-

Mortgage applications decreased 5% from one week earlier as, absent any rate incentive, activity slowed because of the holiday season, according to the Mortgage Bankers Association.

December 18 -

The number of homes sold in metro Baton Rouge in November dropped by 2.4% from the year before, while home prices and the number of properties for sale also decreased.

December 18 -

Without the baggage of living through the Great Recession, homeownership rates for Gen Z should exceed that of millennials, a plurality of respondents to a Zillow survey said.

December 17 -

U.S. homebuilder sentiment advanced in December to the highest level since 1999 amid stronger sales and a surge in prospective buyer foot traffic.

December 16 -

A larger share of Manhattan high-end residential property purchasers took out a mortgage during the third quarter rather than pay all cash for their condominium

December 16 -

Economists see little break in the feverish Bay Area residential real estate market coming in 2020.

December 16 -

Albuquerque is expected to have more empty houses than most cities, due to the baby boomer generation leaving their single-family homes behind.

December 16 -

Houston's feverish housing market is poised for another record year as low mortgage rates, population growth and a relatively healthy economy fuel sales throughout the region.

December 13 -

While the housing market countrywide is expected to cool in 2020, the Chattanooga area is set to sizzle as the fourth best metro area in the country, a new ranking shows.

December 13 -

From the Southeast to the Midwestern plains, here's a look at the 12 cities where first-time homebuyers can afford the largest share of houses for sale, according to First American.

December 12 -

Mortgage lenders became slightly bearish on their profitability outlook in the fourth quarter, with the competitive landscape and shift to a purchase market cited as the main concerns, according to Fannie Mae.

December 12 -

Mortgage application activity increased 3.8% from one week earlier, with refinance volume for Federal Housing Administration-insured loans taking the spotlight, the Mortgage Bankers Association said.

December 11 -

The prequalification letter is a great way to move borrowers from casual tire kickers to committed applicants, but advances in digital verification will soon make it obsolete.

December 10 Blend

Blend -

The housing market is likely changing to predominantly repeat purchasers, even as growth in the first-timer buyer segment continued in the third quarter, a study from Genworth found.

December 10 -

Colorado Springs-area homebuyers continued to find slim pickings last month, as the supply of local properties available for purchase remained at historically low levels.

December 9 -

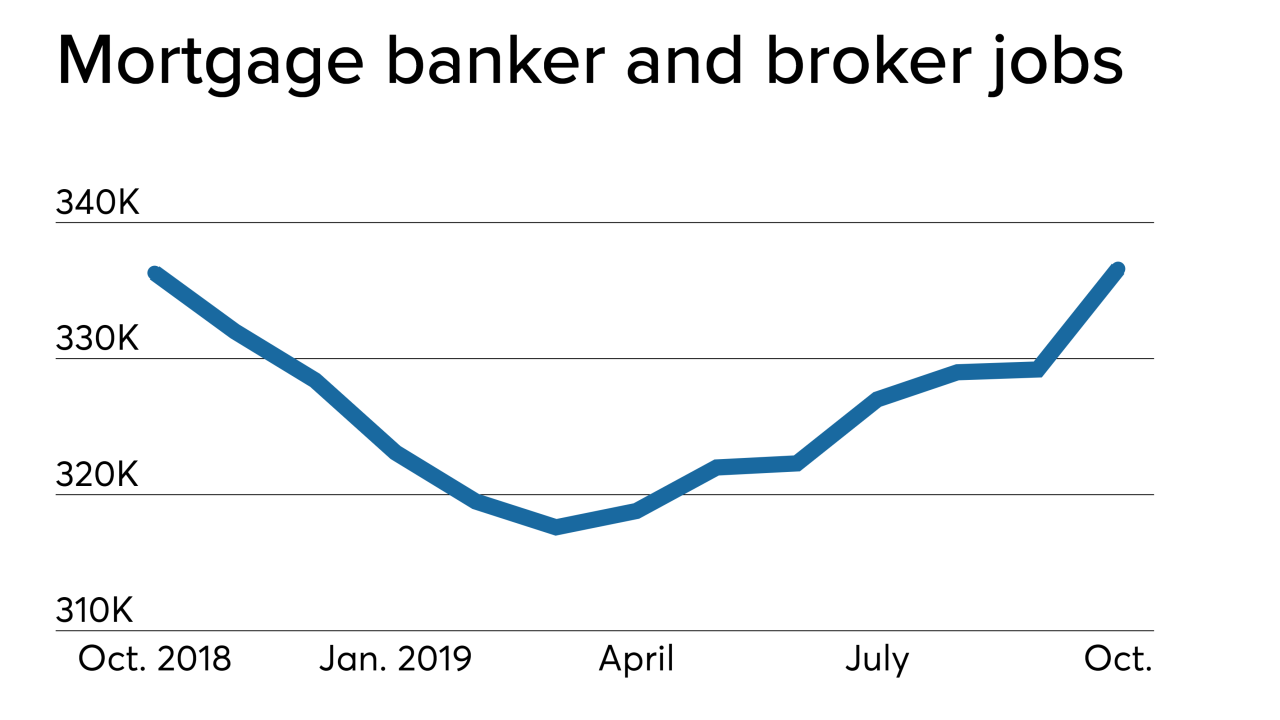

The latest monthly employment estimates for nondepository home lenders and loan brokers rebounded in October and rose year-to-year, reversing a downward trend in 12-month comparisons.

December 6 -

Mortgage-bond investors will need to absorb about 26% more agency MBS supply in 2020 as both home sales and prices continue to climb, according to the average estimate of six of Wall Street's biggest dealers.

December 5 -

Connecticut single-family home sale prices in October reached their highest level in 12 years for the month, a bit of welcome news in a housing market that is looking for a boost in a decade-plus recovery.

December 5 -

Millennials took advantage of the low mortgage rate landscape in October, boosting their refinance share to a survey-record high, according to Ellie Mae.

December 4 -

The vision underpinning the American dream — of fresh-faced young people buying a first home with a white-picket fence — hasn't held up well.

December 4