-

MGIC Investment Corp. posted better-than-expected first-quarter earnings as expenses were lower than projected while net premiums came in higher.

April 23 -

360 Mortgage is bringing back the no-income, no-asset loan, but says its $1 billion pilot's guidelines differ from those of the NINA loans that contributed to the financial crisis.

April 18 -

General Electric Co. finalized an agreement to pay $1.5 billion to settle a U.S. investigation into the manufacturer's defunct subprime mortgage business.

April 12 -

Non-qualified mortgage-backed securities record issuance in the first quarter puts it on pace to top full-year volume predictions, according to Keefe, Bruyette & Woods.

April 9 -

Artificial intelligence, automation, electronic closings; the 2019 Top Producers identified the biggest technology initiatives bending the way mortgages get done.

April 4 -

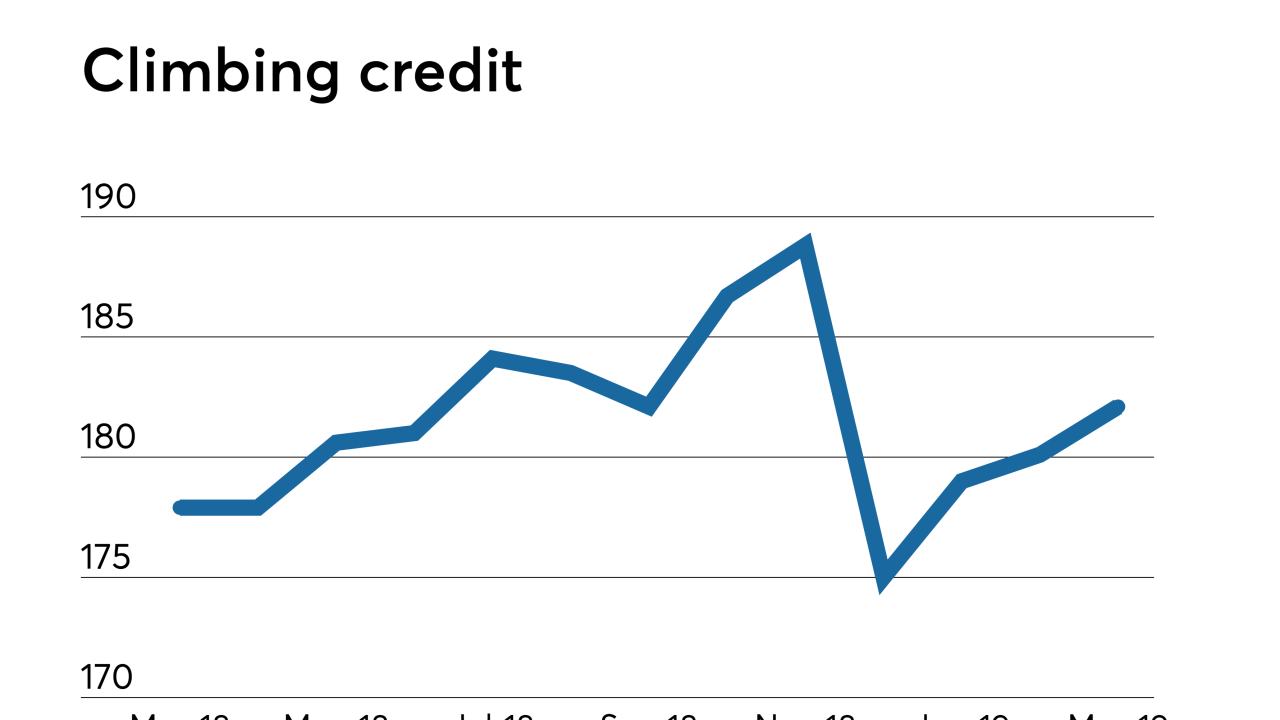

Mortgage lending standards loosened in March, as a swell in jumbo credit helped drive an expansion in availability for the third straight month, according to the Mortgage Bankers Association.

April 4 -

Plaza Home Mortgage has expanded the guidelines of its wholesale and correspondent non-qualified mortgage program to allow using bank statements for documenting income.

April 3 -

Mortgage borrowers don't know about the logistics of applying for a loan, which is the basis for their erroneous ideas about the process, the respondents to the 2019 Top Producers Survey said.

April 2 -

Plaza Home Mortgage's wholesale division has rolled out a one-time close, construction-to-permanent loan that meets Fannie Mae underwriting guidelines.

April 1 -

Technology, staffing, reform: Here's a look at 12 key insights from the 2019 Top Producers, from what they considered critical to success to stances they have on industry initiatives going forward.

April 1 -

Income-related mortgage application fraud risk has the potential to increase as competition rises among buyers during the peak spring season, First American said.

March 29 -

The digital lender rebranded its mortgage business as SoFi Home Loans about four months after it took a step back from real estate finance to redesign its processes.

March 29 -

With the launch of its Medical Professional Mortgage Product, TD Bank is leveraging an opportunity to attract new customers and to address what it says is a knowledge gap among this group of professionals.

March 22 -

The Federal Housing Administration is returning to manual reviews of higher-risk loans it insures because it's finding that a growing share have lower credit scores, higher debt-to-income ratios, or both.

March 18 -

Freddie Mac is broadly offering instant representation and warranty relief for automatically validated self-employment income following a test of the concept last year.

March 6 -

New York regulators rejected Fidelity National Financial's acquisition of Stewart Information Services because the combination would have a dominant share of title insurance in the state.

March 6 -

AI Foundry is aiming to further cut the time it takes to originate a mortgage by adding artificial intelligence tools designed to improve on optical character recognition.

March 5 -

The conventional market recaptured a lot of the first-time homebuyers it lost during the financial crisis, but service members instead have increasingly stuck with loans insured by the Department of Veterans Affairs.

March 1 -

David Plunkett, a 53-year-old accountant in Lynn, Mass., pleaded guilty to bank fraud this week for his part in a scheme to defraud mortgage lenders between 2006 and 2015.

February 28 -

Being too dependent on the automated underwriting tools created by the government-sponsored enterprises to originate loans underlying private-label mortgage-backed securitizations could negatively affect their credit quality, a report from Moody's said.

February 26