-

Demand was strongest at the high end of the market, which pushed loan amounts up for the fourth straight month.

June 17 -

As home prices set new records, a shift in consumer attitude led to fewer bidding wars and a growing number of listings, according to Zillow and Redfin.

June 16 -

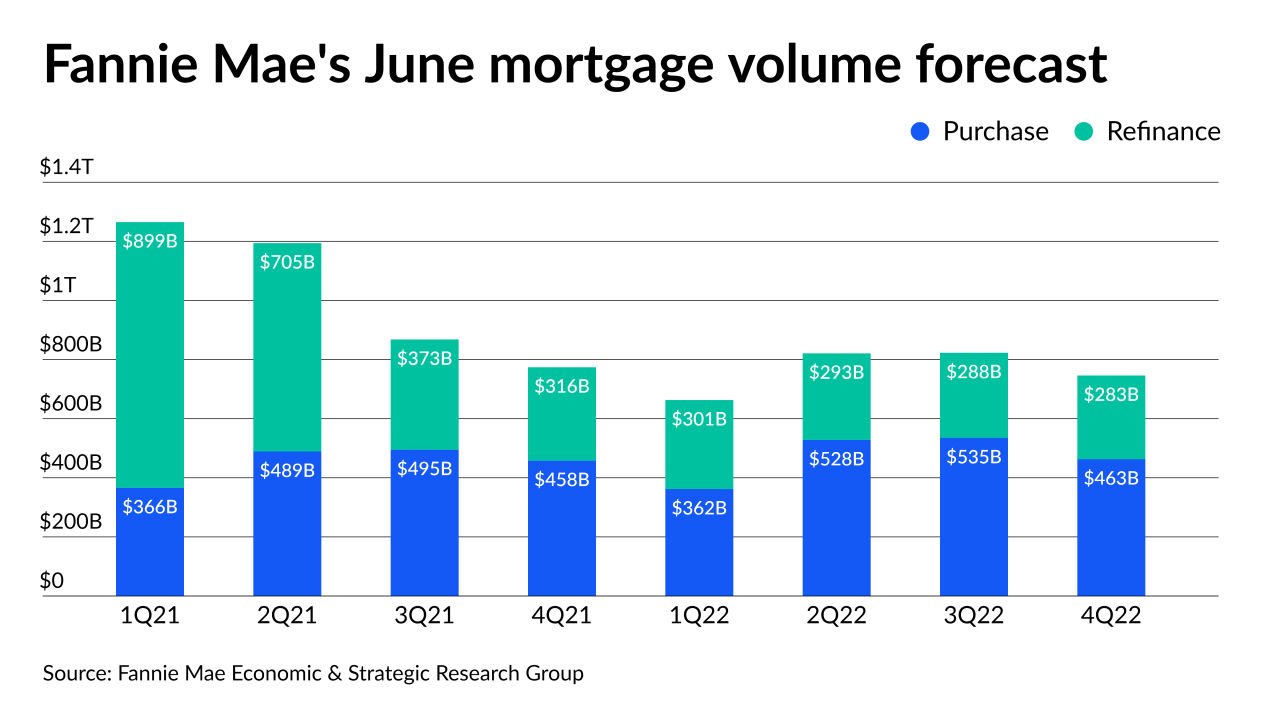

But the government-sponsored enterprise raised its total origination volume forecast for 2021 based on slightly stronger than expected refinance activity.

June 16 -

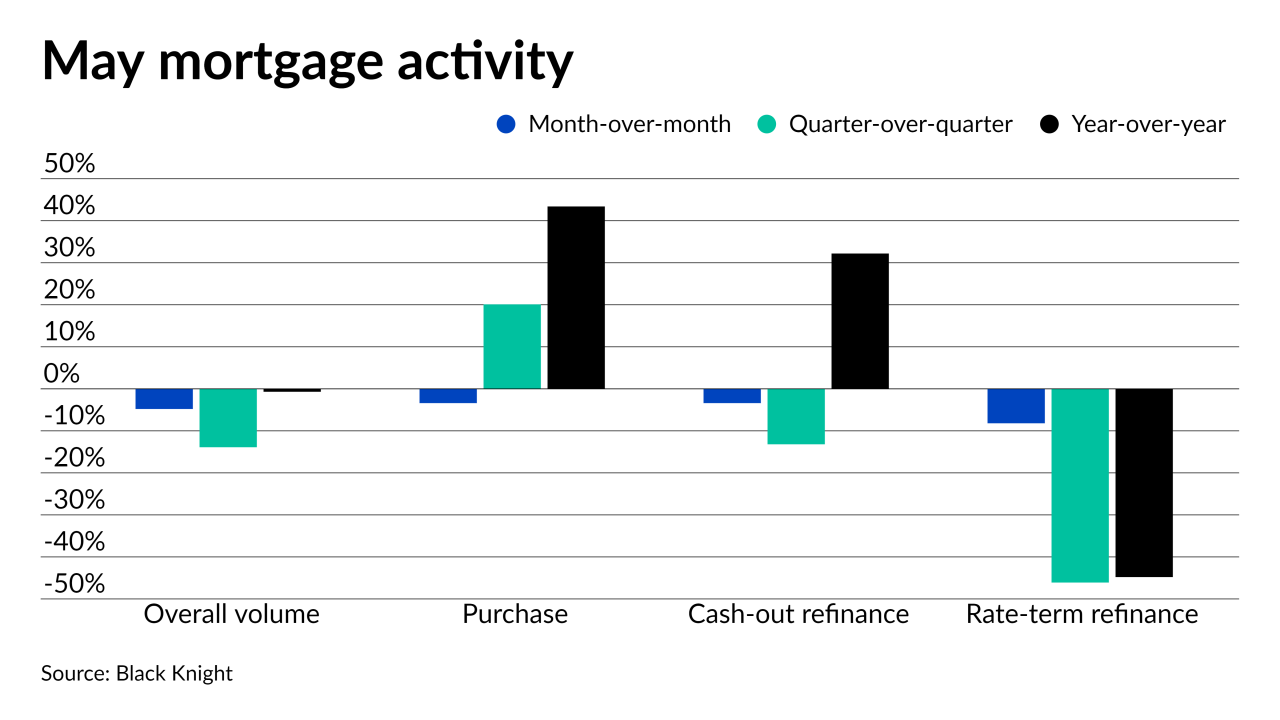

Changed borrower psychology and the severe housing inventory shortage dropped lending activity across the board, according to Black Knight.

June 14 -

Rising sea levels aren’t keeping buyers from scooping up oceanfront homes as work flexibility gives consumers wider options on where to live, according to Redfin.

June 9 -

While a growing share of consumers feel optimistic about the economic recovery underway, the extreme seller’s market made the majority of prospective borrowers pessimistic for only the second time in 10 years, according to Fannie Mae.

June 7 -

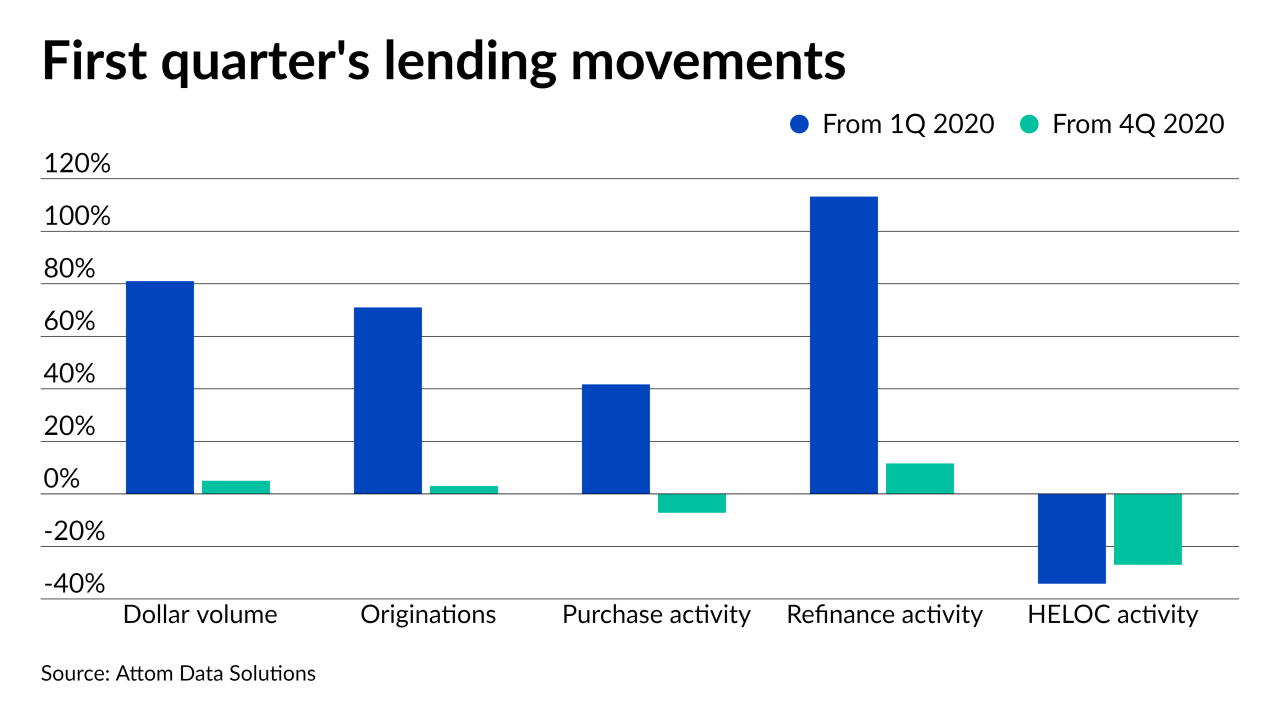

Refinancings more than doubled the year-ago amount and made up for the slowed purchase activity, according to Attom Data Solutions.

June 3 -

The reopening of the economy may only go so far toward reversing the intensified shift toward building in areas with longer commutes.

June 2 -

Housing value growth in April hit a 15-year high as the inventory squeeze created gridlock between baby boomer sellers and millennial buyers, according to CoreLogic.

June 1 -

The increasing regulatory costs may give the Biden administration reason to encourage the rollback of some zoning restrictions that hamper construction.

May 28 -

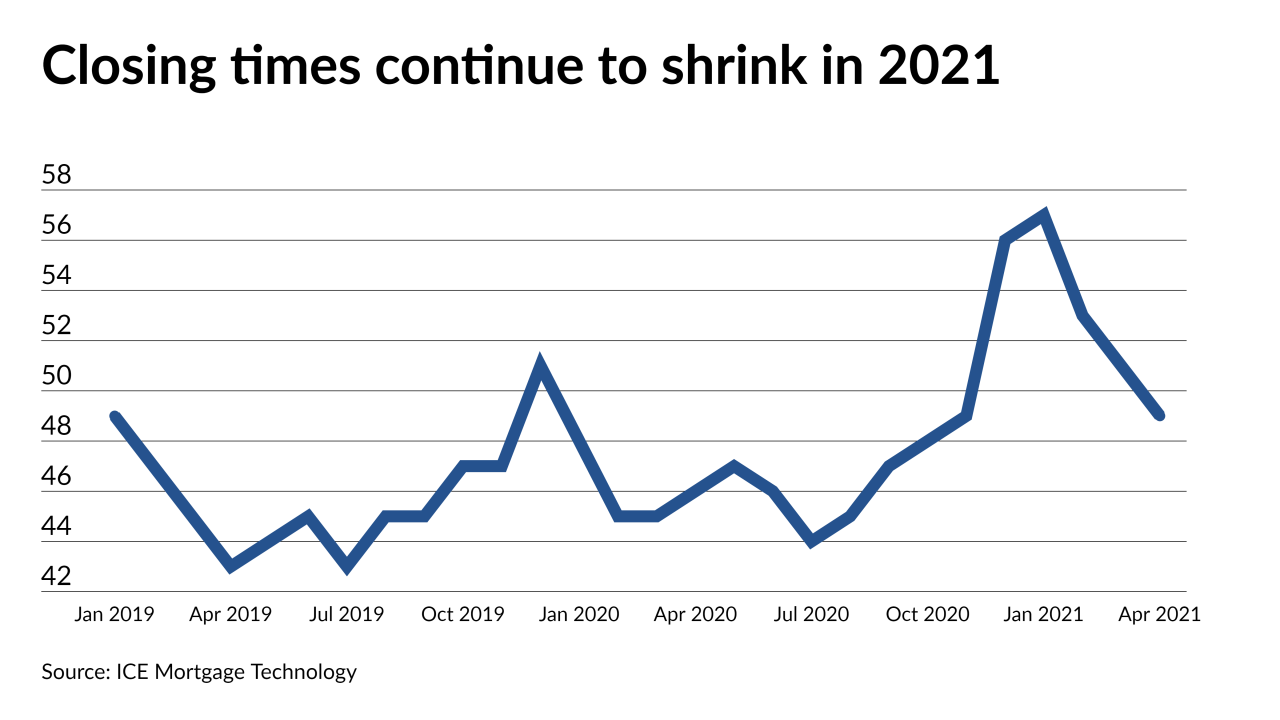

Average days to close dropped closer to pre-pandemic levels in April, according to ICE Mortgage Technology.

May 26 -

While purchases increased, refinancing activity slowed considerably compared to its pace over the past month.

May 26 -

Estimated activity exceeded projections as consumer purchasing power rose, although inventory continued at a record nadir and otherwise held back potential home sales, according to First American.

May 20 -

The month saw the highest median home sales price ever along with the quickest time ever to sell a new listing.

May 19 -

Economic recovery should soar into the summer as vaccination rates climb and restrictions loosen up, but low inventory is likely to limit mortgage activity into the next year, according to Fannie Mae.

May 19 -

Mortgage activity fell across the board despite analysis that 14.5 million current qualified borrowers would benefit from a refinance, according to Black Knight.

May 17 -

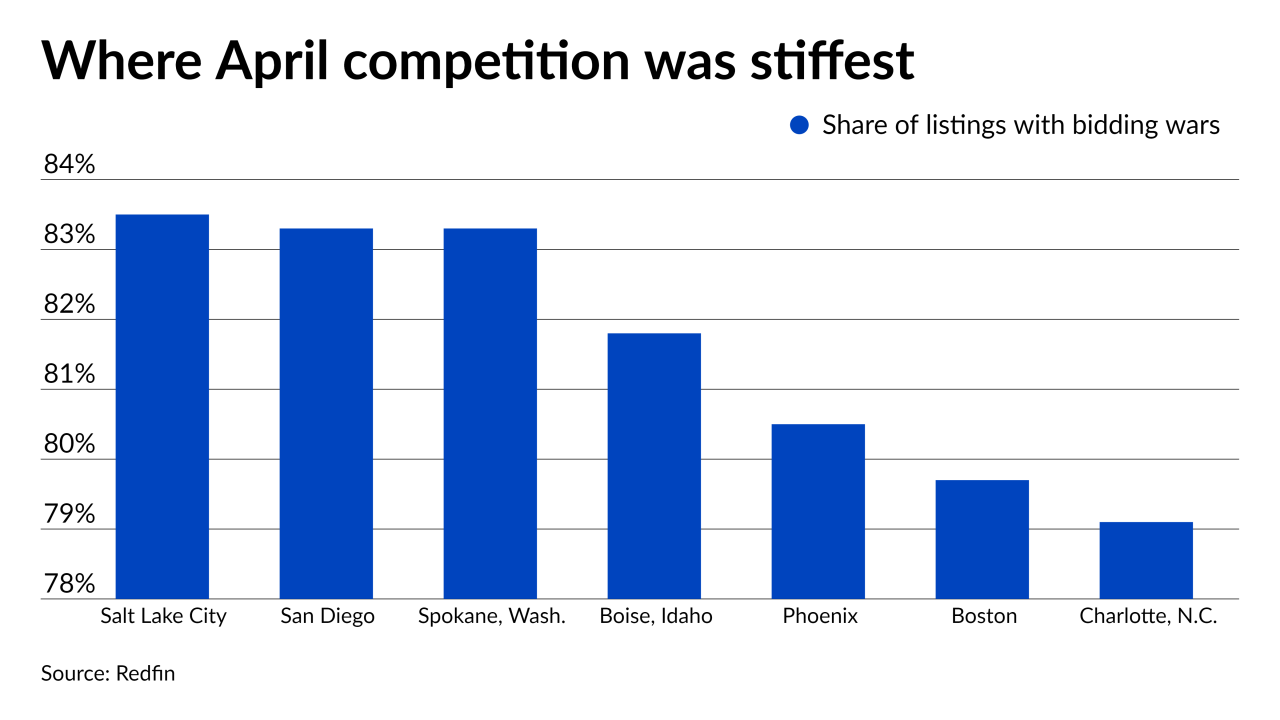

Homebuyer competition reached new heights right as the purchase market hits its busiest time of year, according to Redfin.

May 14 -

Purchase loan volume also increased, as borrowers tried to take advantage of rate dips across all loan types

May 12 -

It’s getting easier to close bigger loans for higher-priced properties, but credit is expanding slower for first-time buyers.

May 11 -

In spite of an improving economy, acute competition and supply scarcity soured homeshoppers on the purchase market in April, according to Fannie Mae.

May 7