-

After surging earlier in the year, the number of mortgage loan application defects remained flat in November, a positive sign when it comes to fraud incidents going forward.

December 29 -

From consolidation to tech innovation, here's a look at some of the top challenges and trends that mortgage executives from lenders, servicers and vendors are focused on for 2018.

December 28 -

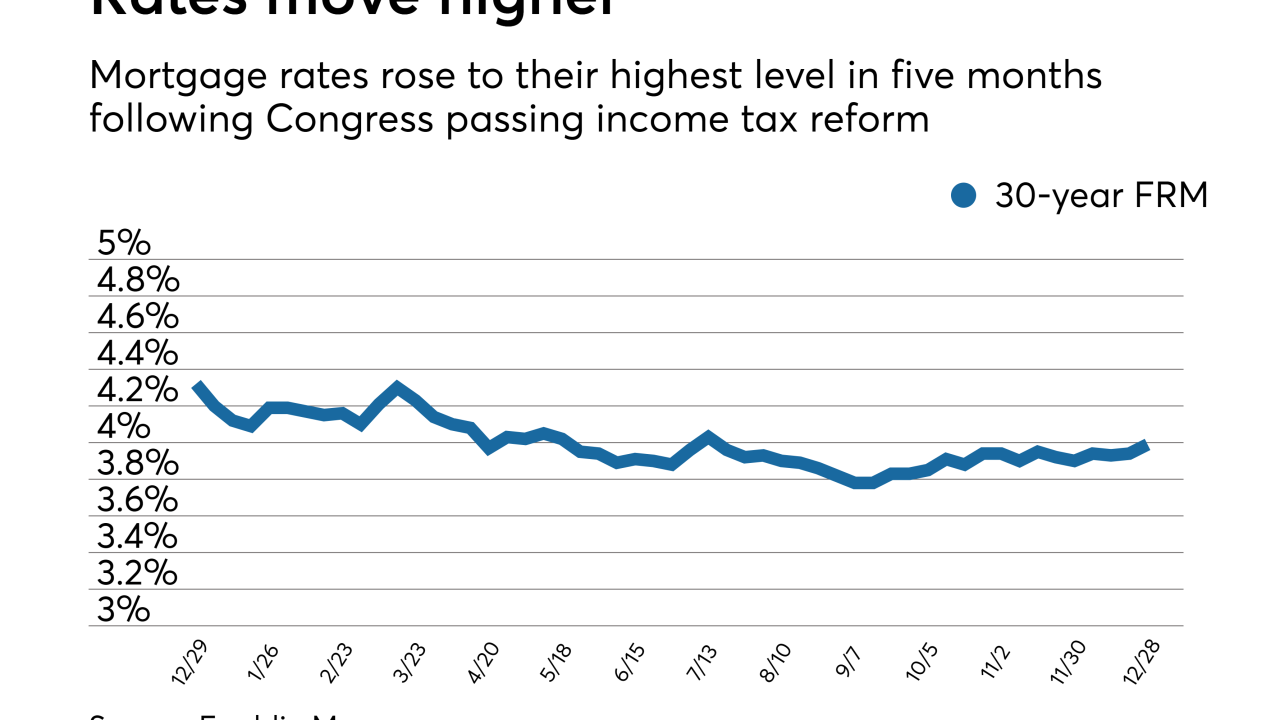

Mortgage rates rose to their highest level since the summer as predicted following Congress passing income tax reform, according to Freddie Mac.

December 28 -

Billionaire Dan Gilbert's Quicken Loans Inc. outgrew almost every U.S. mortgage provider by unfurling technology like its online Rocket Mortgage platform faster than big banks.

December 28 -

Most housing finance companies are preparing to fight for a dwindling number of loans and operate on thinner margins.

December 26 -

Lending outside the qualified mortgage rule will likely become more prominent in 2018, as originators continue to struggle to replace lost refinance volume and their compliance and risk management processes become more robust.

December 26 -

Updated dynamic and interactive versions of Fannie Mae and Freddie Mac's redesigned Uniform Residential Loan Application are out.

December 20 -

Underwriting purchase loans is inherently more precarious for mortgage lenders and that contributed to the year-over-year increase in risk in new originations during the third quarter, CoreLogic said.

December 19 -

To succeed in an era of increasingly narrow margins and broad competition, mortgage lenders must be methodical about loan fulfillment and take a "less is more" approach to designing workflows.

December 18 cloudvirga

cloudvirga -

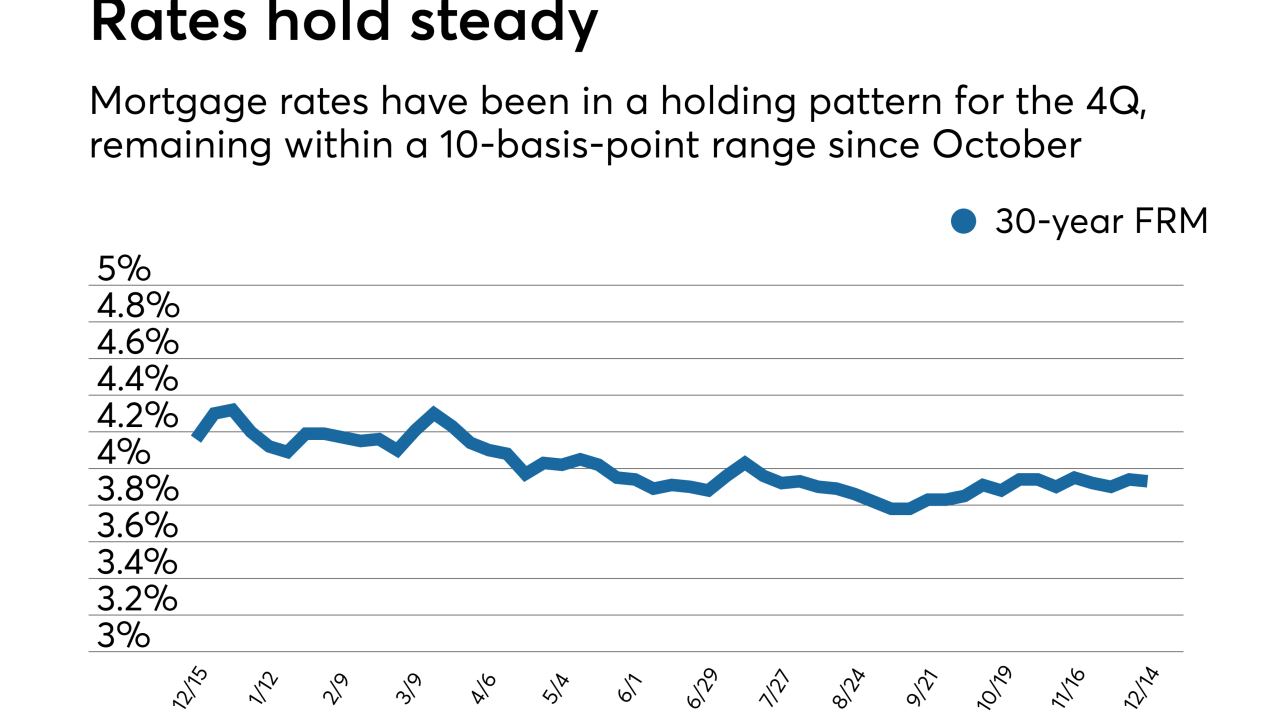

The mortgage market had already priced the Federal Open Market Committee's 25-basis-point hike into its rates so there was little change, according to Freddie Mac.

December 14 -

The U.S. is taking steps to stamp out the practice of servicemembers and veterans being pressured into taking mortgages they don't need, a move that officials say will lower consumer costs and could lead to financial penalties for lenders.

December 7 -

Mortgage rates ticked up this week, but a larger rise is possible next week depending on what Congress does about tax reform and the budget.

December 7 -

Men listed as the primary borrower on a mortgage on average get approved for larger-balance loans than women, Ellie Mae finds in its latest Millennial Tracker survey.

December 6 -

Dozens of workers at the Frederick, Md., office of First Guaranty Mortgage Corp. will be out of work after layoffs were announced, but the office won't close as initially reported by a state agency.

December 5 -

Mortgage rates moved lower this week, but strong economic data and comments by the outgoing Federal Reserve chair left many anticipating higher rates, according to Freddie Mac.

November 30 -

Sometimes reaching underserved borrowers takes experimenting with changes to the mortgage finance system. That's why Fannie Mae and Freddie Mac are working with lenders to test innovative loan products that meet borrowers' evolving needs.

November 24 -

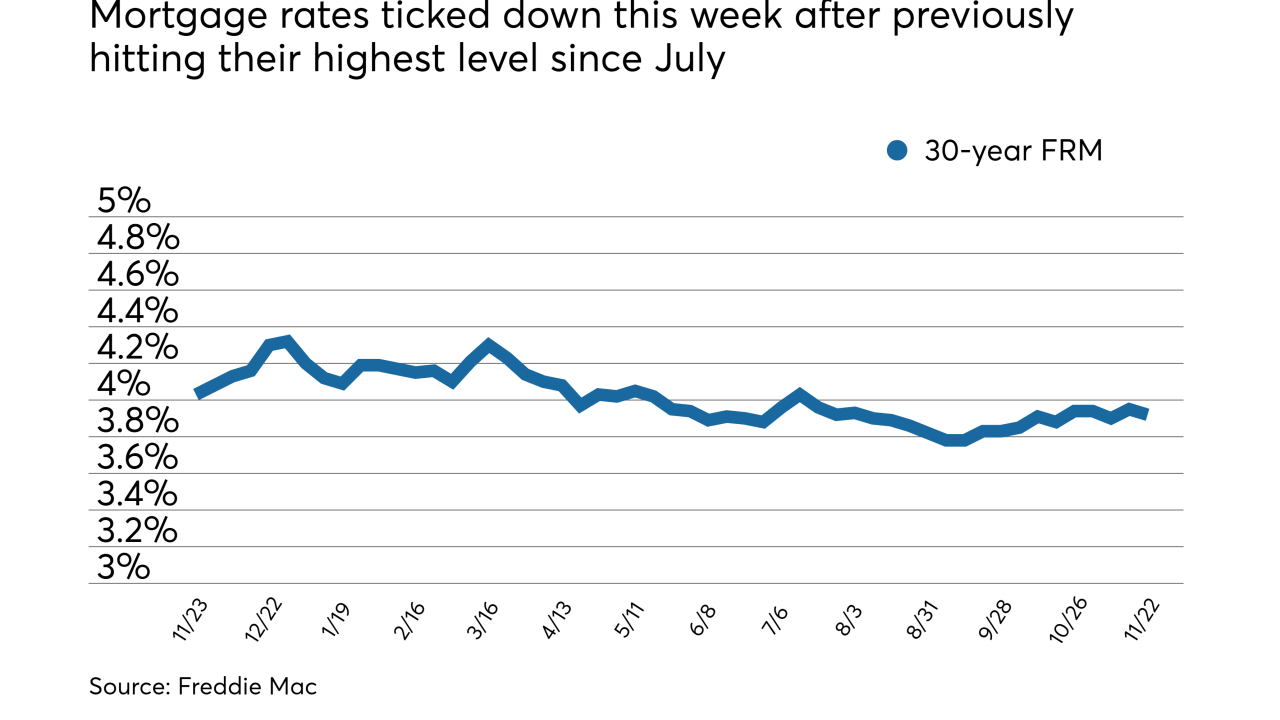

Mortgage rates ticked down this week after previously hitting their highest level since July, according to Freddie Mac.

November 22 -

Consumer default rates are up month-to-month, which may reflect a gap between spending and income that is stressing second mortgages and bank cards, Standard & Poor's and Experian find.

November 22 -

Mortgage closing costs average nearly $4,900 nationwide. But in some states, those fees can reach or exceed five figures. Here's a look at the areas where it costs the most to close a mortgage.

November 21 -

Mortgage rates moved to their highest mark since July and the 10-year Treasury yield ticked up 6 basis points, according to Freddie Mac.

November 16