-

The average home price in the Cincinnati region climbed to $180,372 in February compared to $160,839 a year earlier, a 12.14% increase.

March 28 -

Home prices in 20 U.S. cities climbed in the 12 months through January at the fastest pace since July 2014, while nationwide the increase in property values also accelerated.

March 28 -

Most tax lien and civil judgment data will be taken out of credit bureau files on July 1, possibly inflating scores and raising concerns about liability for mortgages that sour.

March 27 -

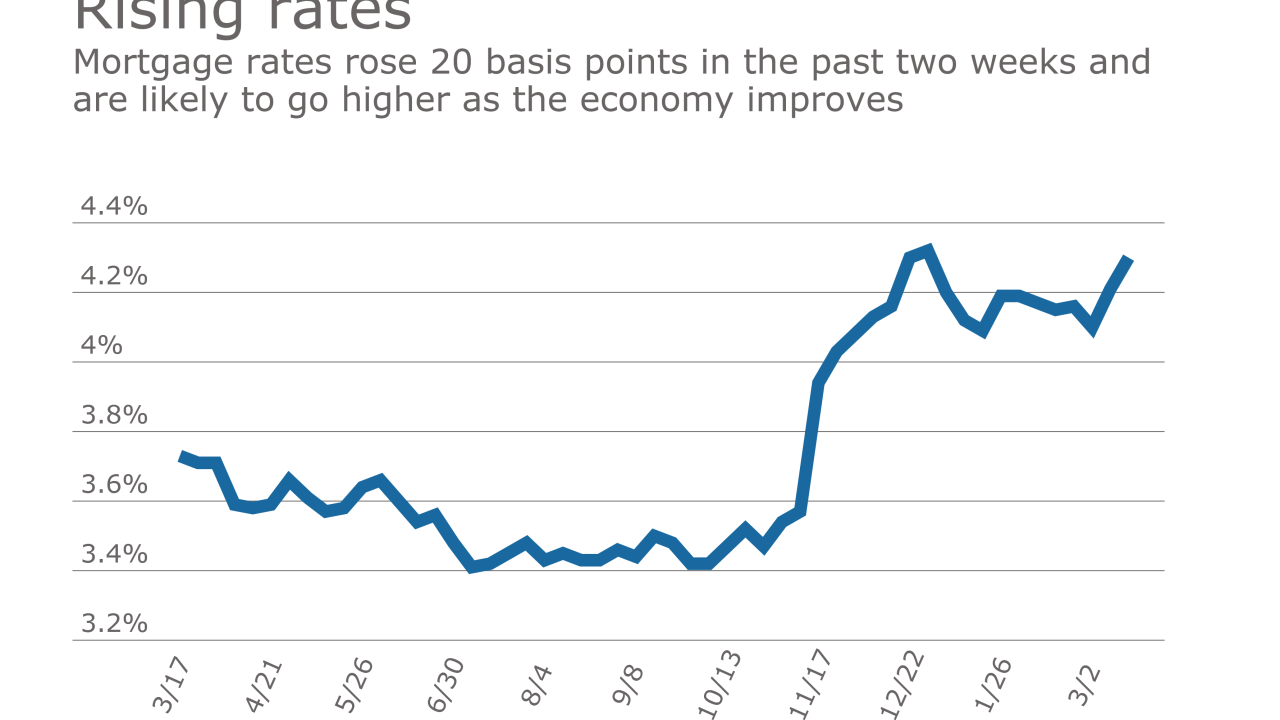

Rising interest rates made mortgage lenders bearish on their short-term outlook for purchase originations and that is affecting their expectations on profits.

March 27 -

Continued price growth in New York drove January's home prices up by 0.1% from December and by 5.4% over the previous year, according to Black Knight Financial Services.

March 27 -

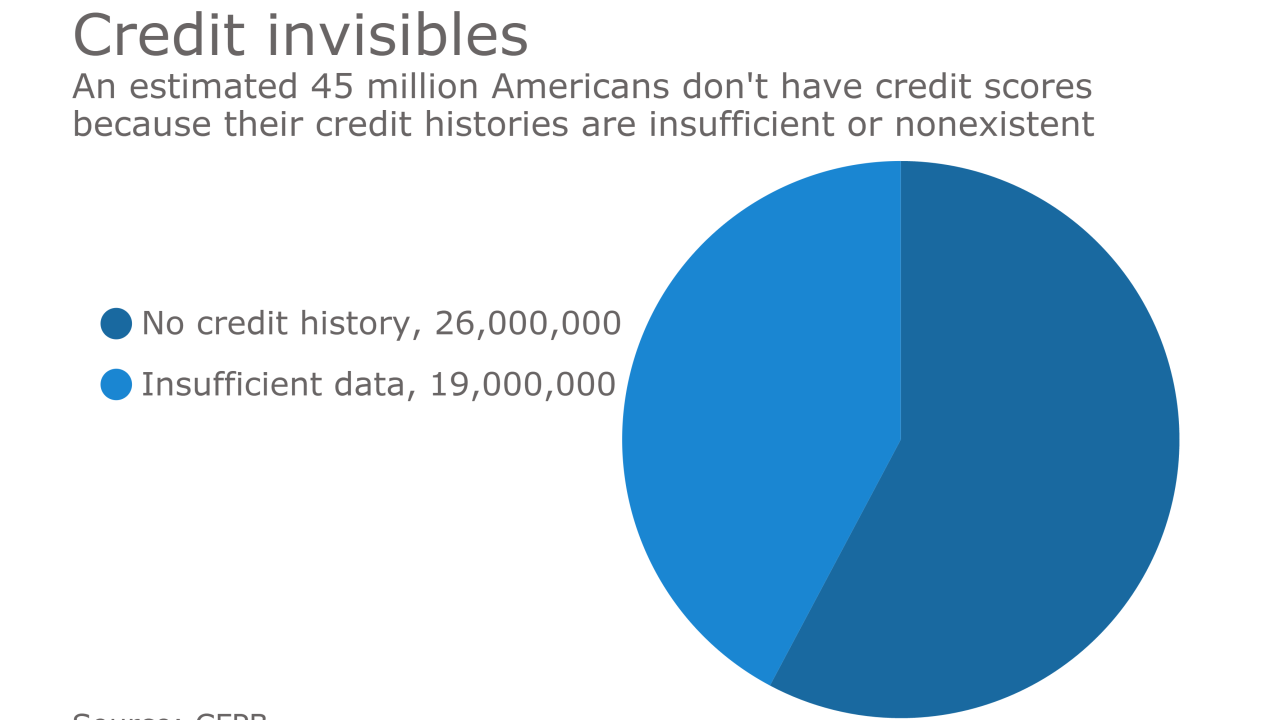

With refinance volume shrinking, some lenders are making up the difference by turning to alternative loan products for borrowers with lower credit scores.

March 23 -

Freddie Mac will soon allow automated underwriting of borrowers who lack scores but have other financial records.

March 23 -

The 30-year fixed-rate mortgage averaged 4.23% for the week ending March 23, down from last week when it averaged 4.3%.

March 23 -

Mortgage applications decreased 2.7% from one week earlier after the Fed announced a rate hike, according to the Mortgage Bankers Association.

March 22 -

Loans originated in the fourth quarter of 2016 carried less credit risk, according to the latest Housing Credit Index from CoreLogic.

March 21 -

Experian and Finicity have released a product that aims to speed up decisions on mortgage applications, using financial data aggregation technology.

March 20 -

Shellpoint is marketing another offering of private-label mortgage bonds backed primarily by loans it acquired rather than loans originated by its own New Penn subsidiary.

March 20 -

U.S. bank regulators have tentatively agreed to ease an appraisal requirement that could help commercial real estate borrowers.

March 20 -

Mortgage industry hiring and new job appointments for the week ending March 17.

March 17 -

Homes for sale listings are scarcer than they've ever been entering the spring selling season.

March 17 -

Banks are losing wealthier underbanked customers to alternative lenders — an undercurrent that is halting progress in expanding credit access for all.

March 17 Aite Group

Aite Group -

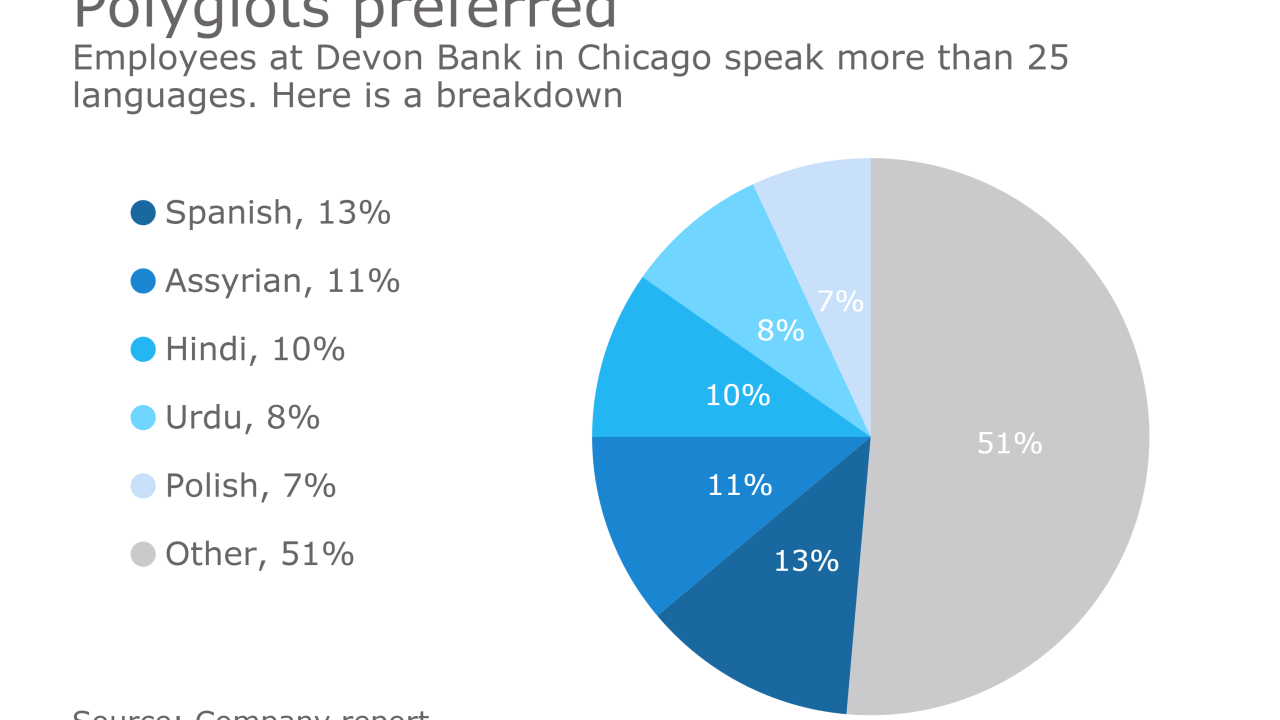

Devon Bank in Chicago has a long history serving immigrant groups in one of the nation's most diverse neighborhoods. Right now, its clients are worried about President Trump's actions on immigration and deportation.

March 16 -

Black Knight Financial Services is bringing its Empower loan origination system to midsized mortgage lenders by offering a preconfigured version of its highly customizable platform.

March 16 -

Mortgage rates are being pushed higher by the same economic factors that led the Federal Open Market Committee to increase short-term rates.

March 16 -

LoanDepot Inc. is exploring the possibility of reviving a stock offering after cancelling one in November 2015

March 16