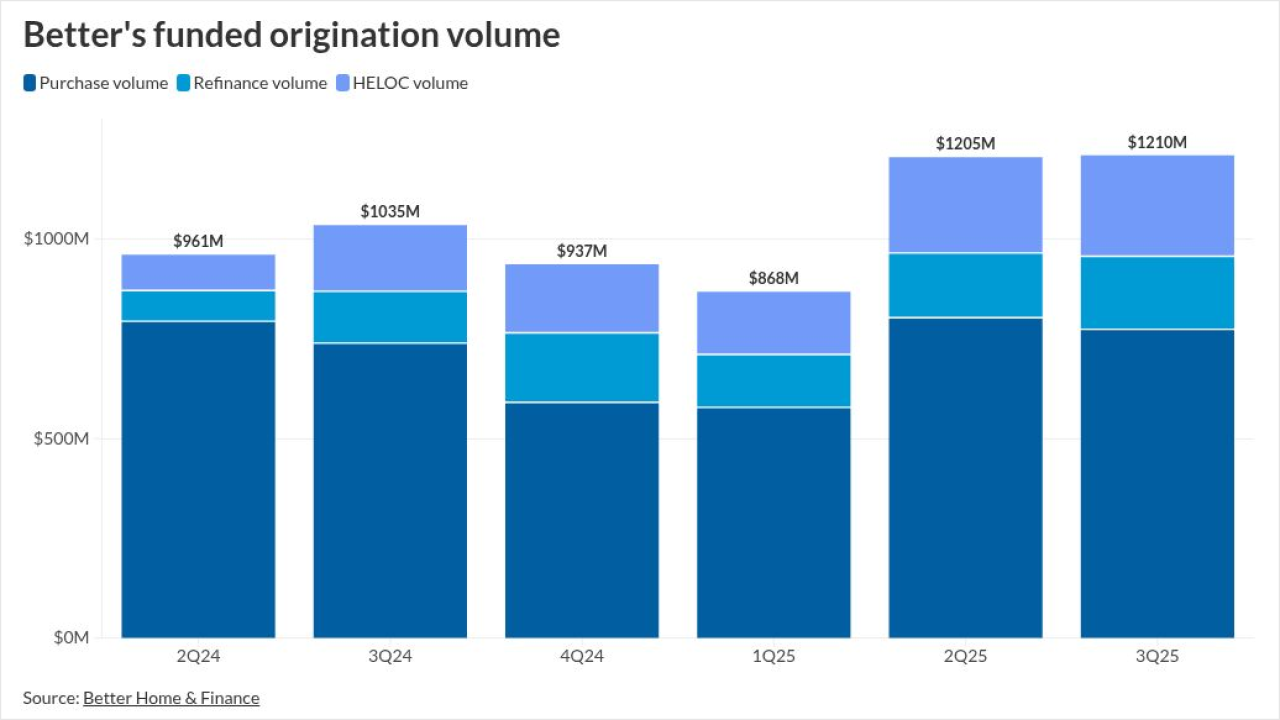

The lender, which crossed the $1 billion origination mark for the second consecutive quarter, is bullish on several new mortgage partnerships.

November 13 -

While Rocket increased 15 points, it slipped to 11th overall as other mortgage lenders had higher customer service score growth, J.D, Power said.

November 12 -

More profitable companies are weighing deals because they're bullish on their leverage or are simply eying today's big price tags, the expert said.

November 11 -

The FHFA director hinted at a partnership in the works and doubled down on criticism of homebuilders and the Fed chair in a housing conference interview.

November 7 -

New guidelines should provide homeownership opportunities for certain consumer segments with thin credit files and open up product options, lenders said.

November 6 -

Built launched Draw Agent Tuesday, which can process thousands of construction loan draws monthly.

November 5 -

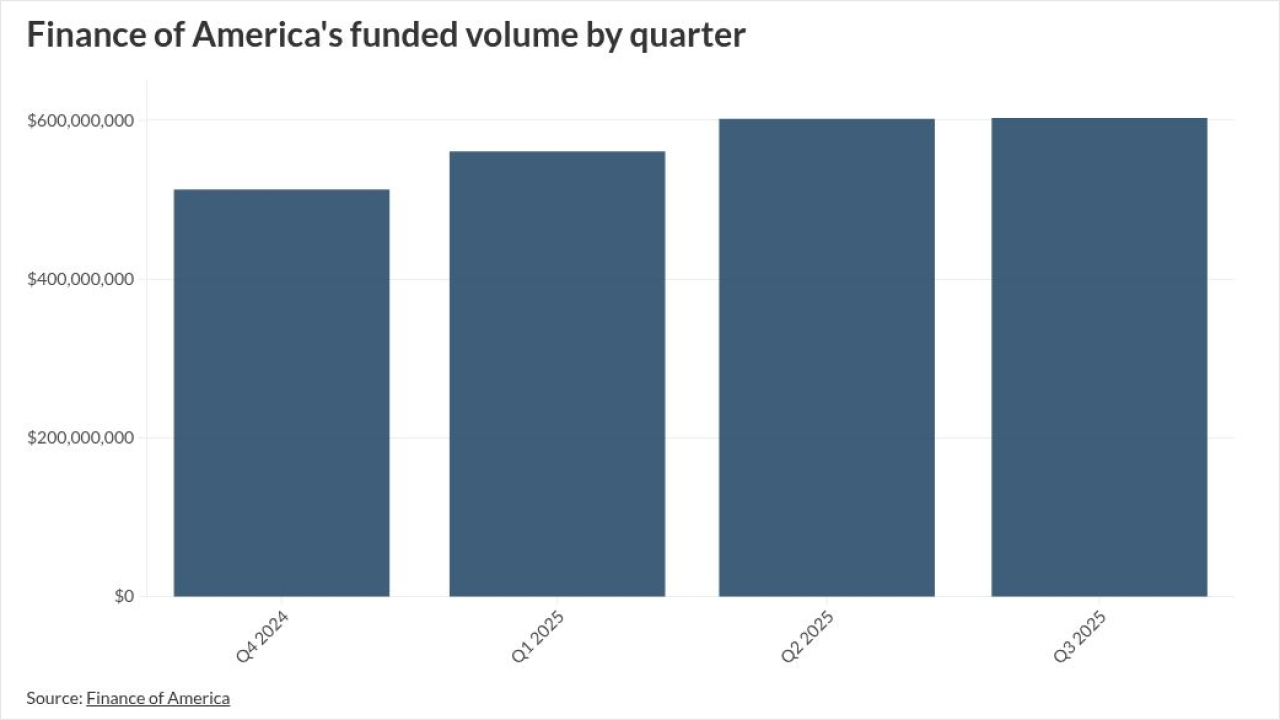

Home price modeling changes hurt FOA's third-quarter interim results but it was in the black between January and September on a continuing operations basis.

November 4 -

Newer automation that can serve as a wraparound to existing technology can cut servicing costs in a competitive industry, according to fintech executives.

November 4 -

A successful summer pilot led to wider rollout of a program, whereby Robinhood Gold subscribers will be able to find discounted rates and closing costs.

November 3 -

The new president, a 35-year industry veteran, explains the value every lender, vendor and regulator can get by participating in the standards organization.

November 3 -

The tech giant provided context around Flagstar and Pennymac's moves, as it reported more Encompass and MSP clients and greater mortgage income.

October 30 -

The deal will help drive development at Mortgage Cadence, which had been a unit of Accenture, and enable new integrations and automation, according to leaders.

October 29 -

While Rocket Mortgage's satisfaction score improved by 4% versus 2024, the industry as a whole dropped 1%, with credit unions outpacing banks and IMBs.

October 28 -

Bilt members will be able to earn benefits through Venmo use, with the agreement coming after the company recently added mortgage payments to its points mix.

October 28 -

Home loan players are diverting technology budgets to cover back-office operations, after big spending in a downcycle, counter to historical patterns.

October 23 -

Selected companies will have the opportunity to demo their compliance-related solutions at a February 2026 tech sprint following a December kickoff event.

October 22 -

The head of the government-sponsored enterprises' oversight agency also asked existing investors to review risk factors as officials eye a new public offering.

October 15