-

A new public-private network is pursuing a more comprehensive approach than other states to cultivate a strong financial technology industry by uniting banks, insurance companies, startups, government agencies, investors, universities and students.

June 9 -

2020 was a challenging year for banks. The impact of COVID on the economy as well as changes to accounting for loan loss provisions were evident in weaker financial and stock price performance in 2020 for many banks and yet CEO compensation increased. Learn from experienced executive compensation consultants about the challenges Compensation Committees faced in 2020, why pay levels increased relative to 2019, what were common COVID-related compensation changes, and what changes were made for 2021 incentive plan design.

-

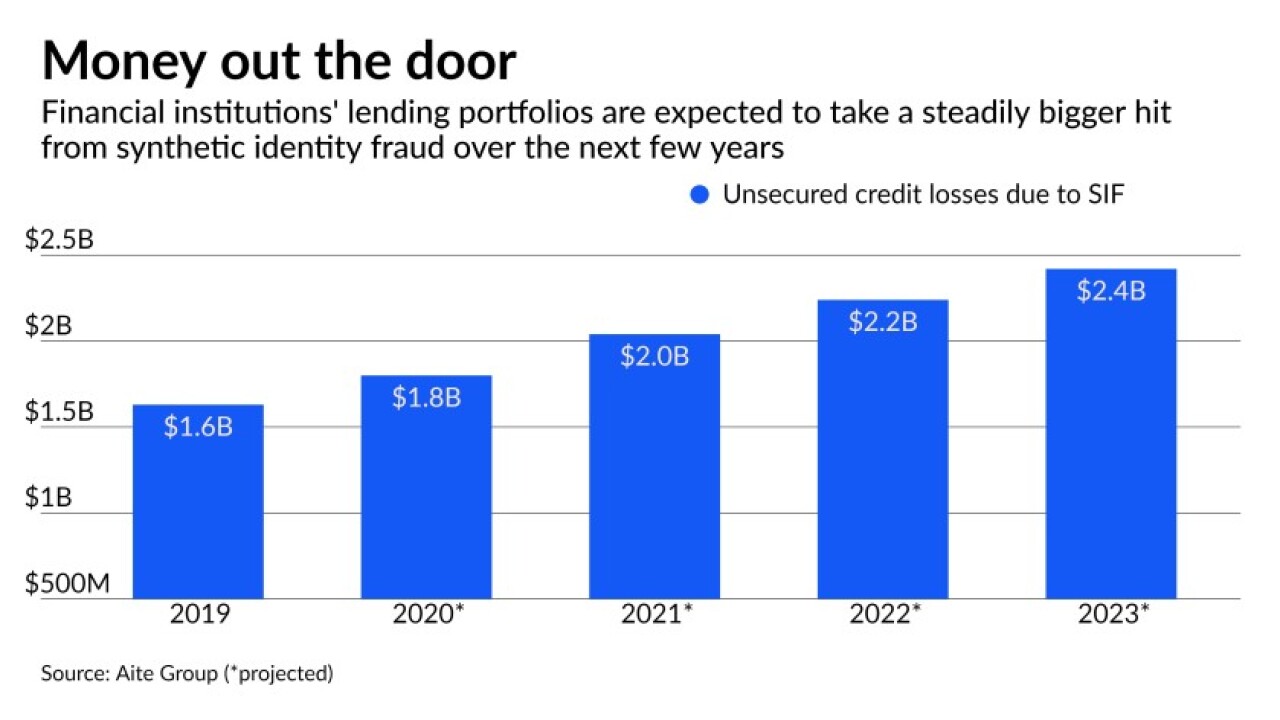

Scams in which a real person’s information is used to create fictitious businesses or individuals have led to $6 billion in credit losses. The Federal Reserve has developed a standard definition for synthetic identity fraud so lenders can distinguish it from traditional identity theft.

June 2 -

This is the multi-hyphenate company’s sixth deal since the start of 2020 — a series of acquisitions in a variety of sectors within the industry, ranging from analytics to artificial intelligence.

May 28 -

While COVID-19 pushed digitization to the forefront of lending, a majority of borrowers still want some degree of human interaction, according to a survey by ICE Mortgage Technology.

May 13 -

The move formalizes the use of the Rocket Mortgage moniker, which has been a major part of the company’s branding since 2016.

May 12 -

Juliet Weissman of New York City's Cornell Tech campus discusses the role of higher education and partnerships in luring startups and their workforces.

May 10 -

The Dallas company will pay nearly $54 million for a 49% stake in a lender that operates in 10 states.

April 28 -

The merger would create a company with nearly 400 branches, 87 loan production offices and $87 billion of assets.

April 26 -

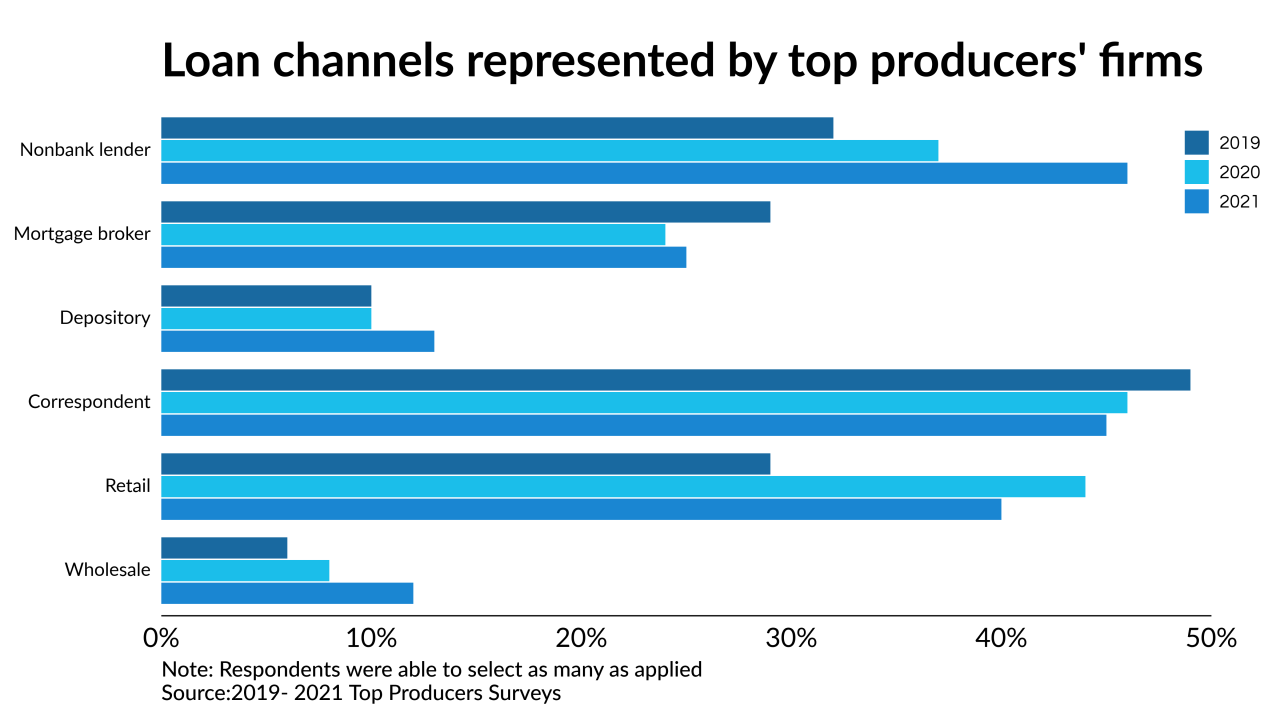

The loan officers who brought in the highest volumes last year offer their perspectives on social media, the GSEs, loan channels and more.

April 15 -

After years of lagging other industries, financial services marketers are finally ramping up their digital investments. But this new spending must be aligned with smart strategies and urgency.

April 8 -

Servicers struggled to bring back their borrowers as the overall retention rate crept down to a nadir in the fourth quarter, according to Black Knight.

March 8 -

New brands are emerging to improve banking services to targeted consumer segments, and Daylight is one intent on winning over the LGBTQ market. What are mainstream banks getting wrong that leaves an opening for niche brands like Daylight?

-

As the pandemic continues to weigh on us all, BlueVine shares how it is putting employees first.

-

Virtual events will continue to replace the large in-person gatherings for the foreseeable future, lenders in the Best Companies to Work for list say.

March 1 -

Reimagining LGBTQ+ efforts at UBS for improving diversity in their recruitment process

-

HUD also said that it will extend mortgage insurance to homeowners whose properties have been destroyed.

February 22 -

The Madison, Wis.-based credit union will donate $1.5 million to a pair of United Way chapters in the region which will help distribute the funds to organizations serving communities of color.

February 18 -

Acquiring AmeriHome would provide the fee revenue the Phoenix company seeks to compensate for low interest rates and tepid commercial loan demand. The deal also would allow it to reinvest billions of dollars of excess liquidity.

February 17 -

The operating environment is dramatically different than it was pre-pandemic and presents all-new challenges for financial institutions. Tried-and-true strategies that led to high performance for many years are no longer going to be successful. Join Bonnie McGeer, Executive Editor of American Banker, and Claude Hanley, Partner at Capital Performance Group, as they highlight important trends and comb through data from top-performing banks across the country for insights that will help regional and community financial institutions thrive in 2021. Executives will learn what metrics will be most critical to focus on to maintain high performance going forward.