-

Financial consultancy Richey May has purchased mortgage business analytics provider Amata Solutions in a deal that will help the acquiring company further build out the technology-consulting division it started last year.

January 24 -

A security lapse left millions of mortgage records exposed online without proper data protections, according to security researchers.

January 23 -

Timothy Mayopoulos is back in the mortgage industry, becoming the new president of the digital mortgage technology developer Blend, months after leaving his post as Fannie Mae’s CEO.

January 22 -

As the industry shuffles closer to completely digital mortgages, the next wave of technology aims to usher in total automation and uniformity.

January 16 -

Highlands Residential Mortgage credits its ability to recruit and retain high-performing loan officers for its ability to thrive during in declining originations market.

January 7 -

Here's a look at key findings from the 2019 Best Mortgage Companies to Work For survey, highlighting the qualities that distinguish companies on the list from those that are not, and how the offerings from small, medium, and large companies on the list compare.

January 7 -

Having authentic curiosity as a core value and hiring people who embody it is how Radius Financial Group builds out a strong fintech base, complete with AI and robotic automation.

January 7 -

By eliminating a sense of hierarchy, promoting innovation and offering attractive work perks, New York-based lender Better Mortgage succeeds as a top employer by investing in its employees as it does its customers.

January 7 -

When husband and wife Rick and Patty Arvielo set out to establish a strong corporate culture for their company, New American Funding, they turned to a leadership seminar from online retailer Zappos.

January 7 -

National Mortgage News is pleased to present the inaugural Best Mortgage Companies to Work For, a survey and awards program dedicated to identifying and recognizing the industry's best employers and providing organizations with valuable employee feedback.

January 7 -

The Best Mortgage Companies to Work For study is a collaboration between National Mortgage News and the Best Companies Group, which conducts extensive employee surveys and reviews employer reports on benefits and policies.

January 7 -

Mortgage technology is rapidly advancing, with incumbents and new entrants scrambling to take advantage of developments in artificial intelligence and automation. The goal? Beat the customer expectations set by Amazon and Uber, not just other lenders, says KPMG Managing Director Teresa Blake.

December 28 -

Consumers traditionally pick the lender with the best rate and the lowest payment, but in a competitive marketplace, the customer's digital mortgage experience is often the first tiebreaker.

December 19 Notarize

Notarize -

Texas Capital Bank, which already provides warehouse financing for e-mortgages, will now purchase these loans off those lines as it looks to increase liquidity for this product.

December 12 -

Hometown Lenders Inc. will acquire TotalChoice Mortgage in a move to expand its geographic footprint and meet its goal of growing annual originations from $1 billion to $5 billion.

November 30 -

Equifax is supporting mortgage lender customer retention efforts with a new tool that predicts the likelihood that a lead will apply for a loan within the coming months.

November 29 -

Mortgage fintech LoanSnap launched VA Smart Loans, which will provide personalized options to current and former service members applying for a Veterans Affairs-guaranteed mortgage.

November 15 -

Lenders are constantly looking for ways they can streamline their operations and produce savings for themselves and their borrowers in order to compete in a leaner market this year.

November 12 -

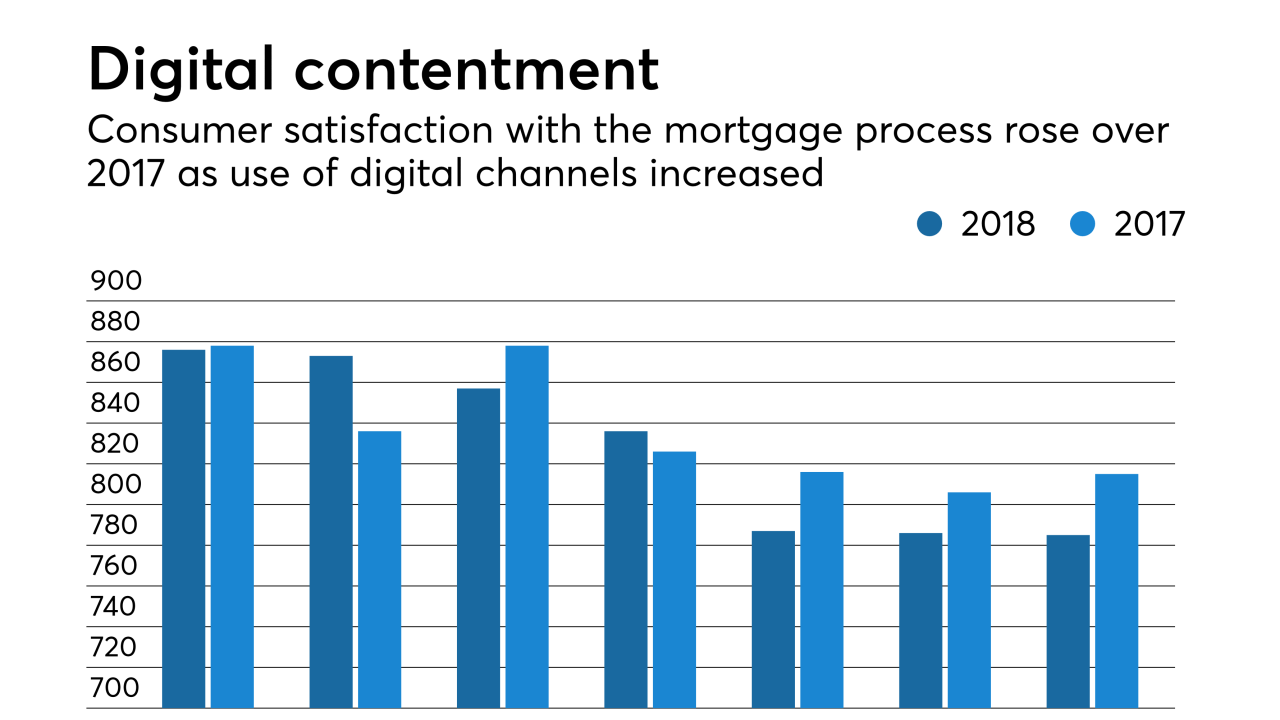

The growth of digital mortgage origination channels has improved customer satisfaction with the process, but consumers still want personal interaction at some point, according to J.D. Power.

November 8 -

Texas is expected to be the tipping point in online closing adoption, and title companies predict that e-closings will soon be standard operating procedure.

November 6 NotaryCam

NotaryCam