-

For the digital mortgage to reach its full potential, lenders and technology developers still have to solve for the disconnect between the front-end application process and the underwriting work required before a loan closes.

September 20 -

Technology isn't a magic bullet for success, and just doing mortgages digitally doesn't change how the business fundamentally works.

September 20 Roostify

Roostify -

Many lenders are focusing too much time on user experience and overlooking the frustratingly inefficient mortgage process happening behind their pretty loan applications.

September 20 cloudvirga

cloudvirga -

As lenders embrace the automated processes and data integrations of digital mortgages, they must also rethink their approach to quality control.

September 20 TRK Connection

TRK Connection -

The shift to a purchase market and an increase in wholesale mortgage originations contributed to a nearly 17% year-over-year rise in fraud risk during the second quarter, according to CoreLogic.

September 19 -

-

Efforts to persuade regulators to allow Fannie Mae and Freddie Mac to use alternative credit scores would stifle competition between the credit bureaus and FICO and do little to expand access to credit, according to industry analyst Chris Whalen.

September 18 -

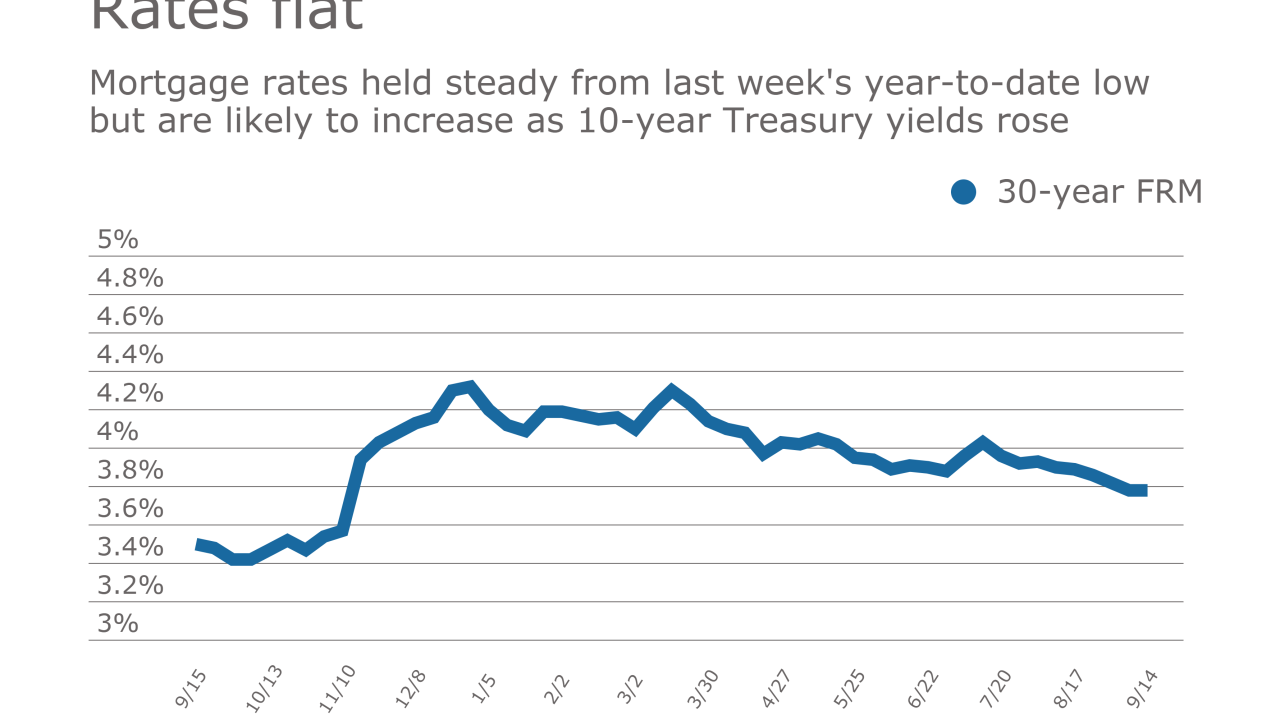

Mortgage rates remained unchanged from last week's year-to-date low but going forward they are likely to increase as 10-year Treasury yields rose.

September 14 -

A decade after the financial crisis and housing collapse, more consumers seem in the mood to buy a new home before they sell their existing home.

September 13 -

As mortgage rates dropped to new lows for the year, loan application volume increased from one week earlier, according to the Mortgage Bankers Association.

September 13 -

Looser underwriting standards for agency-eligible adjustable-rate mortgages helped increase credit availability in August to its highest level since April, according to the Mortgage Bankers Association.

September 11 -

Mortgage rates dropped to a year-to-date low for the third consecutive week as the 10-year Treasury yield also declined, according to Freddie Mac.

September 7 -

As head of Fannie Mae's single-family mortgage business, Andrew Bon Salle wants to ease the burden of loan-level price adjustments, streamline condo loan approvals and expand rep and warrant relief. But even he admits there are limits to his power.

September 7 -

Mortgage refinancing applications were more than half of the volume for the first time since January, according to the Mortgage Bankers Association.

September 6 -

Loan application defects were unchanged for July compared with June, the first time in eight months there has not been an increase, according to First American Financial Corp.

August 31 -

Mortgage rates fell to a new low for the year this week, but are 38 basis points higher than they were one year ago, according to Freddie Mac.

August 31 -

Mortgage applications decreased 2.3% from one week ago, according to the Mortgage Bankers Association.

August 30 -

Millennial credit scores are lower than when Generation X consumers were coming of age, reflecting changes in credit consumption and other consumer behaviors.

August 30 -

Wells Fargo forced borrowers to pay millions of dollars in fees to extend interest rate locks that expired due to the bank's delays in processing mortgage applications, a lawsuit claims.

August 29 -

Mortgage rates decreased for the fourth consecutive week and dropped to their lowest mark since November, according to Freddie Mac.

August 24