-

Purchase activity dominated the period and experienced the most growth while refinances cooled off and home equity lines of credit made a comeback, according to Attom Data Solutions.

August 19 -

Despite home supply recovering and sales slowing, properties spent the least amount of time on the market since at least 2009, according to Remax.

August 17 -

The new all-in-one brokerage aims to avoid the "one-size-fits-all approach,"Rocket Homes CEO Doug Seabolt said.

August 12 -

Tight inventory and heightened competition kept prime purchasers at bay as property values continued their summer surge, according to Fannie Mae.

August 9 -

The company’s $204 million in net income was down from unusual highs seen recently but still historically strong thanks to the balance between its loan channels and servicing operation, representatives said.

August 6 -

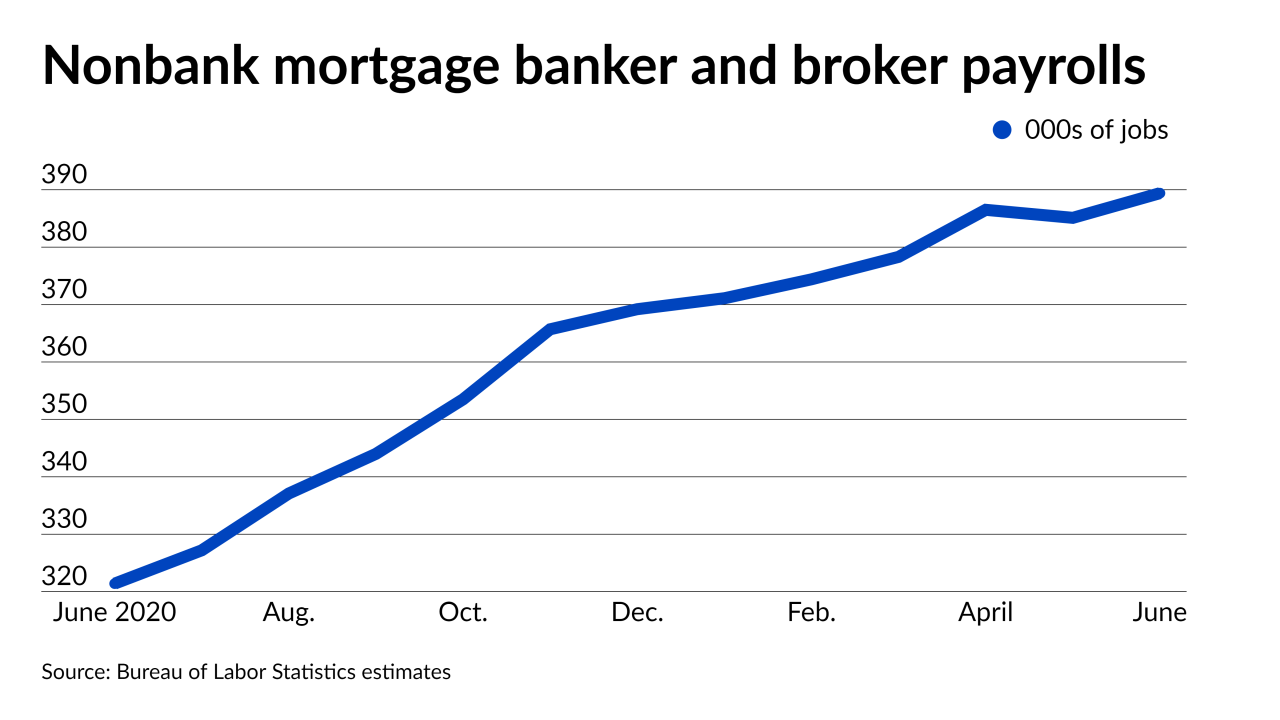

The gain reinforces other estimates that suggest more work-intensive purchase originations have spurred companies to increase staffing. Hiring addressing changing needs in servicing may come next.

August 6 -

A ClimateCheck score measures the risk of disaster at the zip-code level over the period of a 30-year mortgage.

August 4 -

The gulf between buyer demand and the amount of listings for sale drove housing values to a six-decade peak, according to CoreLogic.

August 3 -

The company's Series A funding round, led by Sequoia Capital, added $165 million in capital, which will allow it to expand its home buying operations into more states.

July 27 -

The average mortgage borrower has gotten a hometown discount when buying a property, as the rise of remote work allowed for migration away from large metropolitan areas, according to a Redfin report.

July 26 -

Soaring home prices and the abundance of all-cash offers that the deep-pocketed can afford makes home buying even harder for the average borrower, according to a Redfin report.

July 22 -

The shift to higher-margin home purchase policies helped to boost results at First American, Old Republic and Stewart.

July 22 -

More units sold above asking price as skyrocketing home values pushed consumers out of the single-family market, according to Redfin.

July 21 -

While the unit saw a bigger increase in purchase volume compared to its competitors, net income, loan sales margins and total volume was lower compared with prior periods.

July 21 -

Meanwhile, the average new-home mortgage price climbed to a new all-time high, according to the Mortgage Bankers Association.

July 20 -

The adverse market fee change could contribute to an increase in refinance volume, adds Mortgage Bankers Association economist Mike Fratantoni.

July 19 -

The GSE forecasts $4 trillion in production this year because refinance activity is stronger than expected.

July 16 -

Competition amongst those shopping for homes fell for the second straight month as surging prices pushed consumers to the sidelines and inventory saw modest gains, according to Redfin.

July 13 -

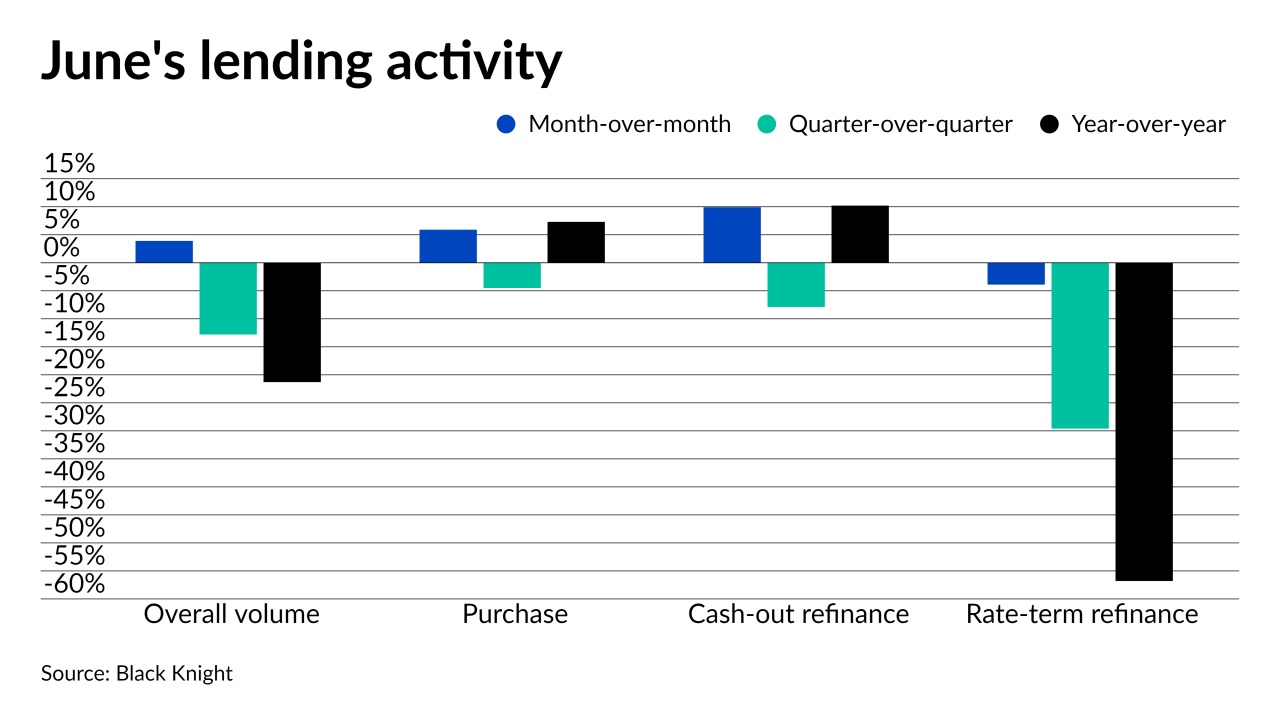

Boosts in purchases and cash-out refinances drove the summer turnaround, according to Black Knight.

July 12 -

Still, the average time a property is on the market is at an all-time low, with more than half going into contract within two weeks.

July 9