-

“Builders continue to be confronted with rising input costs and a lack of available lots, causing them to slow production,” MBA’s Joel Kan said.

March 16 -

As more borrowers between 21 and 40 leveraged the historically low mortgage rates in January, the average age rose to a report high, according to ICE Mortgage Technology.

March 10 -

Mortgage rates surged 40 basis points since the start of the year as the economy improved.

March 10 -

The number of product offerings stayed at a level last seen in 2014 as slight gains in government and jumbo loans were offset by fewer conventional mortgages coming on the market.

March 9 -

The gap between those that considered it a good or bad time to buy narrowed 10 percentage points in February, the tightest spread since last April, Fannie Mae found.

March 8 -

After the coronavirus spurred a great migration in search of literal greener pastures, homebuyers are returning to cities with the end of the pandemic in sight, according to Redfin.

March 5 -

With the latest growth, interest rates spiked 37 basis points since the calendar flipped to 2021 alongside rising Treasury bond yields.

March 4 -

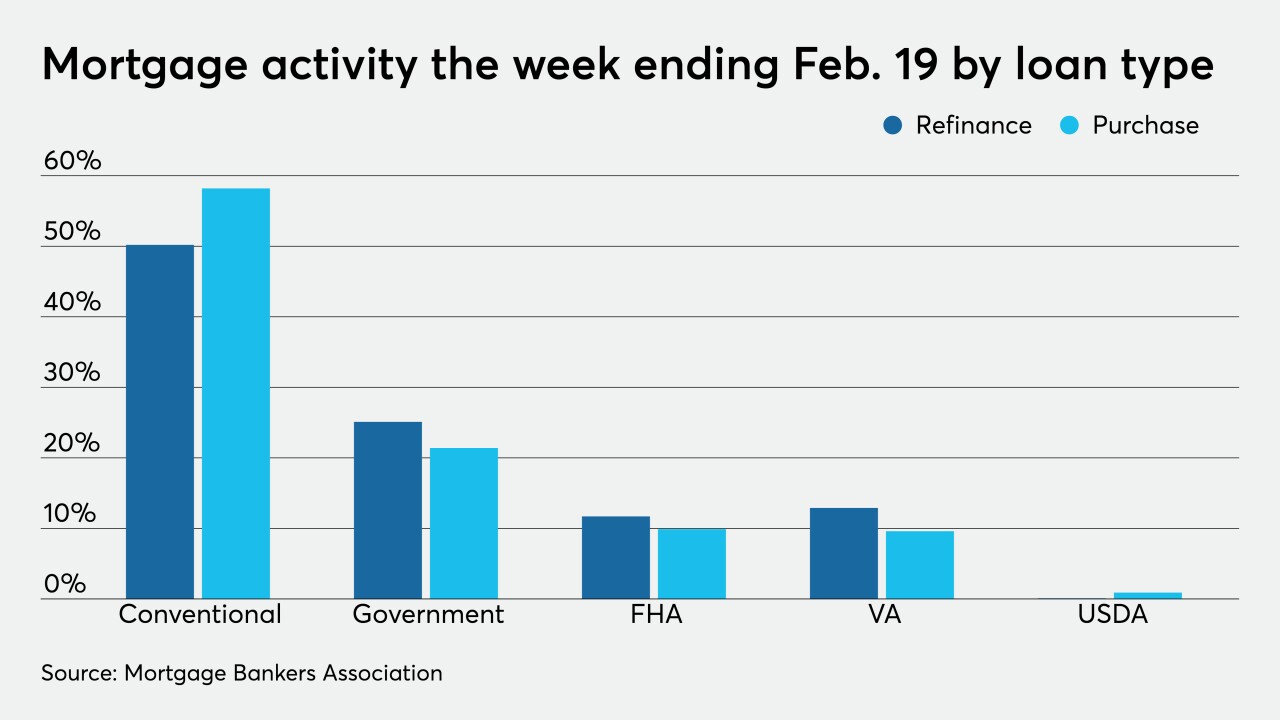

A slight lift in the purchase market paired with a surprising reversal in the size of the average loan, according to the Mortgage Bankers Association.

March 3 -

With the pandemic’s radical disruption of the housing market, values grew at the highest rate in eight years, according to CoreLogic.

March 2 -

The rush to refinance led to more errors in January and the shift to more-risky purchase apps will add to lenders' fraud concerns going forward.

March 2 -

The number of home listings collapsed to the lowest level on record, leaving “nearly all of the shelves empty,” Glenn Kelman said in the company’s latest home sales report.

February 26 -

The mortgage brokerage franchisor added 30 operating offices and had its best year yet for unit sales.

February 26 -

After several weeks of resistance, mortgage rates are now moving in lockstep with the recent increases in the 10-year Treasury yield.

February 25 -

Severe winter weather and another hike in mortgage rates stifled loan volume for the week, according to the Mortgage Bankers Association.

February 24 -

While sales shot up from the same time last year, inventory reached its lowest level since Remax started its National Housing Report in 2007.

February 17 -

With pandemic conditions in place for a second spring, lenders and brokers discuss the indicators that will reveal whether the market is shifting away from the traditional selling season to one that runs hot throughout the year.

February 15 -

While its net income declined annually for the second consecutive year, CEO Hugh Frater touted Fannie Mae’s resiliency in a record year for providing mortgage liquidity.

February 12 -

The company purchased $1.1 trillion of single-family mortgages and $83 billion of multifamily loans during 2020.

February 11 -

But the average amount for a purchase loan increased to an all-time high, showing the upper end of the housing market remains strong.

February 10 -

The mortgage industry’s technology emphasizes speed, but a surge in volume has elongated the closing process for many, which is problematic ahead of a potential seasonal uptick in more time-sensitive purchase loans.

February 9