-

Mortgage application volume increased 3% from one week earlier as slightly lower interest rates resulted in more refinance activity, according to the Mortgage Bankers Association.

August 9 -

PHH Corp. will pay the Justice Department $75 million to settle a False Claims Act investigation of its underwriting practices on government-insured mortgages and loans sold to Fannie Mae and Freddie Mac.

August 8 -

The year opened with hopes that regulatory and enforcement pressures would abate for the mortgage industry. The reality has turned out quite differently.

August 7 -

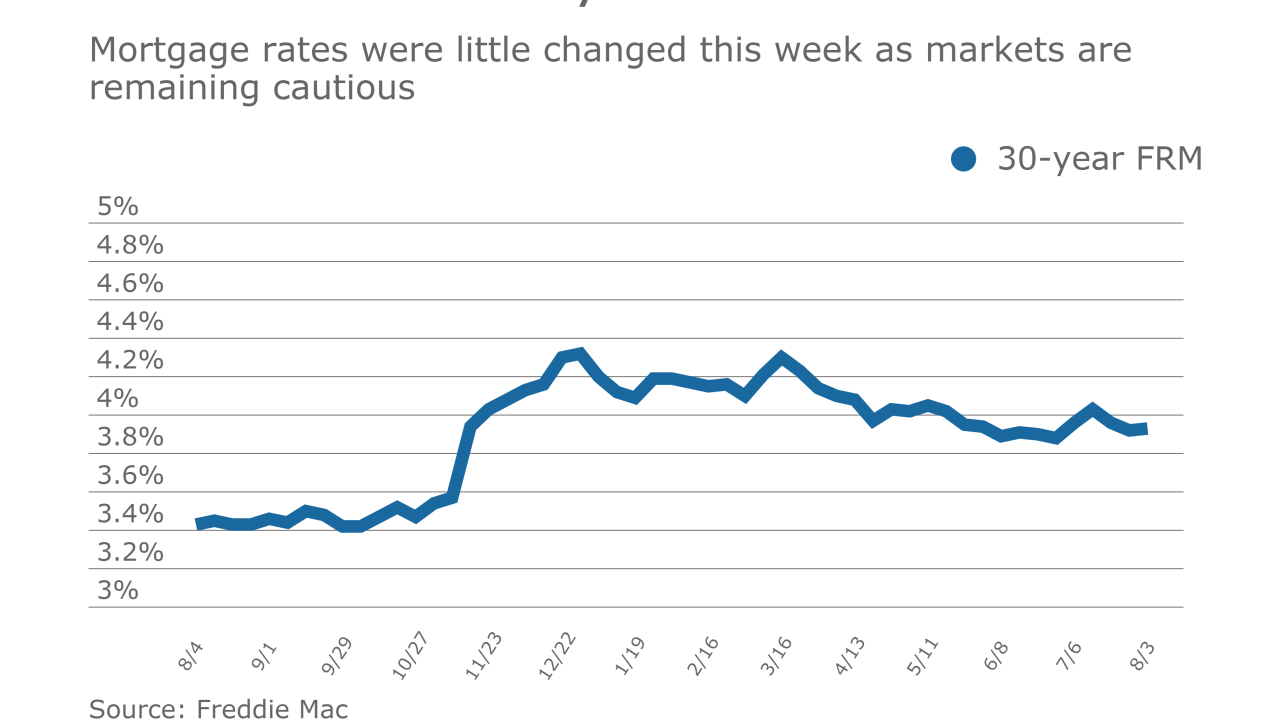

Mortgage rates were little changed this week after declining the previous two weeks, according to Freddie Mac.

August 3 -

Mortgage application activity decreased 2.8% from one week earlier as interest rates were flat or moved slightly higher, according to the Mortgage Bankers Association.

August 2 -

-

Old Republic International Corp. is again making noise about bringing its mortgage insurance subsidiary back to active status, while separating it out from the holding company.

July 31 -

CoreLogic will fully integrate its 4506-T income verification product in August with Fannie Mae's Desktop Underwriter platform to provide Day 1 Certainty service.

July 31 -

Loan application defects increased for the seventh consecutive month in June, due to the highly competitive purchase market, according to First American Financial Corp.

July 31 -

Freddie Mac has set a November implementation date for its plan to tighten restrictions on seller-funded down payments.

July 28 -

Ellie Mae had second-quarter net income of $18.8 million, a 77% increase over the $10.6 million in the same period last year largely due to a tax accounting change.

July 27 -

U.K. regulators’ decision to abandon the Libor benchmark by the end of 2021 threatens to sow confusion in the market as the industry races to replace the scandal-plagued rate that underpins more than $350 trillion of financial products.

July 27 -

Mortgage rates dropped for the second consecutive week, although the yield on the benchmark 10-year Treasury actually increased during the period, according to Freddie Mac.

July 27 -

Loan application volume increased 0.4% from one week earlier, according to the Mortgage Bankers Association, as rates fell to their lowest level in three weeks.

July 26 -

Fannie Mae is increasing the maximum debt-to-income ratio it will allow on purchased loans to 50% from 45% on single-family loans when it rolls out its latest version of Desktop Underwriter on July 29.

July 20 -

When market prices rise faster than comparable home sales values it is imperative for lenders to ensure property valuations are accurate, support the sales price and completed in a timely fashion to keep deals from falling through. (Part four in a four-part series on the mortgage industry's response to the housing inventory shortage.)

July 20 -

Mortgage rates moved back below 4%, pushed by last week's weak economic data report, according to Freddie Mac.

July 20 -

The share of closed purchase loans remained flat in June, affected by the lack of homes for sale, according to Ellie Mae's Origination Insight report.

July 19 -

Mortgage loan application volume increased 6.3% last week as interest rates remained flat after a sharp gain during the previous 14-day period, according to the Mortgage Bankers Association.

July 19 -

Canadians may be shouldering near-record household debt but homeowners have been managing it better than those that don't own property.

July 18