-

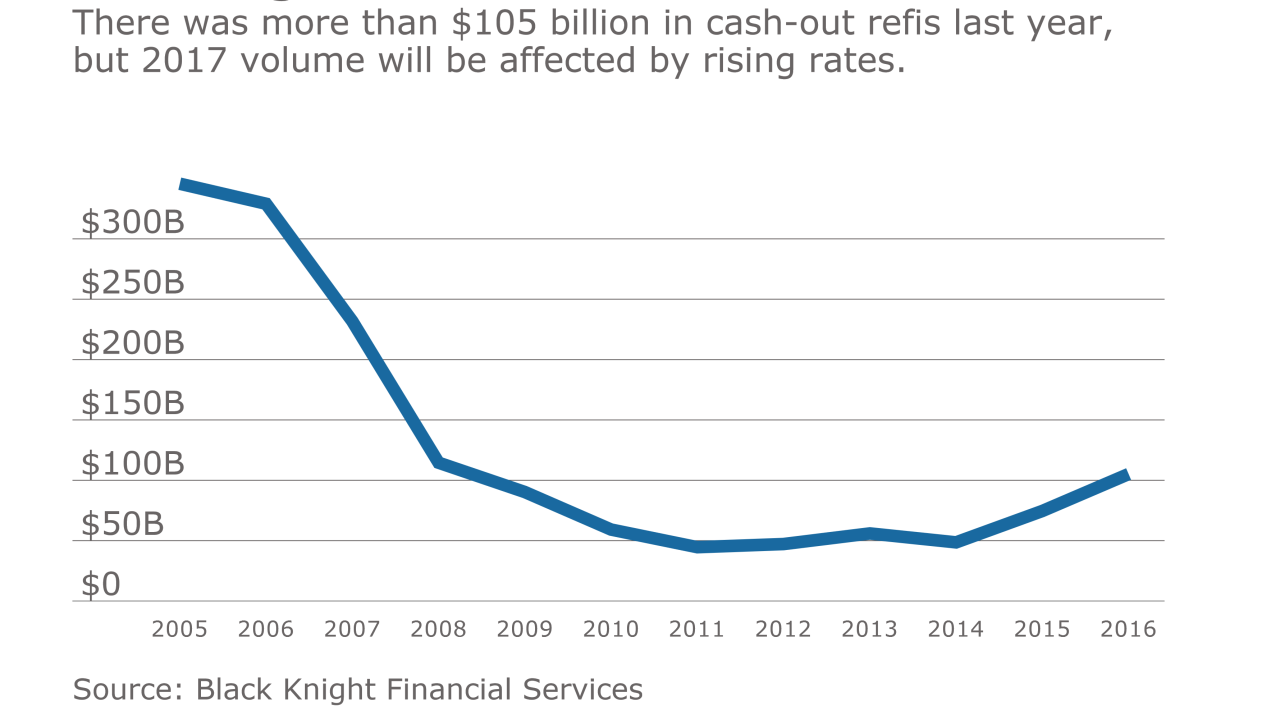

Rising rates will dampen what had been a growing cash-out refinance market even as equity available to homeowners continues to increase.

April 3 -

The combination of rising rates and real estate prices has made home buying less affordable, reviving interest in a product that lets consumers borrow against the future equity of their homes.

April 3 -

Risk management concerns were responsible for a five-percentage-point reduction in bank non-qualified mortgage lending last year.

March 31 -

Lenders can track the effectiveness of product pricing changes on a real-time basis using a new market share analytics tool from Optimal Blue.

March 30 -

Post-recession, educational achievement became a factor in determining whether a young adult decided to buy a home.

March 30 -

The 30-year fixed-rate mortgage averaged 4.14% for the week ending March 30,

down from last week when it averaged 4.23%.March 30 -

February's consumer demand for housing was the strongest ever for that month, but a lack of supply will likely leave many disappointed.

March 29 -

Refinance applications reached their lowest share in more than seven years even as mortgage rates fell last week, according to the Mortgage Bankers Association.

March 29 -

Fintech could cut the closing times on the simplest home loans by more than 50%, but the mortgage business' complexity means there are limits to how much time and money can be saved.

March 28 -

Home sales climbed 6% in the Capital Region in February after a lackluster January.

March 28 -

The average home price in the Cincinnati region climbed to $180,372 in February compared to $160,839 a year earlier, a 12.14% increase.

March 28 -

Home prices in 20 U.S. cities climbed in the 12 months through January at the fastest pace since July 2014, while nationwide the increase in property values also accelerated.

March 28 -

Most tax lien and civil judgment data will be taken out of credit bureau files on July 1, possibly inflating scores and raising concerns about liability for mortgages that sour.

March 27 -

Rising interest rates made mortgage lenders bearish on their short-term outlook for purchase originations and that is affecting their expectations on profits.

March 27 -

Continued price growth in New York drove January's home prices up by 0.1% from December and by 5.4% over the previous year, according to Black Knight Financial Services.

March 27 -

With refinance volume shrinking, some lenders are making up the difference by turning to alternative loan products for borrowers with lower credit scores.

March 23 -

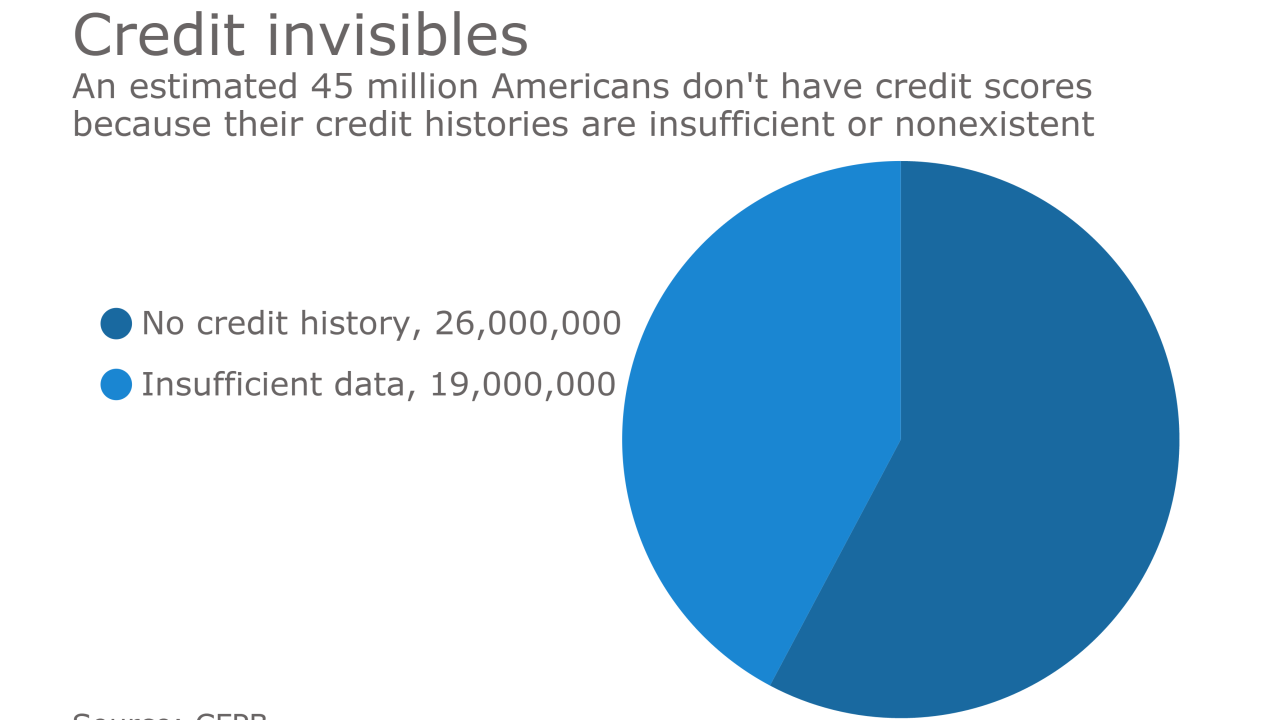

Freddie Mac will soon allow automated underwriting of borrowers who lack scores but have other financial records.

March 23 -

The 30-year fixed-rate mortgage averaged 4.23% for the week ending March 23, down from last week when it averaged 4.3%.

March 23 -

Mortgage applications decreased 2.7% from one week earlier after the Fed announced a rate hike, according to the Mortgage Bankers Association.

March 22 -

Loans originated in the fourth quarter of 2016 carried less credit risk, according to the latest Housing Credit Index from CoreLogic.

March 21