-

The dynamic between housing market players diverged to an even greater degree amid intense demand and surging home prices, according to Fannie Mae.

July 7 -

While home prices hit another record high, the supply of for-sale properties improved, according to Realtor.com.

July 1 -

Lending startup Tomo Networks will eschew refinances to focus exclusively on purchases.

June 30 -

Though their rate of ownership lags behind preceding generations, millennial interest in purchasing property grew the most of any demographic last year, according to First American.

June 29 -

The lack of homes for sale is supporting the record values, unlike what happened in the mid-2000s, analysts say.

June 28 -

A Realtor.com survey of consumers aged 18 to 25 found that 45% share are already saving for a home.

June 24 -

For all respondents, cash edged financing by one percentage point, but half of those that bought last year used cash, ServiceLink found.

June 23 -

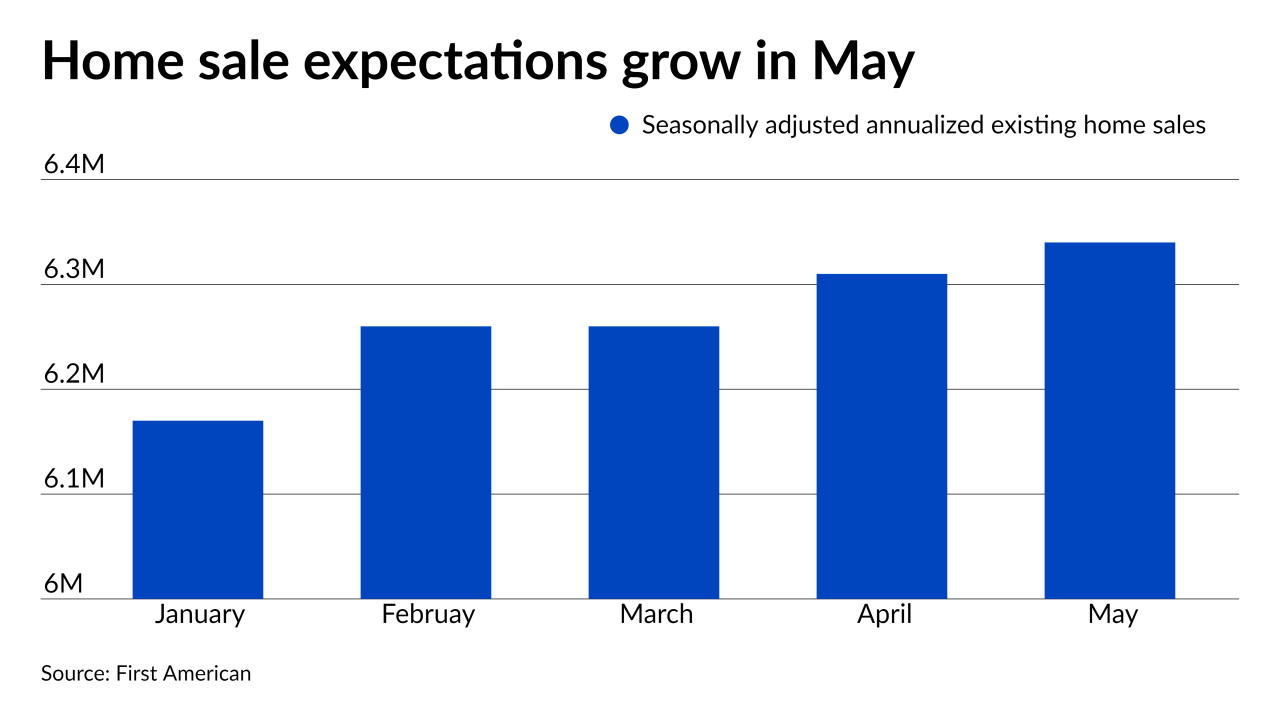

While purchasing power rose due to low rates and increasing income, “homebodies” suppressed inventory, according to First American.

June 22 -

The new calculation of borrowers’ monthly obligations will allow for a higher debt load from tuition, potentially opening eligibility to more Black applicants, according to public officials.

June 18 -

Signs from the Fed regarding tapering and interest rate hikes could spell the end to the year’s low rates.

June 17 -

Demand was strongest at the high end of the market, which pushed loan amounts up for the fourth straight month.

June 17 -

As home prices set new records, a shift in consumer attitude led to fewer bidding wars and a growing number of listings, according to Zillow and Redfin.

June 16 -

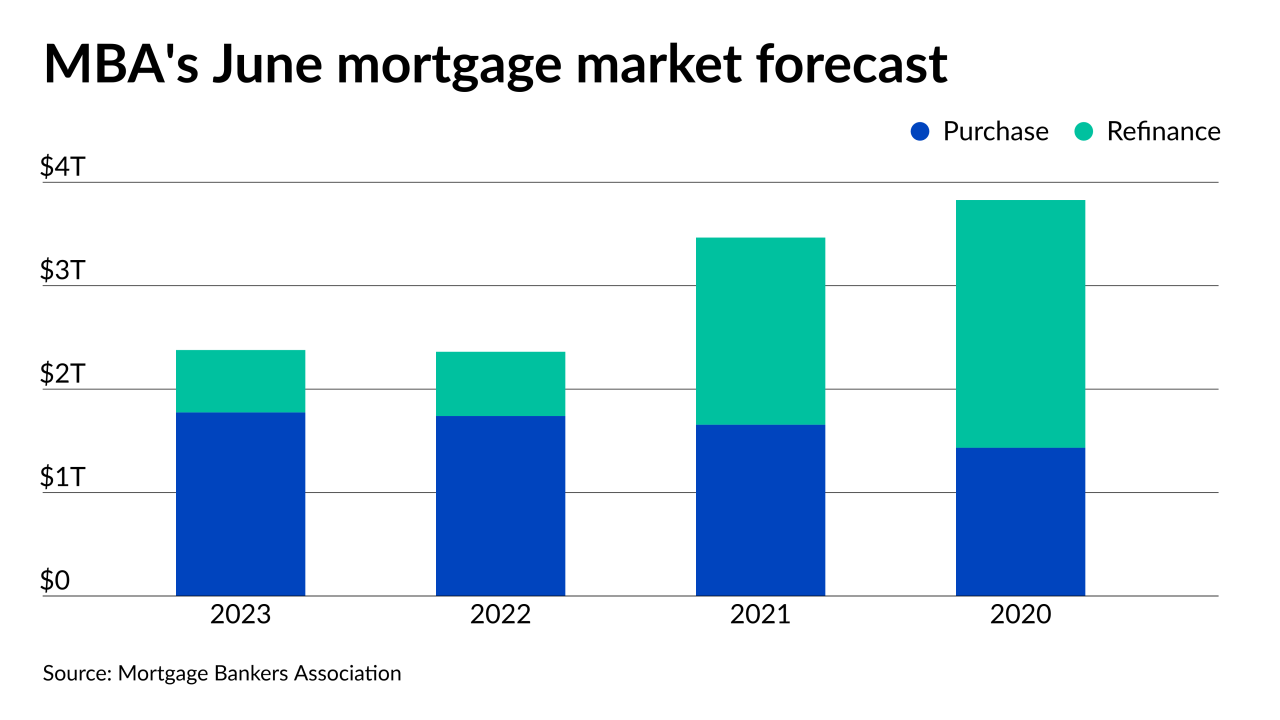

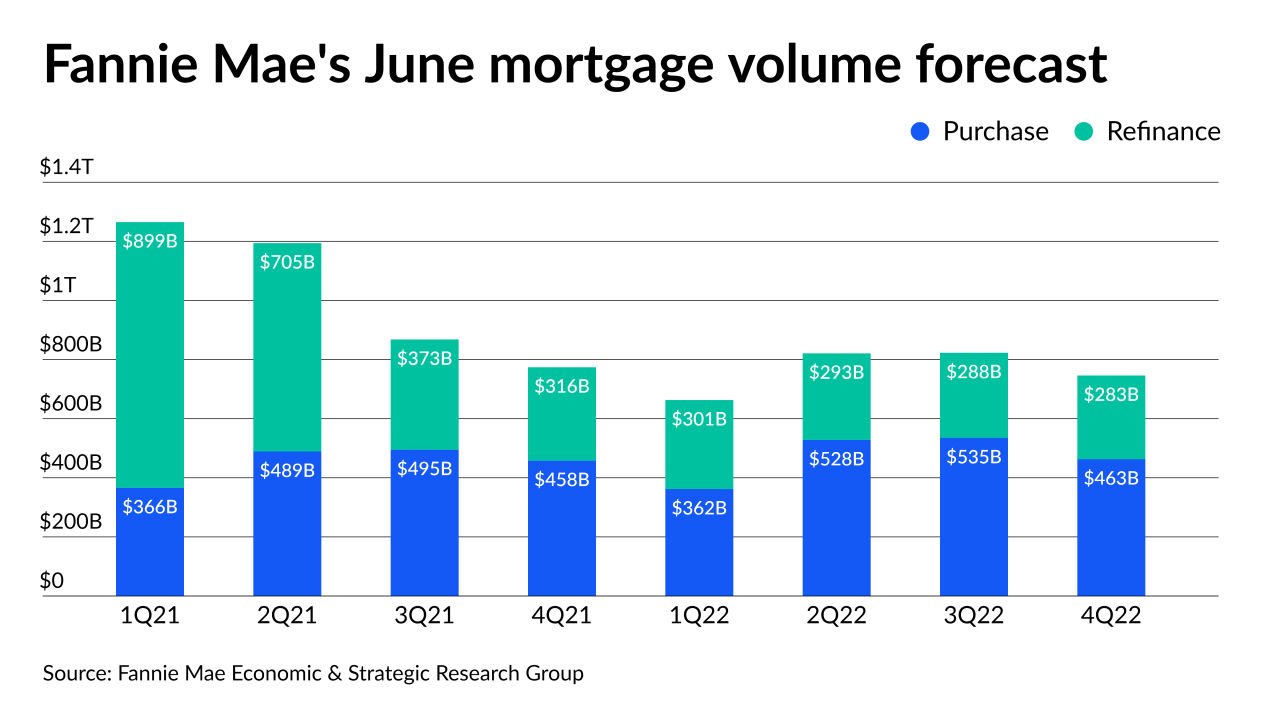

But the government-sponsored enterprise raised its total origination volume forecast for 2021 based on slightly stronger than expected refinance activity.

June 16 -

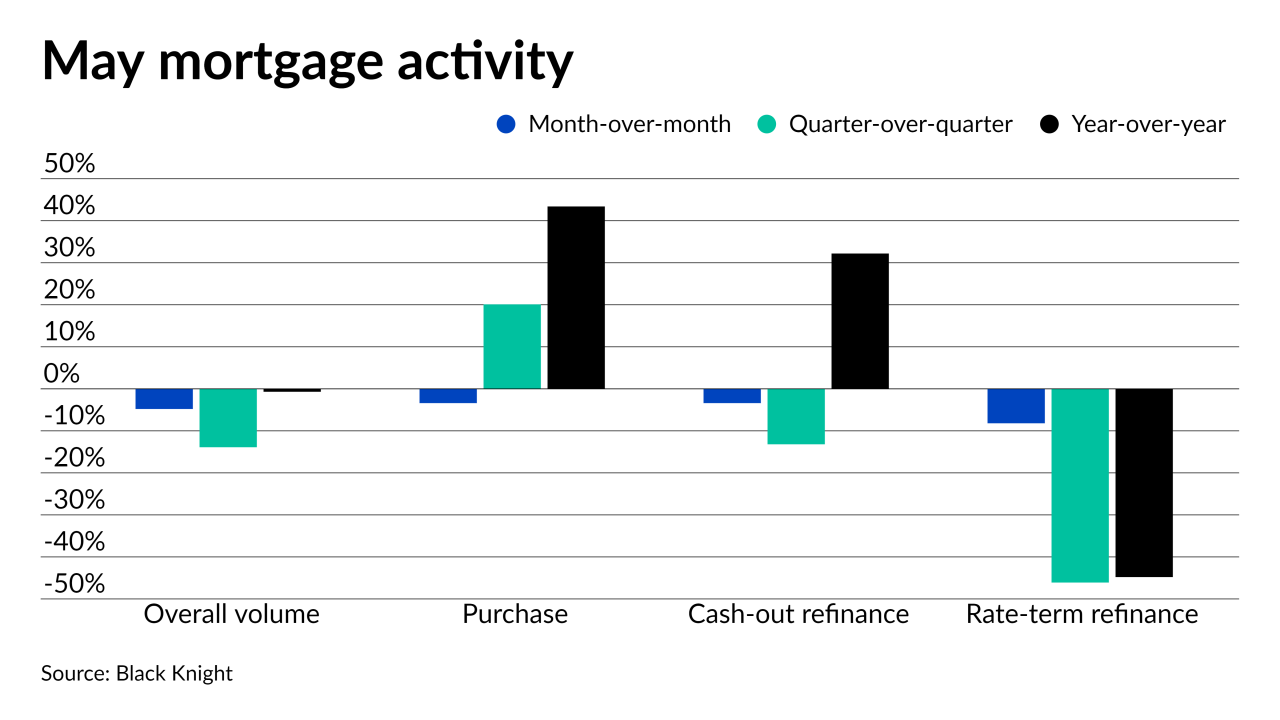

Changed borrower psychology and the severe housing inventory shortage dropped lending activity across the board, according to Black Knight.

June 14 -

Rising sea levels aren’t keeping buyers from scooping up oceanfront homes as work flexibility gives consumers wider options on where to live, according to Redfin.

June 9 -

While a growing share of consumers feel optimistic about the economic recovery underway, the extreme seller’s market made the majority of prospective borrowers pessimistic for only the second time in 10 years, according to Fannie Mae.

June 7 -

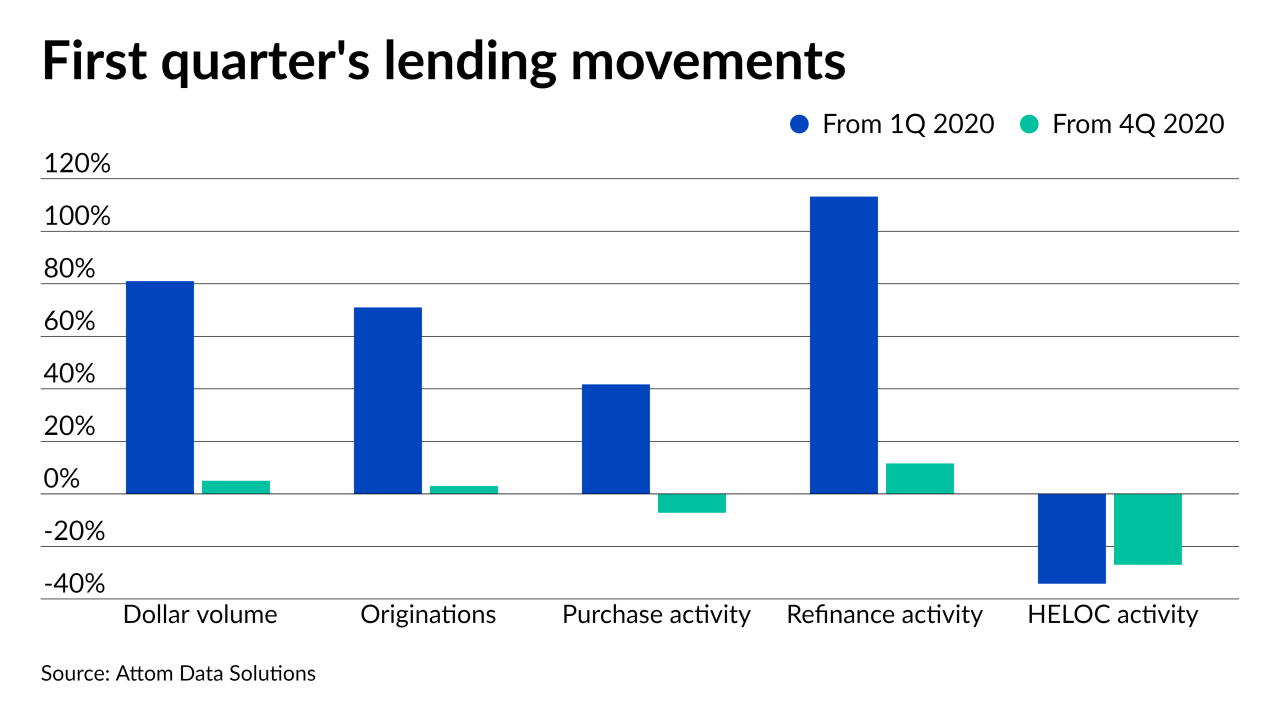

Refinancings more than doubled the year-ago amount and made up for the slowed purchase activity, according to Attom Data Solutions.

June 3 -

The reopening of the economy may only go so far toward reversing the intensified shift toward building in areas with longer commutes.

June 2 -

Housing value growth in April hit a 15-year high as the inventory squeeze created gridlock between baby boomer sellers and millennial buyers, according to CoreLogic.

June 1 -

The increasing regulatory costs may give the Biden administration reason to encourage the rollback of some zoning restrictions that hamper construction.

May 28