-

The company increased and diversified its income streams beyond the mortgage sector but expenses associated with stock-based compensation and a recent acquisition outweighed these gains.

November 11 -

The company is making progress on a focus shift to recurring revenues from transactional activities.

October 28 -

The average of 8% of total expenses that lenders put toward technology has a value, but it shows up more in broader organizational goals and productivity, the study found.

October 26 -

The $146 million deal could indicate that volume in the asset class has gotten large enough to support programmatic activity in the pricey housing market.

October 12 -

With a huge wave of consolidation expected soon, lenders must carefully adjust their mix of personnel and technology to stay profitable, whether they plan to continue to compete or sell.

October 11 -

Take our survey to share your views on how the market will develop in the coming year.

October 6 -

The agreement with affiliate partner ForumPay would allow buyers to convert digital assets at a fixed rate and transfer them directly into escrow.

October 5 -

The platform, built off a recent acquisition, looks to create efficiency in the growing wholesale lending market.

September 15 -

The companies talk through their products aimed at making the processes safer and more inclusive for consumers.

September 14 -

The pandemic, a refinancing boom and intensified appraiser shortage boosted appraisal alternatives in line with the rise in remote work. Now an overheating purchase market and policymaker scrutiny are shifting priorities.

September 13 -

The technology could help firms that have had less access to automation and generally have conducted trades used to hedge loan pipelines by phone.

September 10 -

The loan origination system provider, which launched an IPO on July 28, reported that its second quarter revenue and income grew 38% year-over-year.

September 8 -

The government bond insurer allowed lenders to become “eIssuers” a little over a year ago, and the move contributed to a large surge in electronic notes this year.

September 7 -

The company is divesting itself of another piece of Xome after previously peddling Title365 to Blend Labs.

August 23 -

The lending technology provider currently has 37,741 decisioning steps or pivot points on its platform.

August 18 -

The new all-in-one brokerage aims to avoid the "one-size-fits-all approach,"Rocket Homes CEO Doug Seabolt said.

August 12 -

The expanded credit access in its automated mortgage decisioning goes into effect in mid September.

August 11 -

The two-pronged agreement also will add Figure's mortgage servicing rights onto Sagent's platform.

August 11 -

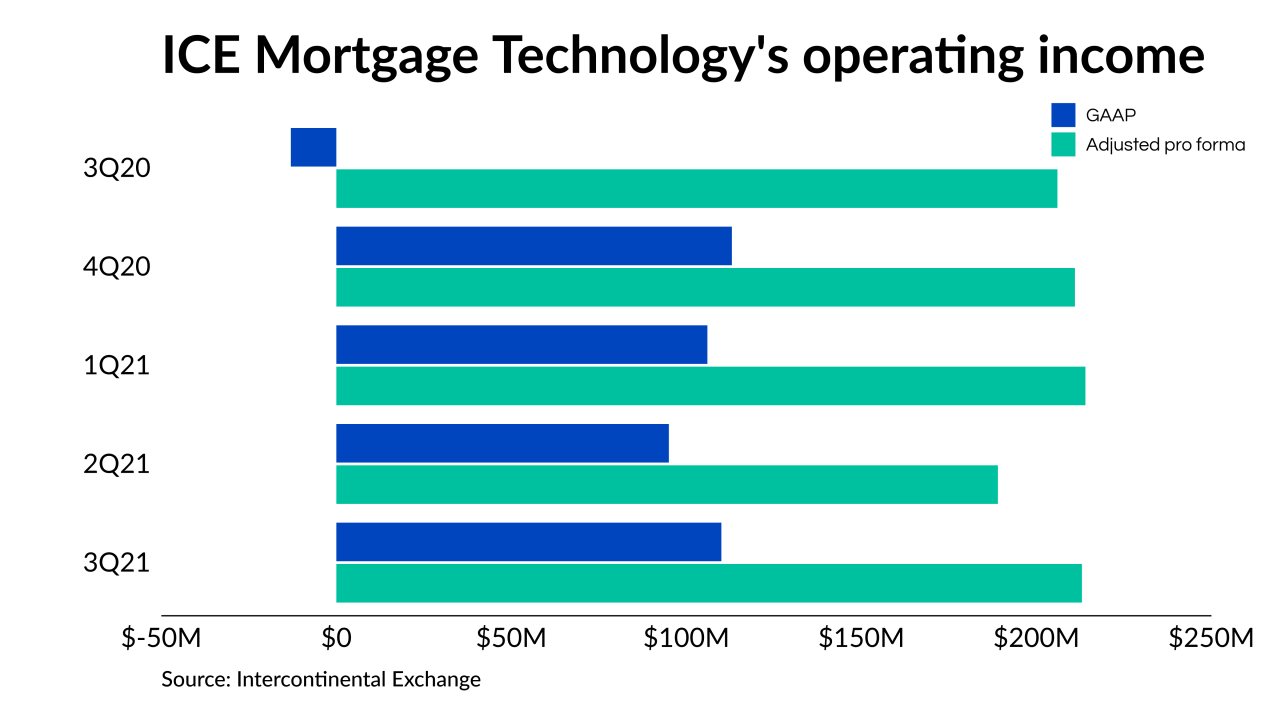

The company's expanded portfolio through its acquisition spree drove revenue, representatives said.

August 5 -

The deal comes just days after Figure closed on a capital raise that valued it at $3.2 billion.

August 3