-

HSBC anticipates its mortgage underwriting volume ramping up significantly after recent initiatives to provide loan officers with more tools and time to address the complex needs of affluent customers, often from overseas.

August 8 -

More applications for non-QM loans might close if lenders and originators beefed up efforts to address missing or outdated information, according to Computershare.

August 8 -

Jumbo loan product availability continued climbing and reached an all-time high in July, but it wasn't enough to stop overall credit standards from tightening, according to the Mortgage Bankers Association.

August 8 -

Essent Group continued to benefit from the volatility in private mortgage insurers' market share, remaining in second place among the six active underwriters at the end of the recent quarter.

August 2 -

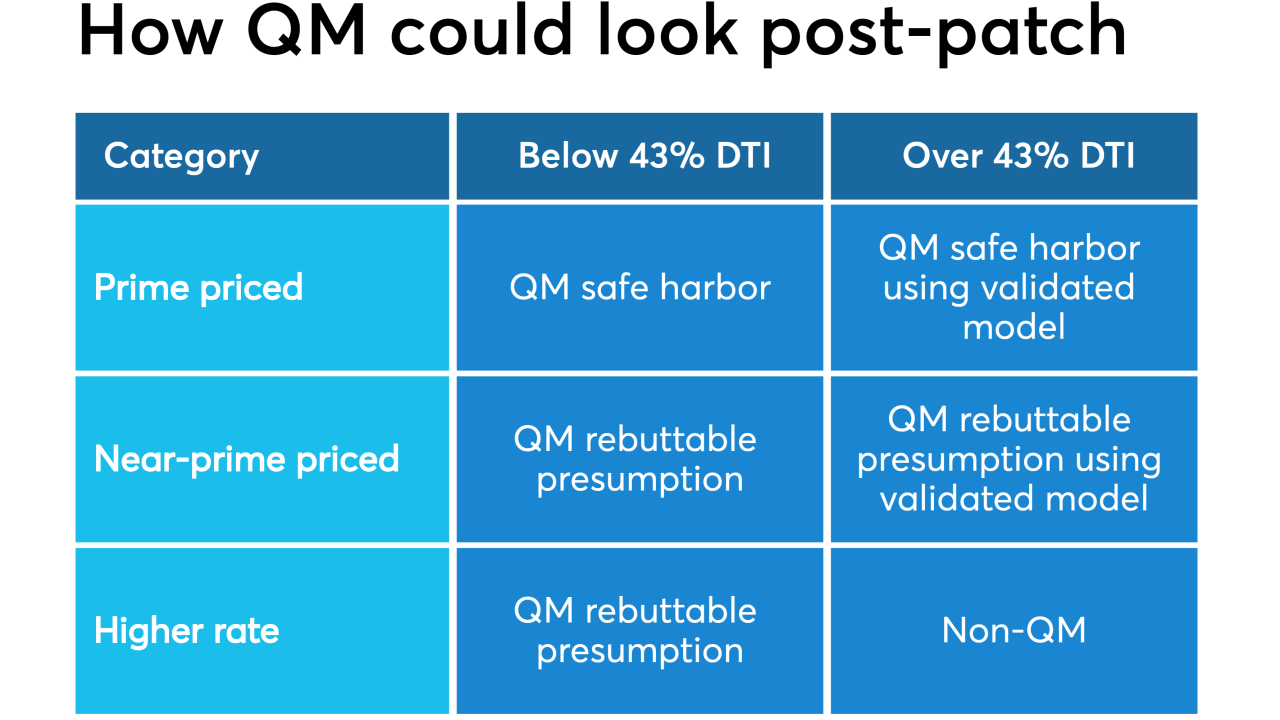

Fannie Mae's current tack could help it weather some of the new challenges confronting the government-sponsored enterprises, including the planned expiration of its qualified mortgage rule exemption and rate-driven earnings volatility.

August 1 -

Mr. Cooper Group reported a second-quarter net loss of $87 million as the company took a $231 million fair value hit to its mortgage servicing rights portfolio.

August 1 -

Loan officers' jobs are harder than they need to be because of back-end system inefficiencies, and it adds cost to the process.

July 31 cloudvirga

cloudvirga -

Equitable Group Inc. and Home Capital Group Inc. are reaping a windfall from Canada's tighter mortgage regulations.

July 31 -

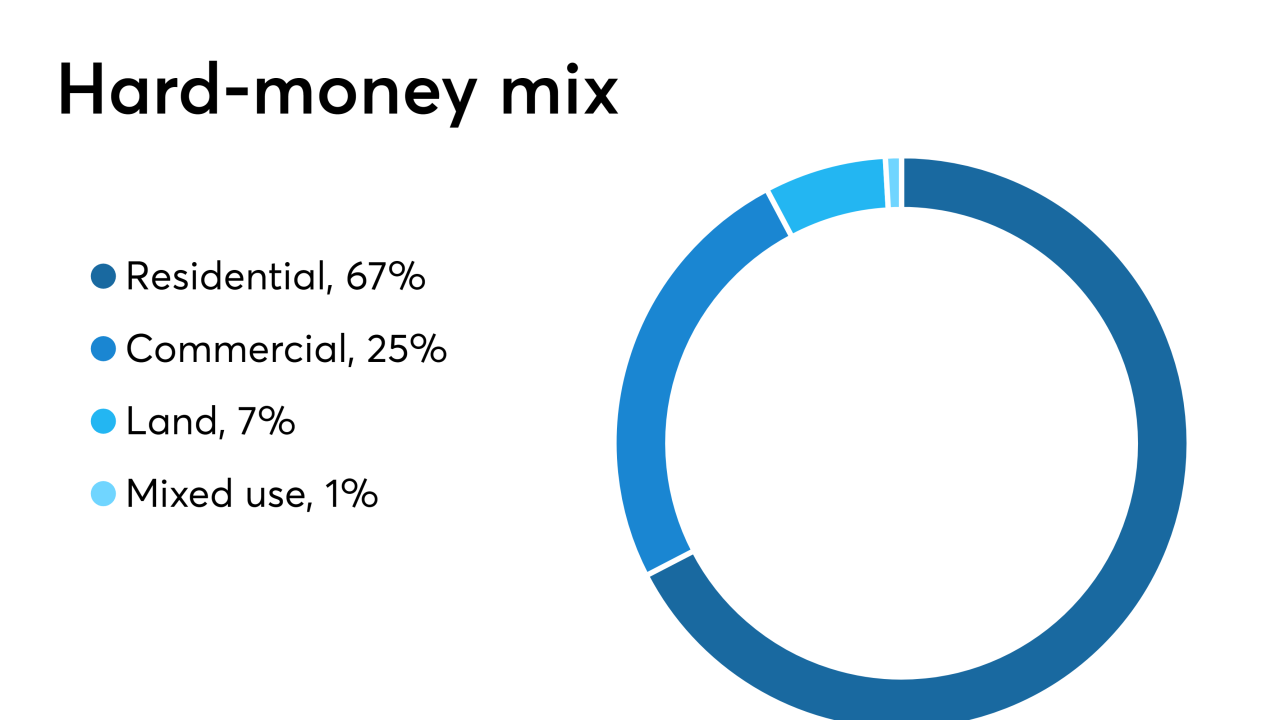

Sachem Capital Corp., a hard-money mortgage lender that makes short-term loans to investors, has raised $10 million in gross proceeds from a public offering of 2 million common shares.

July 29 -

Waterstone Mortgage is now qualifying borrowers without a traditional credit history for both its conventional and government mortgage programs.

July 24 -

The incentives are stronger than ever to work toward standardizing the documentation, language and process for loans in commercial mortgage-backed securities to be combined with PACE financing.

July 23 Alston & Bird

Alston & Bird -

Liberty Home Equity, a subsidiary of Ocwen Financial, is offering a new private-market alternative to Federal Housing Administration-insured reverse mortgages.

July 22 -

A new wave of mortgage production technologies empower lenders to create a more personalized approach to serving borrowers compared with the ubiquitous loan origination systems created over 10 years ago.

July 12 Blue Sage Solutions

Blue Sage Solutions -

Almost two-thirds of consumers think they must be debt-free to get home financing when in fact they can have debt-to-income levels as high as 43% or greater, according to Wells Fargo.

July 10 -

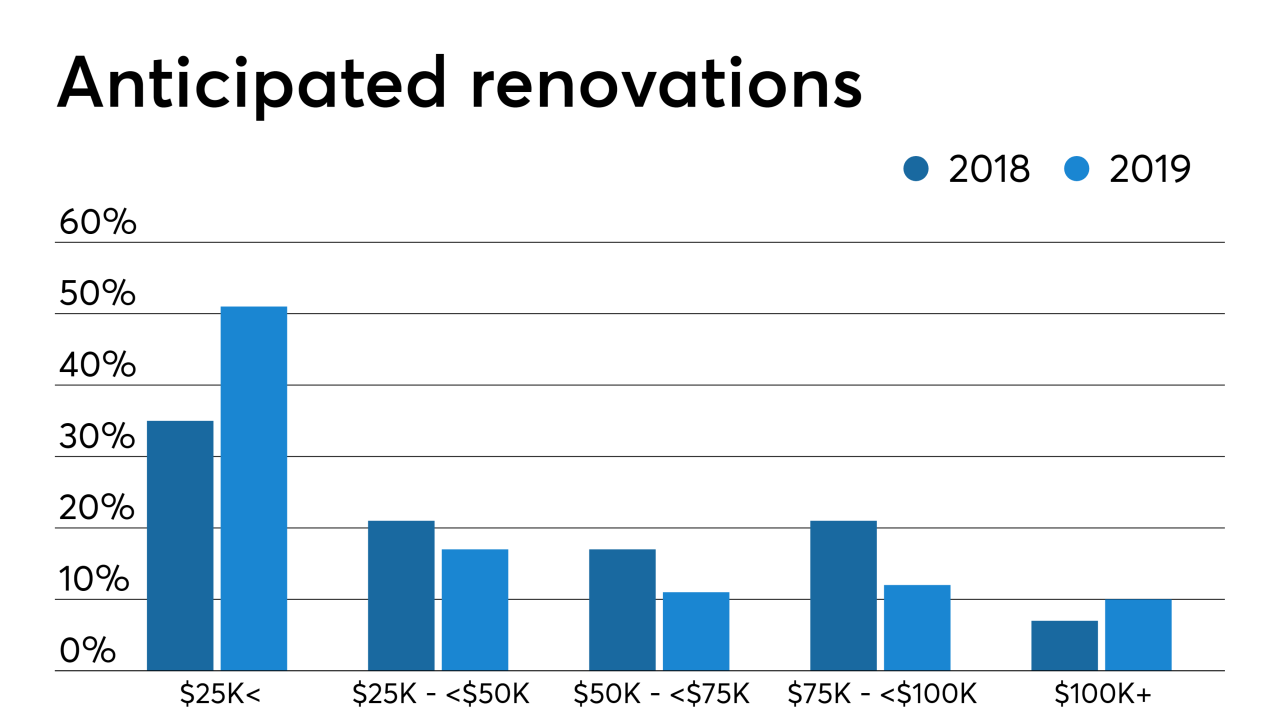

With nearly half of homeowners renovating in the next two years, HELOCs stand as the most likely form of lending sought out by consumers, according to TD Bank.

July 10 -

After the government-sponsored enterprise patch expires, "near prime" loans over the 43% debt-to-income ratio should be qualified mortgages if they have compensating factors, according to the Center for Responsible Lending.

July 9 -

With affordability still an issue despite falling interest rates and harnessed home value growth, lenders further loosened credit standards in June, according to the Mortgage Bankers Association.

July 9 -

Mandate for loan officers is to be able to inform on customers' specific financial needs in areas that extend well beyond the home loan.

July 9 -

A handful of institutions in the last year have rolled out loan programs targeting members of the military and first responders, but there could be risks associated with these mortgages if the economy takes a nosedive.

July 4 -

The post-crisis operational improvements at both Fannie Mae and Freddie Mac have resulted in stronger mortgage loan performance, a Fitch Ratings report said.

July 3