-

The other parts of the Day 1 Certainty program regarding income and asset verifications remain in effect.

May 6 -

The first-quarter loss ended a two-quarter profitability streak the company hoped to maintain.

April 30 -

Correspondent loan sellers are hoping the new GSE purchases will help to open a market frozen by coronavirus-related risk — but the prices offered so far aren't too promising.

April 24 -

The conditions the pandemic created could be the driver of e-mortgage adoption that has been long in coming.

April 23 -

The wealthiest, most-reliable mortgage borrowers in the U.S. are hearing an unfamiliar word from lenders: No.

April 21 -

Separate reports from Radian and Redfin show home values rose during March despite a slowdown in sales, but that is likely to change as shelter-in-place orders affect the real estate markets.

April 21 -

The Federal Reserve's $2.3 trillion loan stimulus includes plans for outstanding commercial mortgage-backed securities and newly issued collateralized loan obligations.

April 9 -

Finance of America Reverse agreed to pay $2.5 million to settle allegations that a company it acquired violated the False Claims Act for loans submitted for Federal Housing Administration insurance in 2010.

April 2 -

Title underwriters won’t be hit as hard by the coronavirus as other insurers, but related economic changes will challenge them, Fitch Ratings said, in assigning a negative outlook to the sector.

March 26 -

The Federal Housing Finance Agency authorized the government-sponsored enterprises to lend additional support to the mortgage-backed securities market and temporarily allow some flexibility in lending requirements to address coronavirus-related concerns.

March 23 -

Additional mortgage-backed securities purchases by the Federal Reserve Bank of New York will address private investor skittishness about the asset class, but it will not necessarily lower rates.

March 20 -

Mortgage industry technology providers are adjusting their processes to allow for originations to keep flowing through the system as the nation combats the coronavirus.

March 18 -

With small businesses feeling the financial scourge of the coronavirus, bridge loans could be the direction they turn to keep things afloat.

March 17 -

Electronic closings are a solution in efforts to limit people congregating, but there could be some state law concerns.

March 16 -

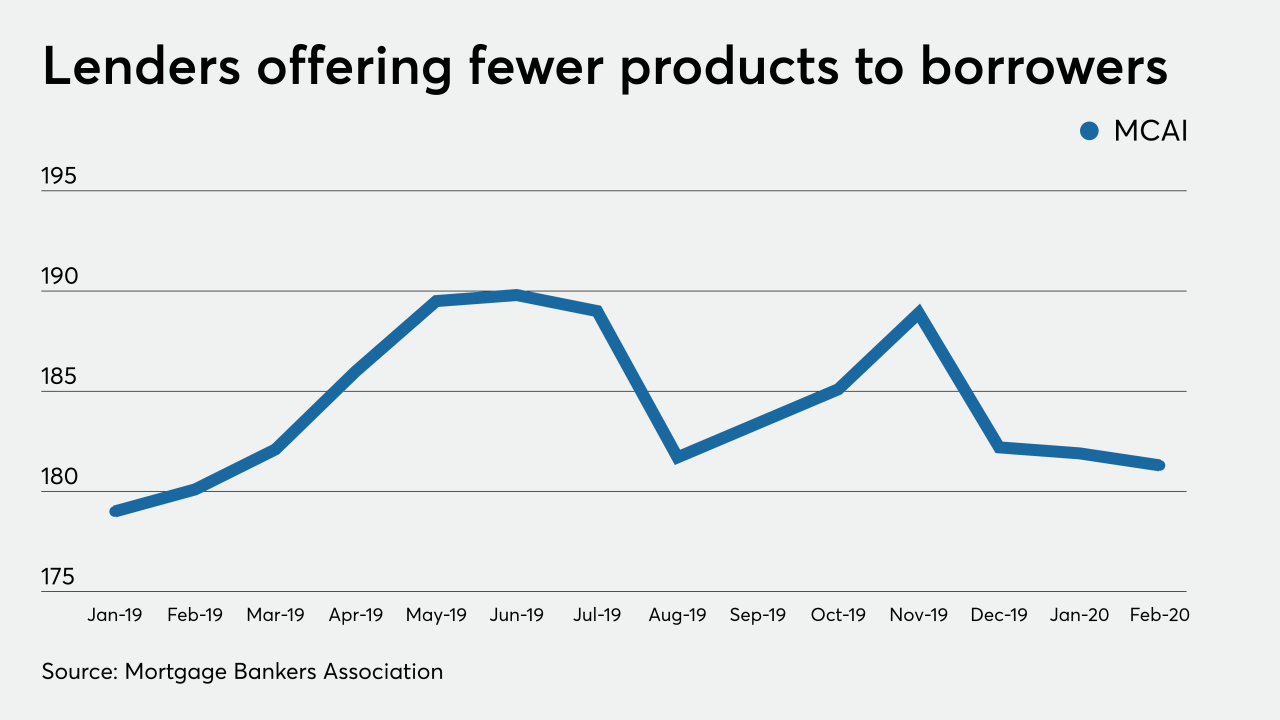

Mortgage credit availability dropped slightly in February, making three consecutive months of tightening, but that streak will likely end with falling interest rates, the Mortgage Bankers Association said.

March 10 -

The dollar amount of fix-and-flip properties purchased using financing reached a 13-year high in 2019, but the share of flips financed was lower year-over-year, according to Attom Data Solutions.

March 5 -

A drop in interest rates in response to the coronavirus outbreak is adding urgency to a hiring spree across the mortgage industry.

March 4 -

Fannie Mae completed its first two Credit Insurance Risk Transfer transactions of 2020, shifting $1 billion of single-family loan credit risk to insurers and reinsurers.

March 4 -

Fidelity National Financial, the nation's largest title insurance underwriter, added a new digital title insurance opening package to its WireSafe homebuyer and seller program.

March 2 -

JPMorgan Chase & Co. is shifting workers to handle an expected surge in demand for home loans as the American housing market looks forward to its strongest spring in at least a decade and the coronavirus sends mortgage rates lower.

February 28