-

The CEO of Freedom Mortgage, Stanley Middleman, provides his take on trends affecting independent mortgage bankers as well as the residential real estate finance industry at large.

February 20 -

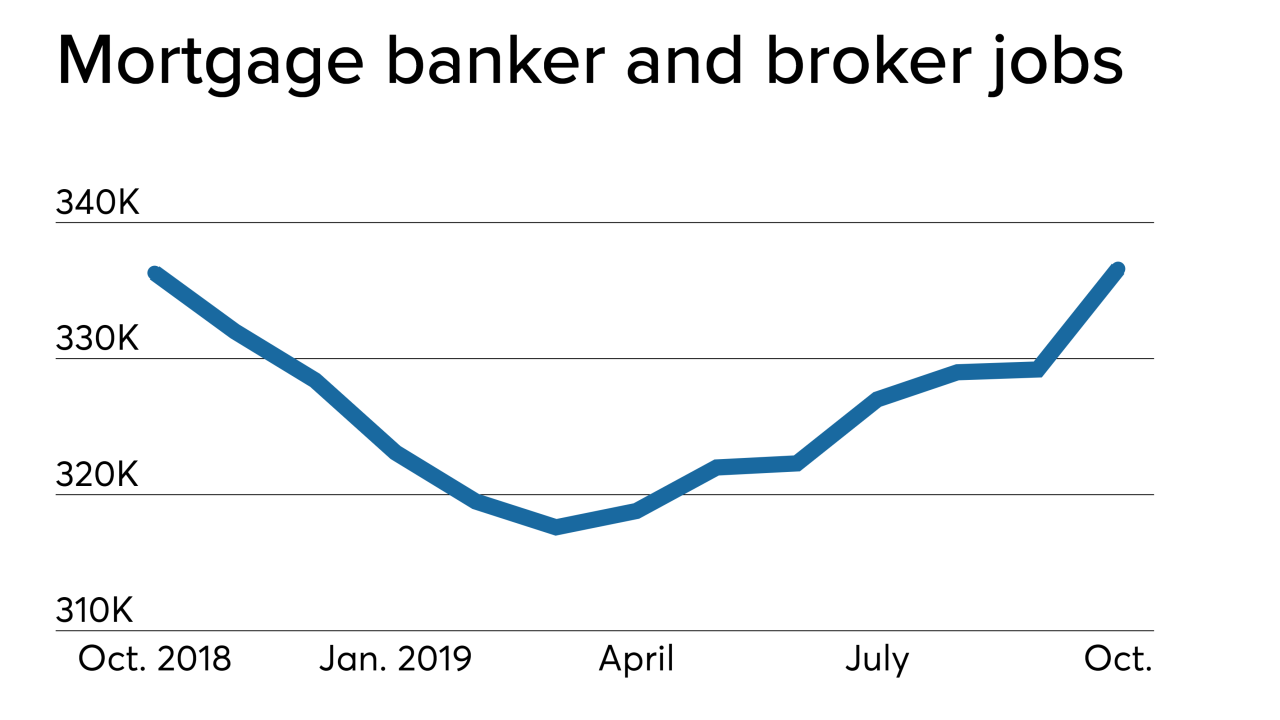

Unexpected rate drops and other factors drove a surprising rebound in nonbank mortgage hiring during what is usually a slow season.

February 7 -

To paint nonbanks as a source of systemic risk, particularly given the track record of commercial banks in causing the 2008 subprime mortgage fiasco, seems absurd.

February 7 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

The Federal Housing Finance Agency plans to increase liquidity standards for nonbank conforming loan servicers, and at the same time raise the net worth requirements for those that also perform the function for Ginnie Mae.

February 5 -

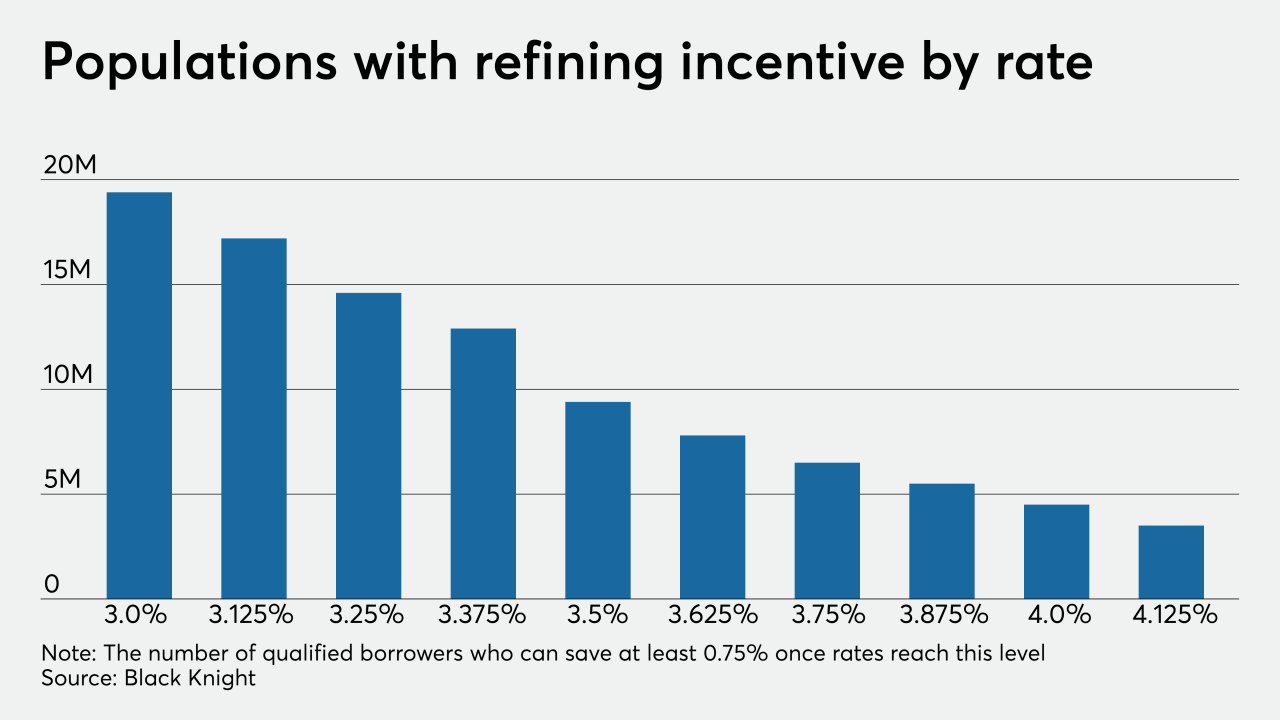

After being range-bound for several weeks, mortgage rates are fluctuating enough to spur significant changes in refi incentive, according to Black Knight.

January 29 -

The estimated number of mortgage professionals employed by nondepository institutions inched down in November 2019 following a surge in the previous month.

January 10 -

California Gov. Gavin Newsom plans to ask the legislature to revamp the current Department of Business Oversight and rename it the Department of Financial Protection and Innovation, modeled after the federal CFPB.

January 9 -

A Conference of State Bank Supervisors subsidiary settled a lawsuit with defendants who allegedly misused and reproduced copyrighted questions from a national exam mortgage loan officers take to obtain licenses.

January 8 -

The Department of Banking and Insurance in New Jersey is warning that enforcement of a 2019 residential mortgage servicer licensing law will begin in 2020.

December 31 -

Mortgage lenders are increasingly introducing new loan programs outside of typical underwriting parameters in line with indicators suggesting that the availability of credit in the housing finance market is growing.

December 10 -

The latest monthly employment estimates for nondepository home lenders and loan brokers rebounded in October and rose year-to-year, reversing a downward trend in 12-month comparisons.

December 6 -

A report from the Financial Stability Oversight Council cited a bigger share of originations and servicing by nonbanks as a potential vulnerability in the financial system.

December 5 -

A report from the Financial Stability Oversight Council cited a bigger share of originations and servicing by nonbanks as a potential vulnerability in the financial system.

December 4 -

In a recent interview, Plaza Home Mortgage CEO Kevin Parra discussed why he likes certain underutilized loan products, thinks online lending will be limited, and is bullish on third-party originations.

December 2 -

The nonbank share of large mortgage servicing is growing, but smaller players tend to be depositories, the Consumer Financial Protection Bureau found in a new report aimed at examining regulatory impacts.

November 22 -

1st Alliance Lending is officially closing, but its CEO still plans to fight Connecticut's allegations that it used unlicensed personnel to take mortgage loan applications.

November 18 -

The 2015 decision posed new legal challenges for institutions trying to sell loans to third parties, but the federal regulatory agency proposed steps Monday for banks and debt parties to evade state interest rate caps.

November 18 -

The Consumer Financial Protection Bureau issued new rules governing mortgage lenders' screening and training of loan originators with temporary authority.

November 15 -

Nonbank and bank mortgage employment has leveled off in line with typical seasonal trends, but some lenders remain more interested in hiring than is usually the case late in the year.

November 1 -

NewDay USA, a lender specializing in loans to veterans and military service members, is addressing rate-driven increases in refinancing by hiring more than 100 workers who are new to the business.

October 7