-

An agency report said servicing portfolios have shrunk by nearly half in 10 years as much of the mortgage market has shifted to nonbanks.

December 12 -

The number of workers employed by non-depository mortgage companies experienced a typical seasonal drop month-to-month, but employment remained higher than a year ago due to the persistence of competitive hiring practices.

December 7 -

The CFPB ordered Village Capital & Investment in Henderson, Nev., to issue refunds and pay a penalty for allegedly misrepresenting the cost savings in a refi product.

December 6 -

Consolidation is coming in the mortgage industry, but a protracted timetable will continue to constrict industry profits.

December 4 -

Hometown Lenders Inc. will acquire TotalChoice Mortgage in a move to expand its geographic footprint and meet its goal of growing annual originations from $1 billion to $5 billion.

November 30 -

Third-quarter profitability fell to 2008 levels in the Mortgage Bankers Association's latest report, suggesting the seasonally slower fourth quarter could be particularly challenging this year.

November 29 -

Altisource Portfolio Solutions plans to discontinue its buy-renovate-lease-sell business for single-family homes and sell its short-term inventory in order to cut costs and repay debt.

November 26 -

Ginnie Mae is adding steps to its process for evaluating new issuers, including new notification requirements related to subservicer advances, servicing income, and borrowing facilities secured by mortgage servicing rights.

November 16 -

FDIC Chairman Jelena McWilliams questioned whether regulators and banks are fully capturing the emerging risks of a new shadow banking system.

November 15 -

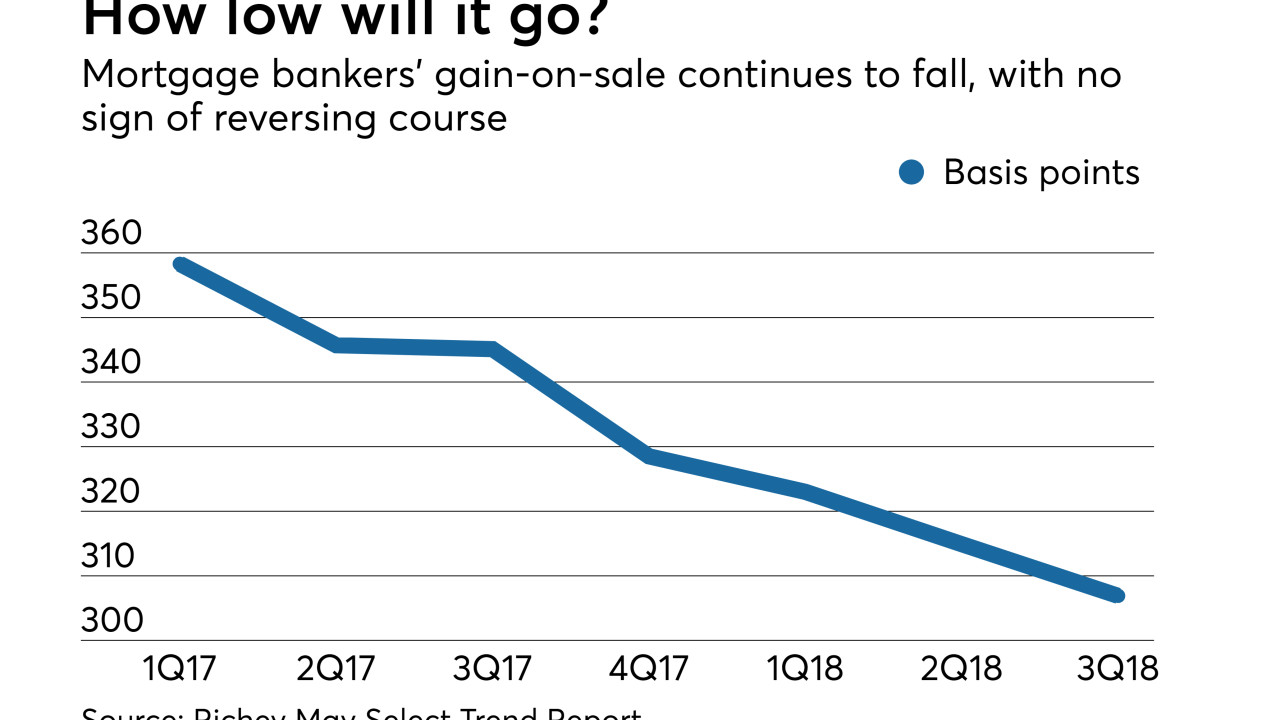

If falling volume and rising costs weren't bad enough for nonbank mortgage lenders, an extended run of tight gain-on-sale margins is further eating into their profits.

November 9 -

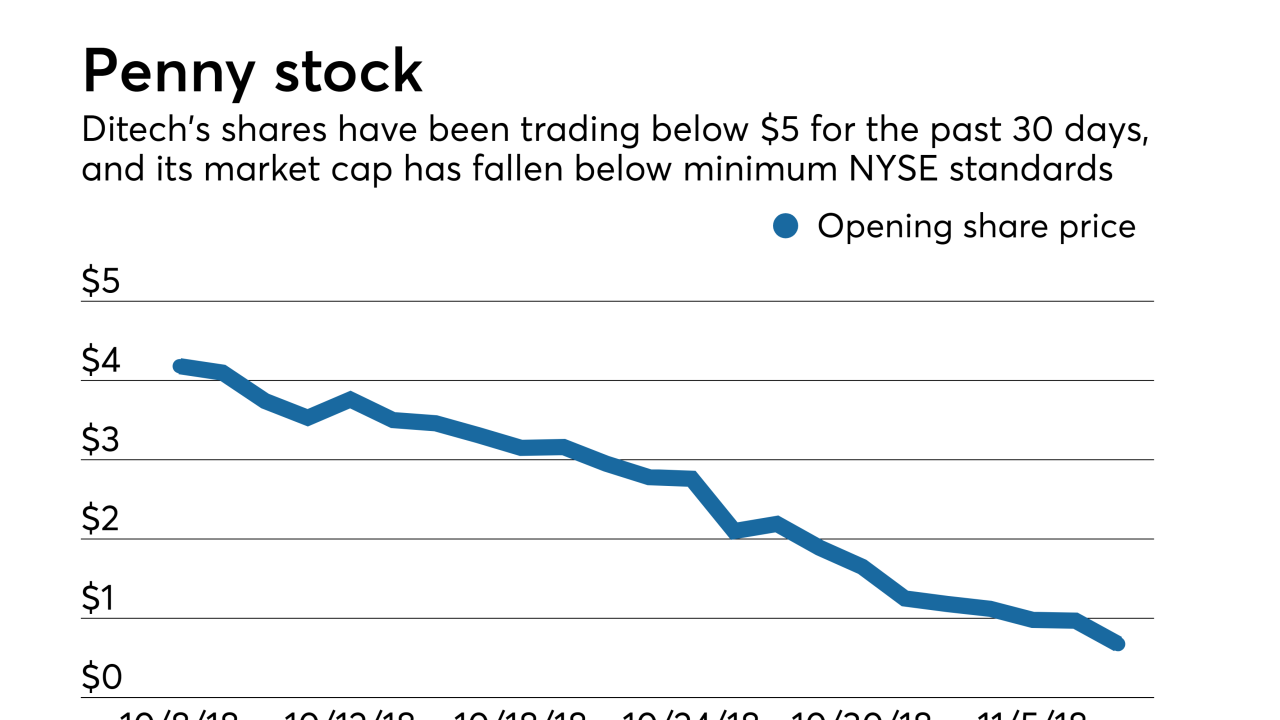

Ditech Holding Corp.'s stock is being delisted from the New York Stock Exchange, and the company is recommitting itself to finding an acquirer or other option that could improve investor value.

November 7 -

Hiring by nonbank mortgage lenders and brokers ebbed in September as the housing market prepares to pack it in for the colder months.

November 2 -

New York developer Silverstein Properties Inc. built a $4 billion pipeline of real estate deals just weeks after starting. None of the money was for buildings it will own.

October 19 -

Hiring by nonbank mortgage lenders and brokers reversed course again and got slightly higher in August as originators made a last-ditch effort to reach seasonal homebuyers before fall.

October 5 -

The senator’s bill to reform the 40-year-old law and expand housing investments could gain clout as Democrats look to pick up congressional seats and she eyes a presidential run.

September 25 -

A former Federal Home Loan bank president argues that the system should limit its exposure to risky nonbanks.

September 19 Flushing Bank

Flushing Bank -

LoanDepot's CEO Anthony Hsieh delivered a bracing message to mortgage lenders on Monday — strong new competitors are coming into this market, so they need to expand their offerings.

September 17 -

The number of workers employed by nonbank mortgage lenders and brokers reversed course and inched lower in July as affordability constraints and limited income gains reduced demand.

September 7 -

With spring homebuying in bloom, the second quarter brought profits to independent mortgage bankers after going negative for the second time ever, according to the Mortgage Bankers Association.

August 29 -

Intensifying margin pressure could spur another wave of cost-cutting at nonbank mortgage lenders, unless other strategies, like consolidation or a mortgage servicing book that could increase in value, offset it.

August 23