-

Experian and Finicity have released a product that aims to speed up decisions on mortgage applications, using financial data aggregation technology.

March 20 -

Shellpoint is marketing another offering of private-label mortgage bonds backed primarily by loans it acquired rather than loans originated by its own New Penn subsidiary.

March 20 -

U.S. bank regulators have tentatively agreed to ease an appraisal requirement that could help commercial real estate borrowers.

March 20 -

Mortgage industry hiring and new job appointments for the week ending March 17.

March 17 -

Homes for sale listings are scarcer than they've ever been entering the spring selling season.

March 17 -

Banks are losing wealthier underbanked customers to alternative lenders — an undercurrent that is halting progress in expanding credit access for all.

March 17 Aite Group

Aite Group -

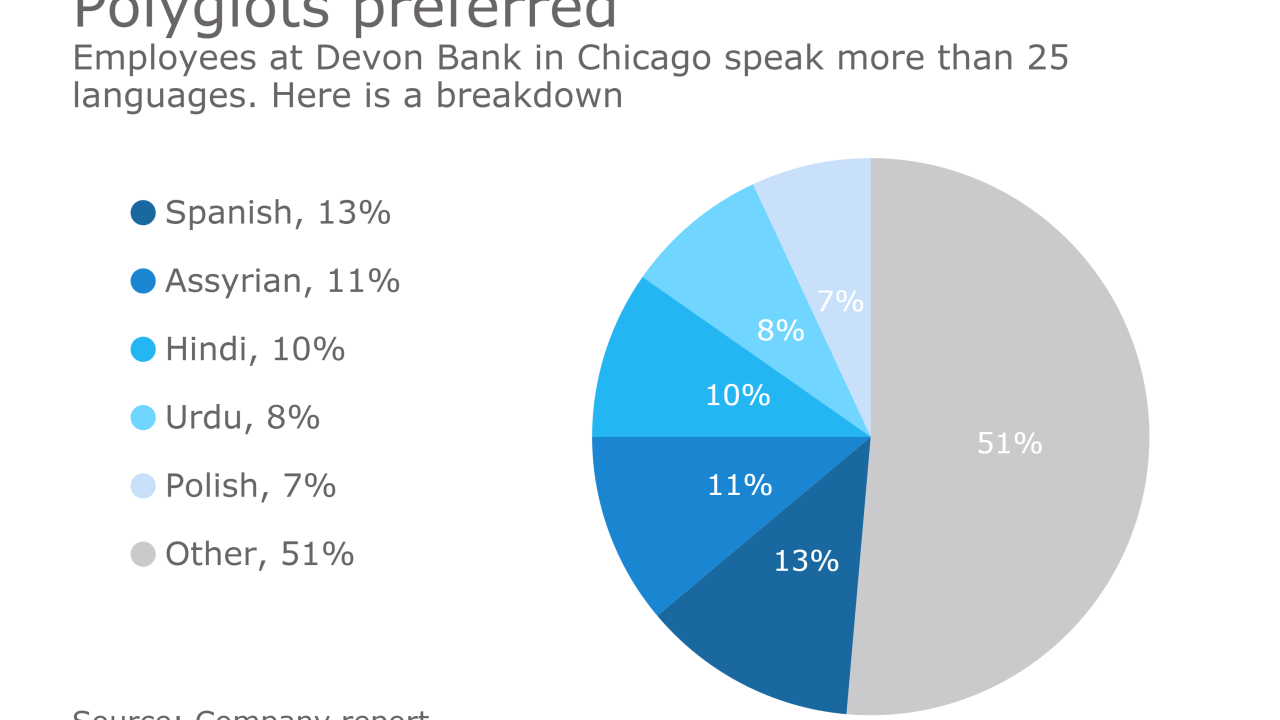

Devon Bank in Chicago has a long history serving immigrant groups in one of the nation's most diverse neighborhoods. Right now, its clients are worried about President Trump's actions on immigration and deportation.

March 16 -

Black Knight Financial Services is bringing its Empower loan origination system to midsized mortgage lenders by offering a preconfigured version of its highly customizable platform.

March 16 -

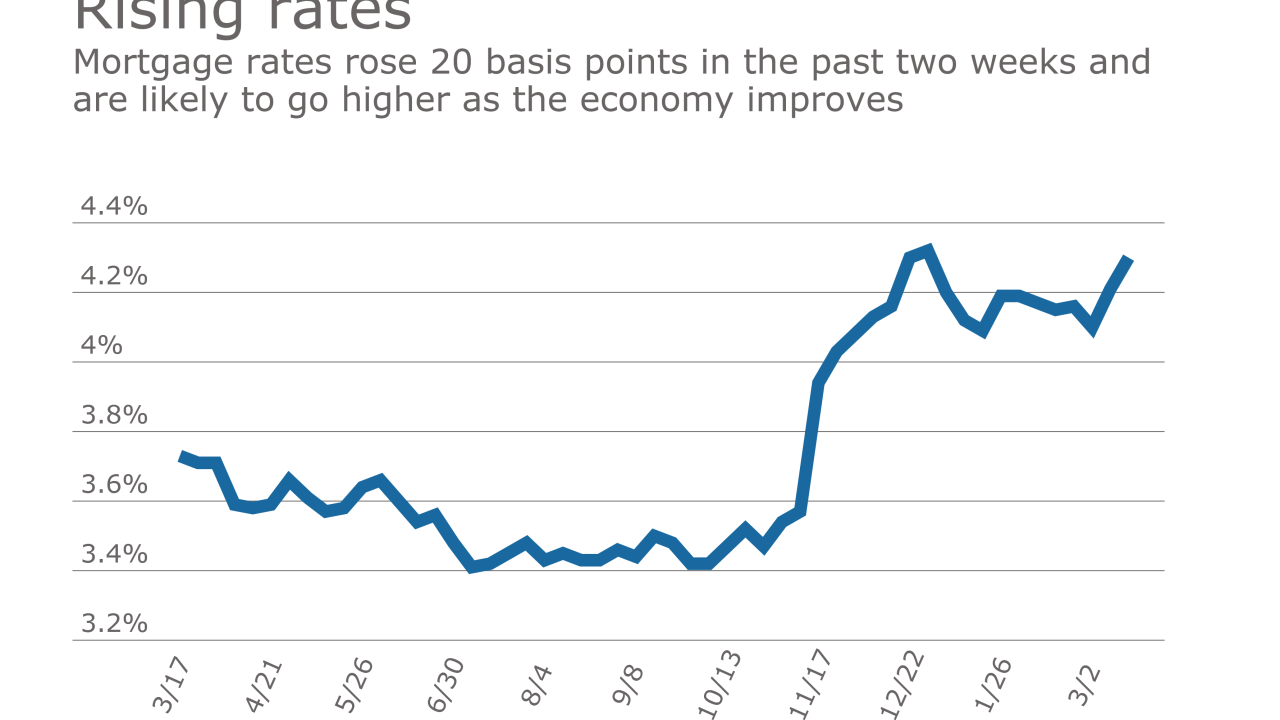

Mortgage rates are being pushed higher by the same economic factors that led the Federal Open Market Committee to increase short-term rates.

March 16 -

LoanDepot Inc. is exploring the possibility of reviving a stock offering after cancelling one in November 2015

March 16 -

Wells Fargo's next offering of commercial mortgage bonds is unusually concentrated in a relatively small number of large loans, though many are high-quality properties located in strong markets.

March 15 -

Reflecting the post-election interest rate rise, closed purchase loans were 57% of February's total volume, according to Ellie Mae's Origination Insight report.

March 15 -

Mortgage applications increased 3.1% from one week earlier even as rates reached their highest level in three years, according to the Mortgage Bankers Association.

March 15 -

Continuing a strong start to 2017, February mortgage applications for new home purchases grew 2.2% from a year ago.

March 14 -

Social Finance's online borrowers are defaulting at higher rates than underwriters for one of its bond deals had expected, the latest sign that an industry that hoped to upend banking is now getting tripped up by bad loans.

March 13 -

Mortgage credit availability went up yet again in February amidst an expansion in access to government loans.

March 9 -

Mortgage interest rates increased 11 basis points over the previous week, reaching their highest level so far in 2017, according to Freddie Mac.

March 9 -

Application activity increased 3.3% from one week earlier, even though mortgage interest rates rose on speculation the Federal Open Market Committee could act in March.

March 8 -

Caliber will also buy about $36 million of mortgage servicing rights in a deal that is expected to close at the end of March.

March 3 -

Angel Oak, a regular issuer of nonprime residential mortgage bonds, is marketing its first transaction with a credit rating.

March 2