-

Soaring home prices and the abundance of all-cash offers that the deep-pocketed can afford makes home buying even harder for the average borrower, according to a Redfin report.

July 22 -

The shift to higher-margin home purchase policies helped to boost results at First American, Old Republic and Stewart.

July 22 -

More units sold above asking price as skyrocketing home values pushed consumers out of the single-family market, according to Redfin.

July 21 -

While the unit saw a bigger increase in purchase volume compared to its competitors, net income, loan sales margins and total volume was lower compared with prior periods.

July 21 -

Meanwhile, the average new-home mortgage price climbed to a new all-time high, according to the Mortgage Bankers Association.

July 20 -

The adverse market fee change could contribute to an increase in refinance volume, adds Mortgage Bankers Association economist Mike Fratantoni.

July 19 -

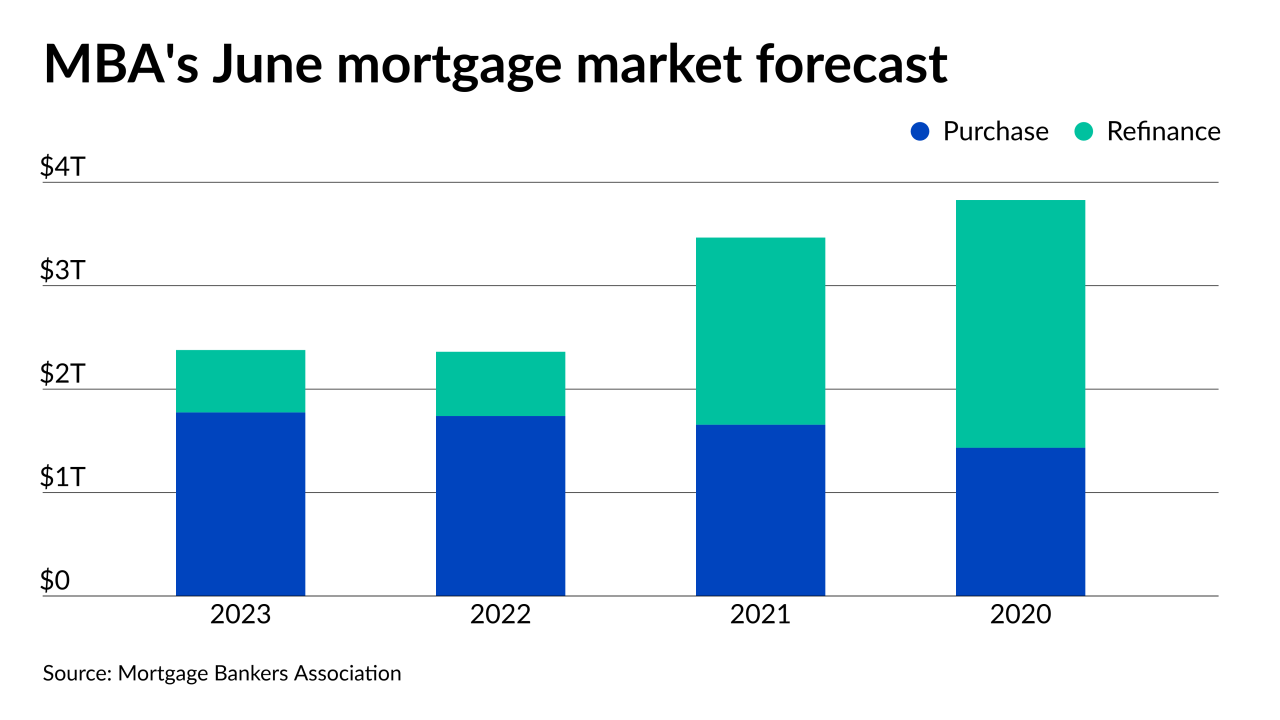

The GSE forecasts $4 trillion in production this year because refinance activity is stronger than expected.

July 16 -

Competition amongst those shopping for homes fell for the second straight month as surging prices pushed consumers to the sidelines and inventory saw modest gains, according to Redfin.

July 13 -

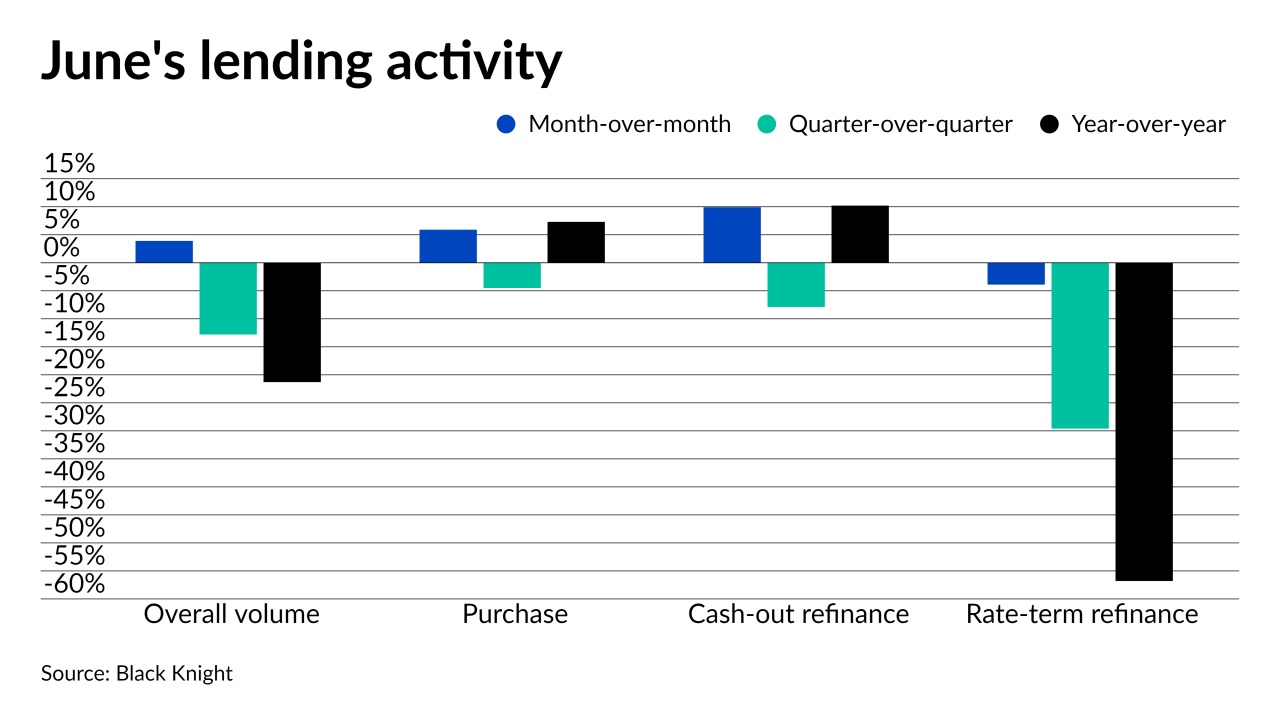

Boosts in purchases and cash-out refinances drove the summer turnaround, according to Black Knight.

July 12 -

Still, the average time a property is on the market is at an all-time low, with more than half going into contract within two weeks.

July 9 -

The dynamic between housing market players diverged to an even greater degree amid intense demand and surging home prices, according to Fannie Mae.

July 7 -

While home prices hit another record high, the supply of for-sale properties improved, according to Realtor.com.

July 1 -

Lending startup Tomo Networks will eschew refinances to focus exclusively on purchases.

June 30 -

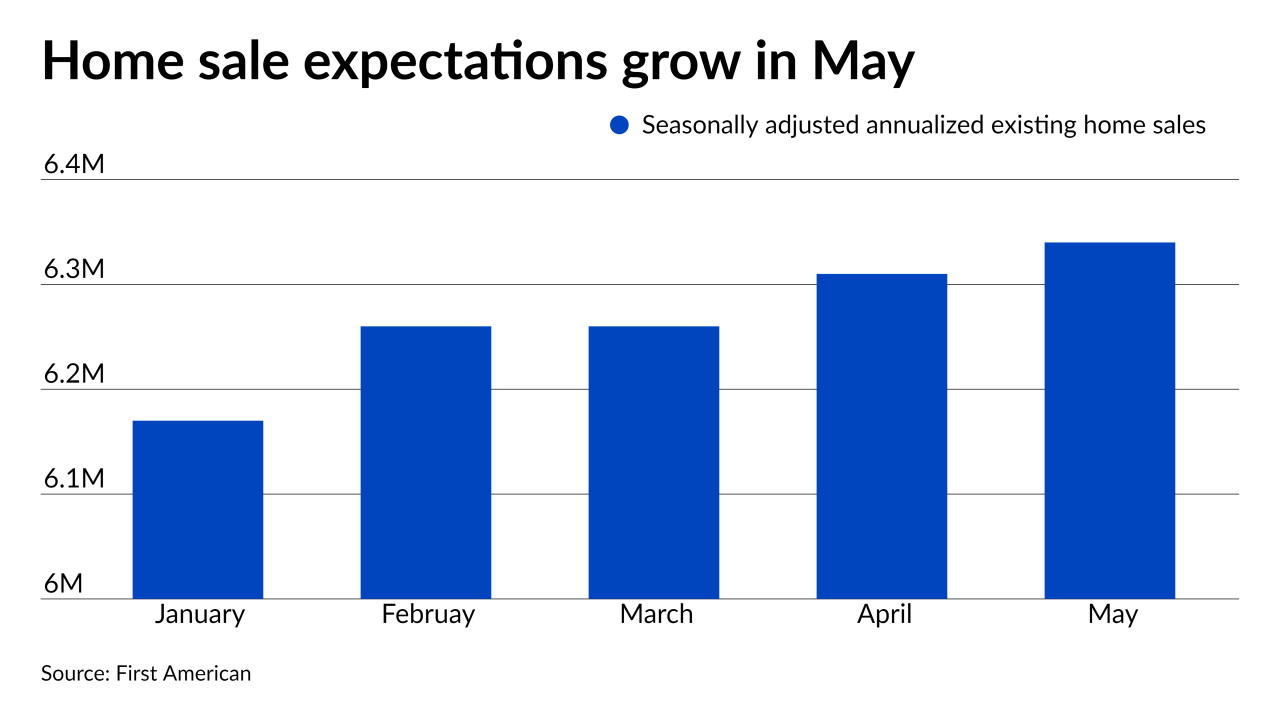

Though their rate of ownership lags behind preceding generations, millennial interest in purchasing property grew the most of any demographic last year, according to First American.

June 29 -

The lack of homes for sale is supporting the record values, unlike what happened in the mid-2000s, analysts say.

June 28 -

A Realtor.com survey of consumers aged 18 to 25 found that 45% share are already saving for a home.

June 24 -

For all respondents, cash edged financing by one percentage point, but half of those that bought last year used cash, ServiceLink found.

June 23 -

While purchasing power rose due to low rates and increasing income, “homebodies” suppressed inventory, according to First American.

June 22 -

The new calculation of borrowers’ monthly obligations will allow for a higher debt load from tuition, potentially opening eligibility to more Black applicants, according to public officials.

June 18 -

Signs from the Fed regarding tapering and interest rate hikes could spell the end to the year’s low rates.

June 17