-

The draft IPO filing for its Class A shares follows speculation that it would follow the lead of Rocket Cos. and other nonbank lenders in going public.

November 11 -

Measures are needed to better address the next event-driven mortgage credit crisis that will likely occur when an even higher percentage of mortgage credit assets are owned by nonbank entities.

November 10 Mayer Brown LLP

Mayer Brown LLP -

The new record in third-party originator hiring numbers adds to indications that some lenders have been leaning harder on the wholesale channel to address capacity issues amid the origination boom.

November 6 -

The agency finalized a rule to determine which party in a loan sale is subject to regulatory requirements. Advocates charged that the move will help predatory lenders.

October 27 -

The company had lower losses on its mortgage servicing rights investments compared with the second quarter.

October 26 -

And how people involved with Replay Acquisition made it more attractive than an initial public offering, according to CEO Patricia Cook.

October 22 -

If the underwriters' option is exercised, proceeds will bring in $112 million instead of a possible $176 million.

October 22 -

The pandemic has turned stress-testing around liquidity from theory into an actual case study. And while lenders shore up their cash reserves, they explain why many have been hesitant to take advantage of Ginnie Mae's Pass-Through Assistance Program.

October 21 -

Minus various expenses including corporate, legal and servicing rights valuation, Ocwen had adjusted pretax income of $13.5 million.

October 20 -

But current owner Blackstone and FOA management will keep 70% of the company after its merger with a SPAC.

October 13 -

If mortgage lenders need to learn anything from the pandemic, it is relying on a single source for any service could disrupt their activities.

October 7 Lereta

Lereta -

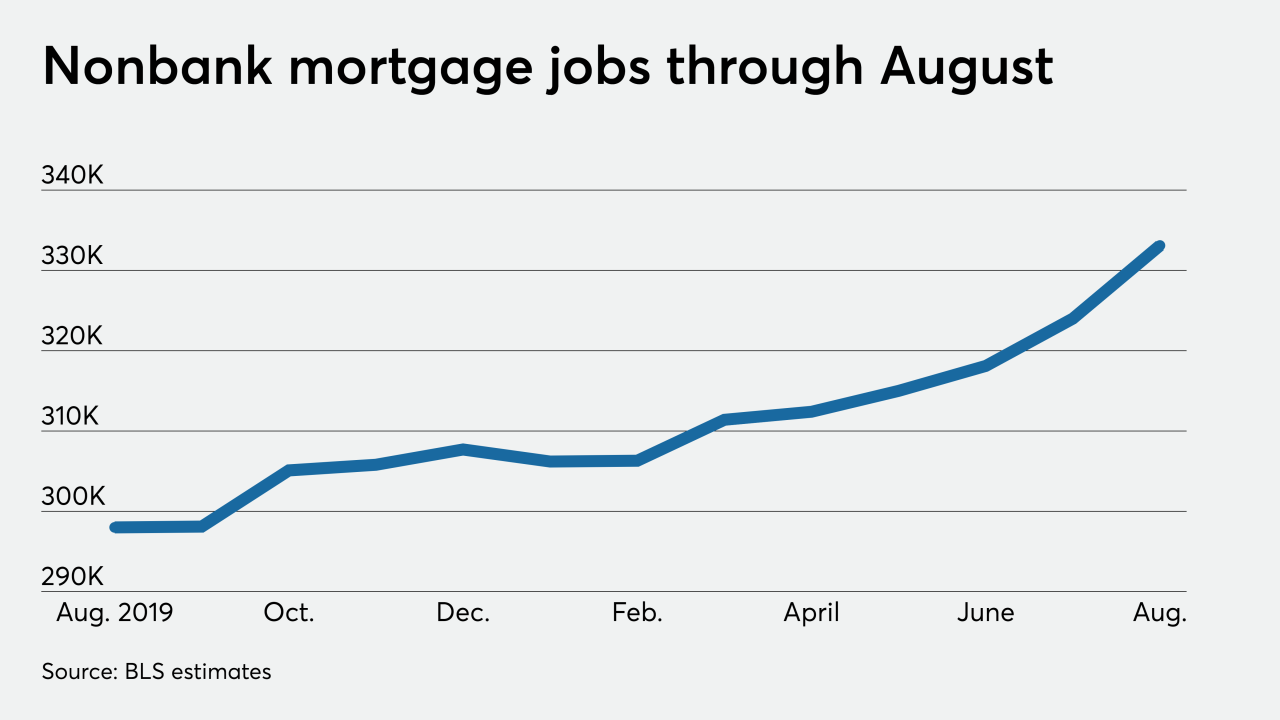

There was an estimated total of 333,100 people on nonbank mortgage banker and broker payrolls in August, and that's the highest recorded since at least 2010.

October 2 -

The future of Fannie Mae and Freddie Mac, the Fed’s supervisory regime for the biggest financial institutions, reform of the Community Reinvestment Act and a host of other industry-related issues are on the ballot this November.

September 17 -

Mortgage lender loanDepot is taking steps toward rebooting plans for an initial public offering, about five years after scrapping one at the last minute, according to people with knowledge of the matter.

September 17 -

The only rational strategy for holding MSRs is to be very aggressive on protecting the servicing assets via loan recapture. This is one of the chief reasons that banks have been willing to give up their share in lending and servicing as they collapse back to retail-only lending strategies.

September 16 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

After being approved, retroactively denied and having a second application rejected, the firm is appealing the decision with federal regulators.

September 15 -

While employment typically ebbs as home buying slows in the fall, several nonbanks have ambitious hiring plans in the works, which call for them to add thousands of workers by year-end.

September 4 -

But federal elections and the pandemic make projections on the sustainability of industry profitability especially tricky.

September 2 -

The new reality for investors and originators accounts for forbearances and ability-to-repay.

August 28 -

A proposal to expand consumer protections in the state was added to a budget bill after being dropped in June. Financial institutions say the measure conflicts with federal law and are working behind the scenes to stop it.

August 14