-

Mortgage rates have been on a steady decline since the March 15 Federal Open Market Committee meeting, hitting a new low for 2017, according to Freddie Mac.

April 13 -

Mortgage applications increased 1.5% from one week earlier even though refinancing activity continues to shrink, according to the Mortgage Bankers Association.

April 12 -

Springtime in the Charlotte region is motivating more area homeowners to put their properties on the market, according to the Charlotte Regional Realtor Association.

April 11 -

Residential property values will see appreciation of 3.5% over the next 12 months, but interest rate increases could put a damper on price growth in several markets.

April 10 -

Large banks will gain the advantage in offering online mortgages because of their greater financial resources, pricing capabilities and cross-selling ability, Fitch Ratings said.

April 6 -

Increased access to jumbo loan products brought mortgage credit availability to its highest level since the bust.

April 6 -

The average weekly rate for a 30-year fixed-rate mortgage dropped to 4.1% from 4.14% despite the release of information about further tapering of the Federal Reserve's mortgage bond holdings.

April 6 -

Mortgage applications decreased 1.6% from one week earlier as refinancing activity continues to shrink, according to the Mortgage Bankers Association.

April 5 -

Late payments on securitized commercial mortgages rose again in March, led by industrial and retail property loans.

April 4 -

Millennial homeowners are more likely to be current and future users of home equity lines of credit than either Gen-Xers or baby boomers.

April 4 -

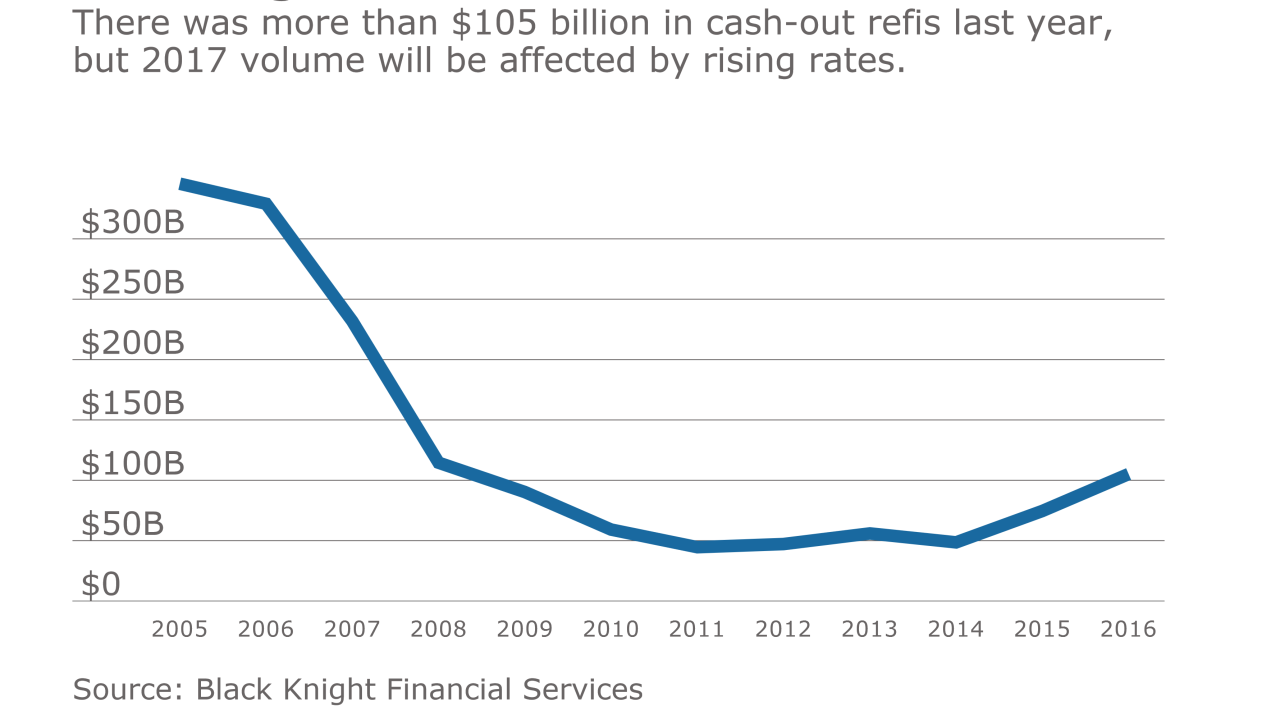

Rising rates will dampen what had been a growing cash-out refinance market even as equity available to homeowners continues to increase.

April 3 -

The combination of rising rates and real estate prices has made home buying less affordable, reviving interest in a product that lets consumers borrow against the future equity of their homes.

April 3 -

Risk management concerns were responsible for a five-percentage-point reduction in bank non-qualified mortgage lending last year.

March 31 -

Lenders can track the effectiveness of product pricing changes on a real-time basis using a new market share analytics tool from Optimal Blue.

March 30 -

Post-recession, educational achievement became a factor in determining whether a young adult decided to buy a home.

March 30 -

The 30-year fixed-rate mortgage averaged 4.14% for the week ending March 30,

down from last week when it averaged 4.23%.March 30 -

February's consumer demand for housing was the strongest ever for that month, but a lack of supply will likely leave many disappointed.

March 29 -

Refinance applications reached their lowest share in more than seven years even as mortgage rates fell last week, according to the Mortgage Bankers Association.

March 29 -

Fintech could cut the closing times on the simplest home loans by more than 50%, but the mortgage business' complexity means there are limits to how much time and money can be saved.

March 28 -

Home sales climbed 6% in the Capital Region in February after a lackluster January.

March 28