-

Roostify is working with Level Access — a software provider enabling disabled people access to technology — to offer Americans with Disabilities Act compliant websites and mobile applications.

November 15 -

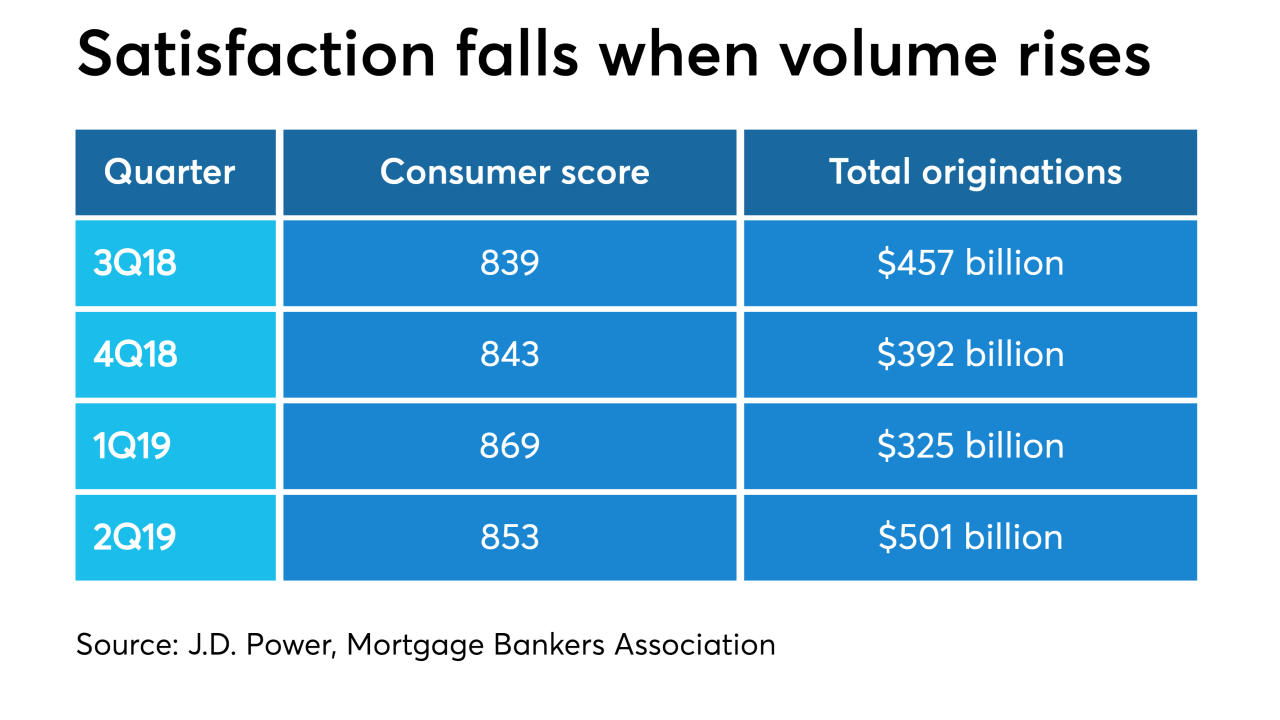

Consumer mortgage originator satisfaction scores fell in the second quarter as lenders had to work through the increase in application activity, a J.D. Power report said.

November 14 -

The average number of attempts to defraud mortgage companies each month increased by 42% this year and hit the smallest businesses hardest, according to LexisNexis Risk Solutions.

October 29 -

The National Credit Union Administration has unveiled a proposal to address a federal judge's concerns that its 2016 field-of-membership overhaul could discourage lending in low-income areas.

October 24 -

Count Citizens Financial’s Bruce Van Saun among those who think interest rate cuts could halt by mid-2020. The key, he says, is to focus on delivering services customers are willing to pay fees for and to skillfully reprice deposits until then.

October 18 -

Charles Scharf’s most immediate priorities will be mending fences with regulators and getting the bank out from under a Fed-imposed asset cap. But he also must come up with strategies for spurring revenue growth and reining in expenses.

September 27 -

Scharf next month will become the fourth leader at Wells Fargo in three years. Meanwhile, Bank of New York Mellon has named Thomas P. "Todd" Gibbons as acting chief executive.

September 27 -

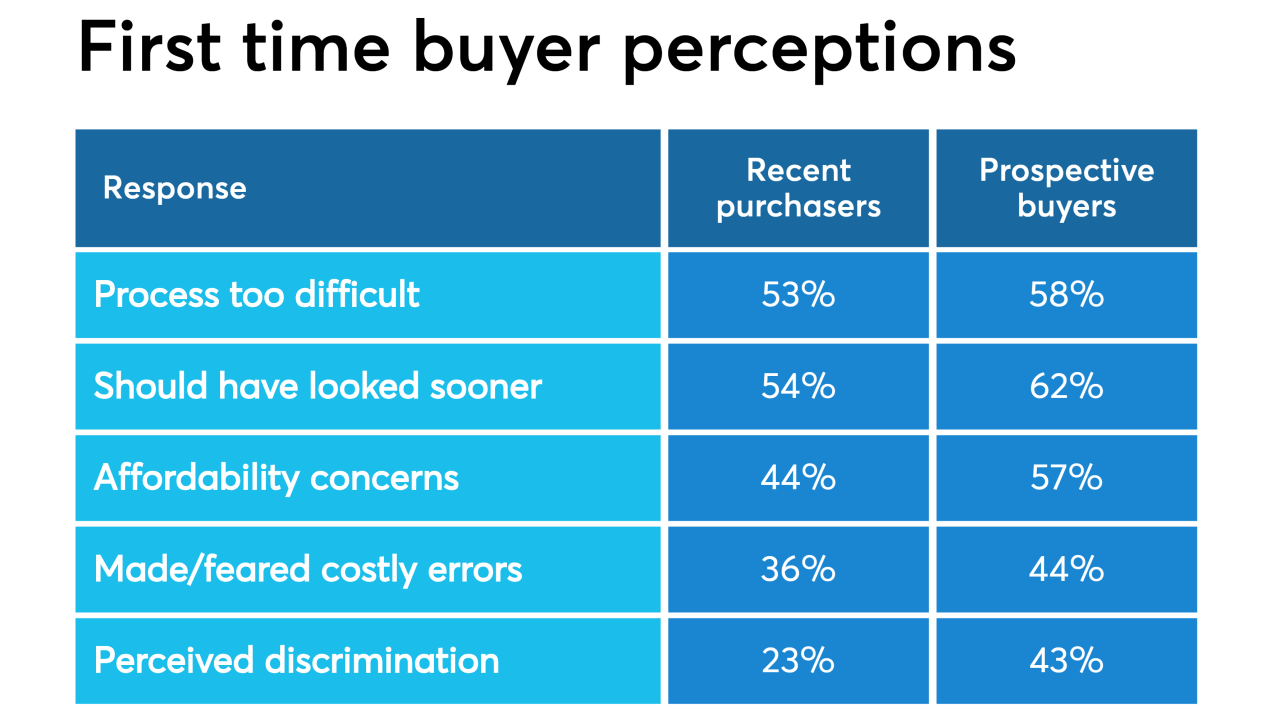

More than half of recent, as well as prospective, first-time homebuyers said purchasing a house was more difficult than it should be, according to a survey for Framework.

September 25 -

Business intelligence software from a compensation management technology provider and an auto-fulfillment service for disclosures were among new offerings introduced by companies at Digital Mortgage.

September 24 -

With the mortgage industry inching closer to full digitization, lenders need to strike the right balance of man-versus-machine as borrowers still look to leverage human interaction during the origination process.

September 20 -

The most successful mortgage originators will use artificial intelligence and machine learning to enhance and enable their people to have better, more meaningful engagements with customers.

September 20 Total Expert

Total Expert -

Seven real estate companies are now facing age-discrimination complaints over allegations they used advertisements posted on Facebook to filter out potential clients over a certain age.

September 19 -

Linda Lacewell, New York’s superintendent of financial services, said the CFPB's debt collection proposal does not go far enough to protect consumers.

September 18 -

The agency put to rest speculation that it might take the database offline, yet new disclosure statements are meant to combat the notion that a complaint proves a company’s guilt.

September 18 -

Like many regional banking companies, Huntington Bancshares casts itself as a community bank, albeit one with more than $100 billion in assets.

September 9 -

The industry has taken some steps to lower barriers to affordable housing, but some observers say that more can be done.

September 5 -

Syracuse Securities Inc., a family-run lender and servicer in New York, is planning to wind down and transfer its outstanding pipeline to Premium Mortgage Corp.

September 4 -

The bucket of homeowners in the money to refinance includes anyone who bought a home in the last 18 months, and lenders are on the phone calling them.

September 3 -

Long Island foreclosure sales doubled over the last five years as the county courts made a priority of clearing bust-era cases.

August 27 -

Sheila Bair, who holds board seats at several other organizations, will sit on Fannie's compensation, corporate governance and risk policy committees.

August 21